Wall Street's Most Accurate Analysts Spotlight On 3 Consumer Stocks With Over 7% Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Consumer Stocks With Over 7% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以通過訪問分析師股票評級頁面,查看他們最喜歡的股票的最新分析師觀點。交易員可以瀏覽Benzinga龐大的分析師評級數據庫,包括按照分析師準確度排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

以下是消費者自由裁量板塊三隻高收益股票最準確分析師的評級。

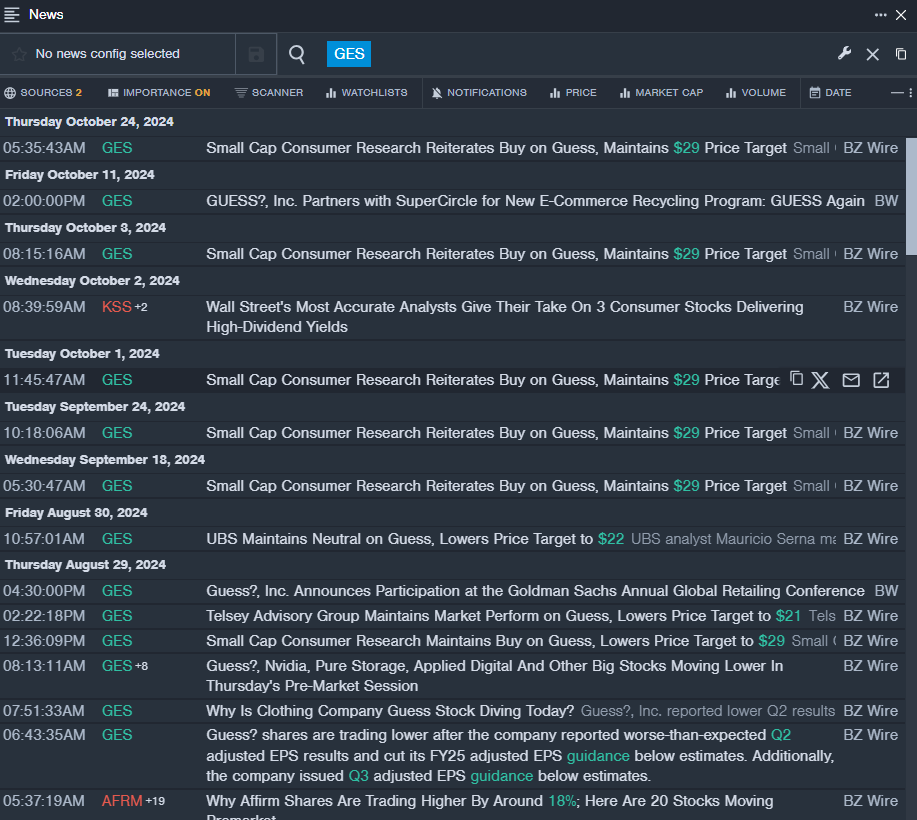

Guess?, Inc. (NYSE:GES)

猜猜品牌公司(紐交所:GES)

- Dividend Yield: 7.08%

- Small Cap Consumer Research analyst Eric Beder reiterated a Buy rating with a price target of $29 on Oct. 24. This analyst has an accuracy rate of 60%.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and cut the price target from $26 to $21 on Aug. 29. This analyst has an accuracy rate of 62%.

- Recent News: On Aug. 28, Guess reported worse-than-expected second-quarter adjusted EPS results and cut its FY25 adjusted EPS guidance below estimates. Additionally, the company issued third-quarter adjusted EPS guidance below estimates.

- Benzinga Pro's real-time newsfeed alerted to latest GES news

- 股息收益率:7.08%

- 小盤消費研究分析師Eric Beder於10月24日重申買入評級,目標股價爲29美元。該分析師的準確率爲60%。

- Telsey諮詢集團分析師Dana Telsey於8月29日維持市場表現評級,並將價格目標從26美元調降至21美元。該分析師的準確率爲62%。

- 最新資訊:8月28日,Guess報告稱第二季度調整後每股收益低於預期,並將FY25調整後每股收益指引下調至預期以下。此外,該公司發佈的第三季度調整後每股收益指引也低於預期。

- Benzinga Pro的實時新聞提醒最新的GES新聞

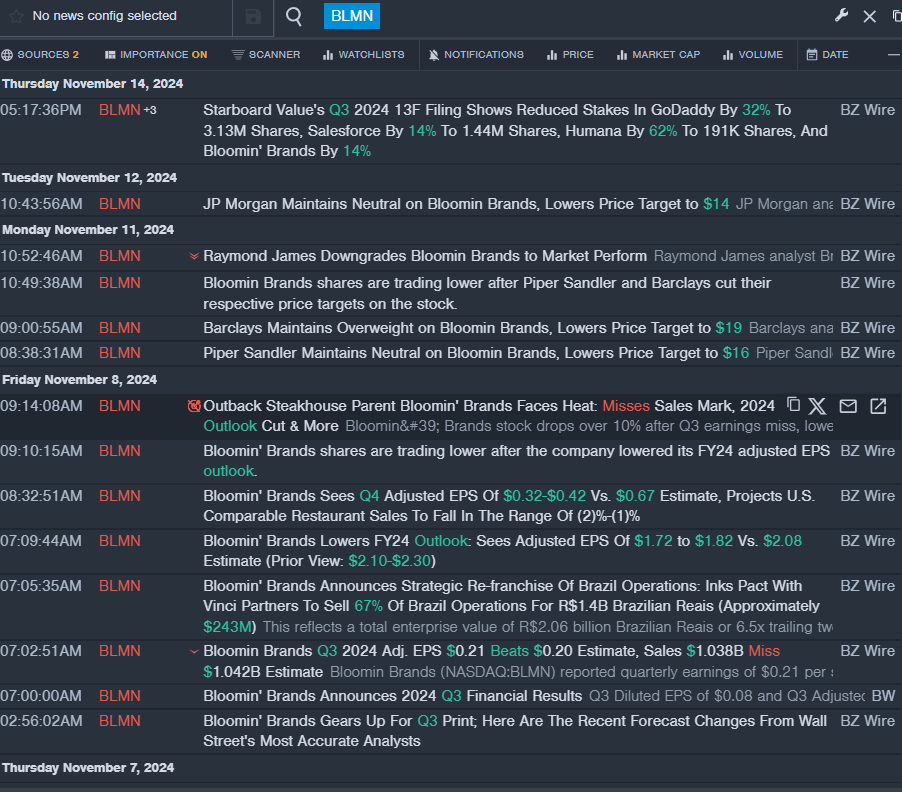

Bloomin' Brands, Inc. (NASDAQ:BLMN)

Bloomin' Brands, Inc. (納斯達克: BLMN)

- Dividend Yield: 7.15%

- Raymond James analyst Brian Vaccaro downgraded the stock from Outperform to Market Perform on Nov. 11. This analyst has an accuracy rate of 82%.

- Piper Sandler analyst Brian Mullan maintained a Neutral rating and slashed the price target from $20 to $16 on Nov. 11. This analyst has an accuracy rate of 76%.

- Recent News: On Nov. 8, the company reported third-quarter adjusted earnings per share of 21 cents, beating the street view of 20 cents. Quarterly revenues of $1.038 billion (down 3.8%) missed the analyst consensus of $1.042 billion.

- Benzinga Pro's real-time newsfeed alerted to latest BLMN news

- 股息率:7.15%

- Raymond James分析師Brian Vaccaro於11月11日將該股票評級從表現優異調降至市場表現。該分析師的準確率爲82%。

- Piper Sandler分析師Brian Mullan在11月11日維持中立評級,並將價格目標從20美元下調至16美元。該分析師的準確率爲76%。

- 近期新聞:公司於11月8日報告了每股21美分的第三季度調整後收益,超過了華爾街預期的20美分。季度收入10.38億美元(下降3.8%),低於分析師一致預期的10.42億美元。

- Benzinga Pro的實時新聞提醒最新的BLMN新聞

Kohl's Corporation (NYSE:KSS)

Kohl's Corporation(紐約證交所:KSS)

- Dividend Yield: 10.74%

- JP Morgan analyst Matthew Boss downgraded the stock from Neutral to Underweight with a price target of $19 on Aug. 29. This analyst has an accuracy rate of 66%.

- Baird analyst Mark Altschwager maintained an Outperform rating and cut the price target from $27 to $25 on Aug. 29. This analyst has an accuracy rate of 71%.

- Recent News: On Nov. 13, the company's board declared a regular quarterly dividend of 50 cents per share on its common stock.

- Benzinga Pro's charting tool helped identify the trend in KSS stock.

- 股息率:10.74%

- JP Morgan分析師Matthew Boss於8月29日將該股票的評級從中立下調至減持,目標價格爲19美元。該分析師的準確率爲66%。

- Baird分析師Mark Altschwager於8月29日維持股票的跑贏市場評級,並將目標價從27美元下調至25美元。該分析師的準確率爲71%。

- 近期資訊:11月13日,公司董事會宣佈每股普通股定期季度股息爲50美分。

- Benzinga Pro的圖表工具幫助識別了KSS股票的趨勢。

Read More:

閱讀更多:

- Jim Cramer Recommends Microsoft, Praises American Water Works For Being 'Consistent'

- 吉姆·克雷默推薦微軟,稱讚美國水務公司"一直如一"

譯文內容由第三人軟體翻譯。