What the Options Market Tells Us About Carnival

What the Options Market Tells Us About Carnival

Benzinga's options scanner just detected over 11 options trades for Carnival (NYSE:CCL) summing a total amount of $882,973.

Benzinga的期權掃描器剛剛檢測到嘉年華(紐交所:CCL)超過11筆期權交易,總金額爲882,973美元。

At the same time, our algo caught 6 for a total amount of 285,343.

與此同時,我們的量化系統捕獲了6筆交易,總金額爲285,343美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $25.0 for Carnival, spanning the last three months.

在評估成交量和未平倉合約後,很明顯主要市場參與者集中在嘉年華的價格區間在20.0美元到25.0美元之間,跨度爲過去三個月。

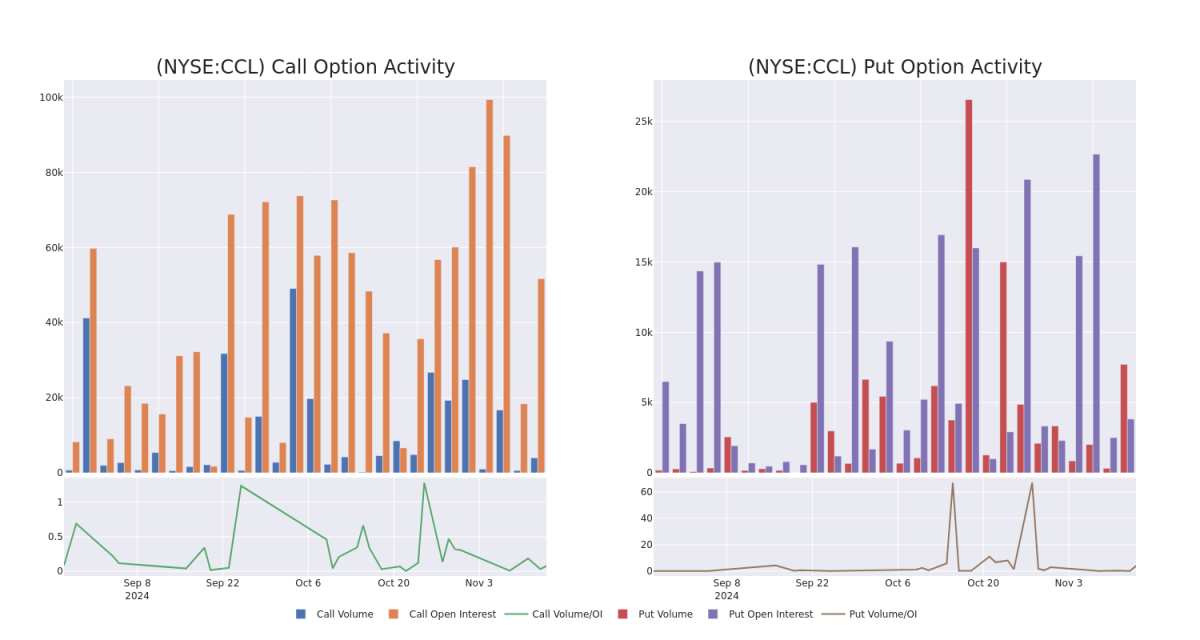

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Carnival's options for a given strike price.

這些數據可以幫助您追蹤嘉年華存託憑證某一行權價的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carnival's whale activity within a strike price range from $20.0 to $25.0 in the last 30 days.

在下面,我們可以觀察到嘉年華在過去30天內的所有鯨魚活動中,看漲期權和看跌期權的成交量和未平倉合約的演變,行使價格區間從20.0美元到25.0美元。

Carnival Call and Put Volume: 30-Day Overview

Carnival看漲和看跌期權成交量:30天總覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | SWEEP | BULLISH | 06/20/25 | $6.3 | $6.1 | $6.15 | $20.00 | $468.6K | 11.3K | 1.0K |

| CCL | CALL | TRADE | BEARISH | 01/16/26 | $6.5 | $6.45 | $6.45 | $22.00 | $301.2K | 1.8K | 2.0K |

| CCL | CALL | TRADE | BEARISH | 01/16/26 | $6.6 | $6.5 | $6.5 | $22.00 | $130.0K | 1.8K | 2.0K |

| CCL | CALL | TRADE | BULLISH | 01/17/25 | $5.15 | $5.0 | $5.15 | $20.00 | $103.0K | 37.0K | 204 |

| CCL | PUT | SWEEP | BULLISH | 01/17/25 | $1.73 | $1.72 | $1.72 | $25.00 | $89.4K | 751 | 520 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 嘉年華存託憑證 | 看漲 | SWEEP | 看好 | 06/20/25 | $6.3 | $6.1 | $6.15 | $20.00 | $468.6K | 11.3K | 1.0千 |

| 嘉年華存託憑證 | 看漲 | 交易 | 看淡 | 01/16/26 | $6.5 | $6.45 | $6.45 | $22.00 | $301.2K | 1800 | 2000 |

| 嘉年華存託憑證 | 看漲 | 交易 | 看淡 | 01/16/26 | $6.6 | $6.5 | $6.5 | $22.00 | $130.0K | 1800 | 2000 |

| 嘉年華存託憑證 | 看漲 | 交易 | 看好 | 01/17/25 | $5.15 | $5.0 | $5.15 | $20.00 | $103.0K | 37.0K | 204 |

| 嘉年華存託憑證 | 看跌 | SWEEP | 看好 | 01/17/25 | $1.73 | $1.72 | $1.72 | $25.00 | $89.4千美元 | 751 | 520 |

About Carnival

關於Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

Carnival是全球最大的遊輪公司,在2023財年結束時擁有92艘船隻。其品牌組合包括北美的Carnival Cruise Lines,Holland America,Princess Cruises和Seabourn;英國的P&O Cruises和Cunard Line;德國的Aida;南歐的Costa Cruises。它目前正在將其P&O Australia品牌整合到Carnival中。該公司還擁有Alaska的Holland America Princess Alaska Tours和加拿大育空地區的公司。在2019年新冠肺炎疫情之前,Carnival的品牌吸引了近1300萬客人,這個水平在2023年恢復。

Carnival's Current Market Status

嘉年華存託憑證的當前市場狀態

- Trading volume stands at 3,772,389, with CCL's price up by 1.02%, positioned at $24.8.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 35 days.

- 交易量爲3,772,389,CCL的價格上漲1.02%,現報$24.8。

- RSI指示股票可能已超買。

- 預計35天后公佈收益報告。

Expert Opinions on Carnival

專家對嘉年華存託憑證的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $28.0.

在過去30天內,共有1位專業分析師對該股票給出了看法,設定了28.0美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from B of A Securities persists with their Buy rating on Carnival, maintaining a target price of $28.

Benzinga Edge的期權異動板塊在事件發生之前發現潛在的市場驅動因素。查看大資金在您喜愛的股票上採取的頭寸。點擊這裏獲取訪問權限。* BofA證券的一位分析師堅持對嘉年華存託憑證的買入評級,維持目標價28美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子,並密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報及時了解最新的嘉年華存託憑證期權交易。

譯文內容由第三人軟體翻譯。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.