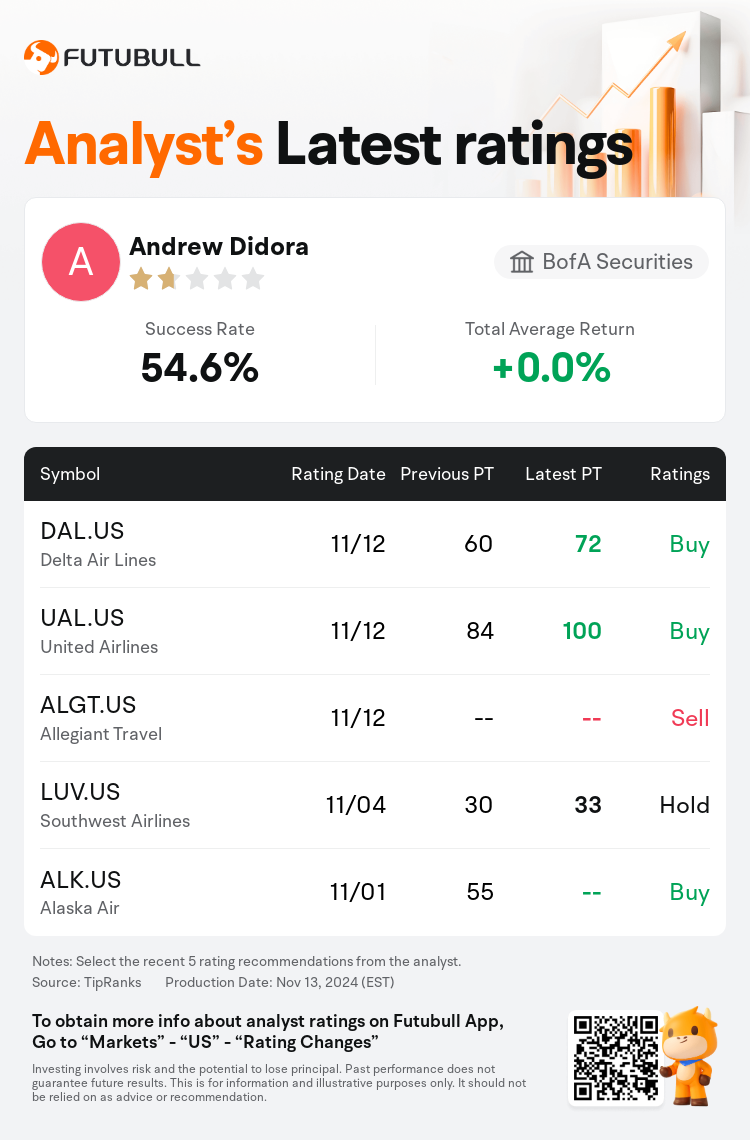

BofA Securities analyst Andrew Didora maintains $Delta Air Lines (DAL.US)$ with a buy rating, and adjusts the target price from $60 to $72.

According to TipRanks data, the analyst has a success rate of 54.6% and a total average return of 0.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Delta Air Lines (DAL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Delta Air Lines (DAL.US)$'s main analysts recently are as follows:

The performance of airline stocks has been strong following the recent election, with a notable uptick in a major airlines index. This significant movement is understandable considering the high beta nature of airline equities. The current market fundamentals appear promising, especially with the slowing pace of domestic capacity growth. Additionally, the outcome of the election seems to bode well for the underlying industry fundamentals and potential earnings.

The firm anticipates hosting its inaugural investor day shortly, during which it is expected to present guidance for FY25 metrics as well as establish new long-term objectives concerning loyalty/co-brand card and non-ticket revenue opportunities. The focal points are anticipated to include strategies related to hub and partnerships, customer lifecycle development, margin enhancements via fleet renewal, technical operations, cost-saving measures, and capital allocation.

Delta Air Lines has been recognized for its effective execution against its three-year goals set back in 2021, despite challenges beyond its control. There is potential for the company to project an earnings per share greater than $10 by 2027, which would surpass estimates by approximately 25% and consensus figures by 15%.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

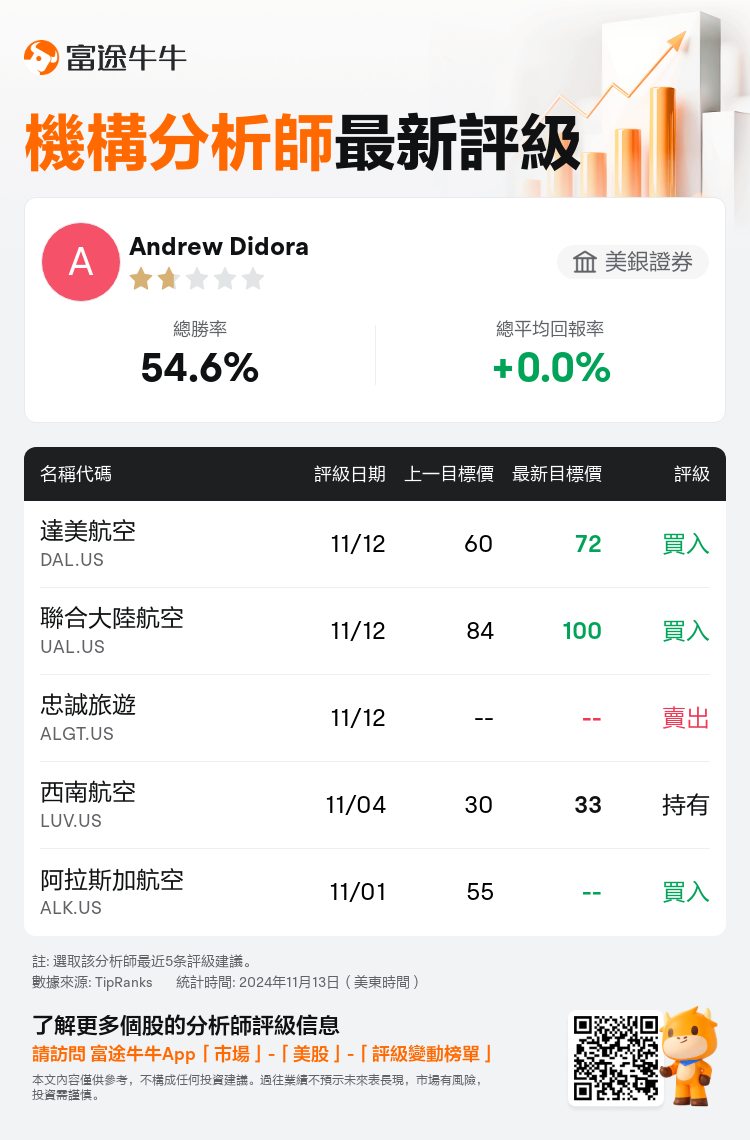

美銀證券分析師Andrew Didora維持$達美航空 (DAL.US)$買入評級,並將目標價從60美元上調至72美元。

根據TipRanks數據顯示,該分析師近一年總勝率為54.6%,總平均回報率為0.0%。

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

航空股票的表現在最近的選舉後表現強勁,主要航空公司指數出現明顯上升。考慮到航空股票的高貝塔特性,這種顯著變動是可以理解的。當前市場基本面看起來令人充滿希望,尤其是國內產能增長步伐放緩。此外,選舉結果似乎對潛在的行業基本面和潛在收入形勢有利。

公司預計不久將舉行首次投資者日活動,屆時預計將提供FY25指標方面的指導,並建立關於忠誠度/品牌卡和非票務收入機會的新的長期目標。重點預計將包括與樞紐和合作夥伴關係有關的戰略、客戶生命週期發展、通過機隊更新實現邊際增強、技術運營、節約成本措施以及資本配置。

達美航空在2021年設定的三年目標方面取得了有效執行的認可,儘管面臨無法控制的挑戰。該公司有望在2027年實現每股收益超過10美元,這將超出約25%的估算,並超出15%的共識數據。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of