Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically...Silver Would Be Down Twice As Much'

Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically...Silver Would Be Down Twice As Much'

As cryptocurrency prices hover around record levels, investors have been keen on adding them to their portfolios. This is evident by the rise in various Bitcoin (CRYPTO: BTC) ETF levels. However, gold prices have declined by nearly 1% in the morning hours as cryptocurrency prices surged. While silver prices have been down too, Peter Schiff, the chairman of SchiffGold.com and chief economist and global strategist at Europac.com suggests that investors should go for silver over Bitcoin as the precious yellow metal declines.

隨着數字貨幣價格接近創紀錄水平,投資者一直熱衷於將其納入投資組合。從比特幣(CRYPTO: BTC)ETF的不同水平上升可以看出這一點。然而黃金價格在早盤下跌了近1%,因爲數字貨幣價格飆升。儘管白銀價格也下跌,SchiffGold.com主席、Europac.com首席經濟學家兼全球策略師Peter Schiff建議投資者應選擇白銀而不是比特幣,因爲這種貴重黃金屬價格下跌。

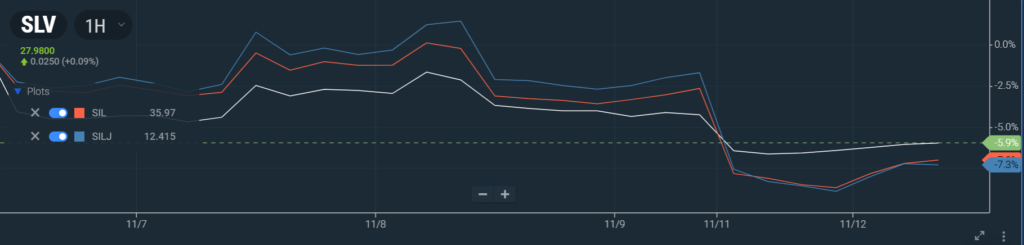

What Happened: Schiff suggests that "typically" silver prices should drop to about half the rate of gold. However, with silver prices holding steady amid market fluctuations, he views this resilience as a "silver lining." Schiff believes this unusual performance makes silver an attractive investment alternative to Bitcoin and gold ETFs, given its relative stability in the current market.

發生了什麼:舒菲特建議,「通常情況下」白銀價格應該下跌到黃金的一半左右。然而,隨着白銀價格在市場波動中保持穩定,他將這種韌性視爲「一線希望」。舒菲特認爲,白銀的這種異常表現使其成爲當前市場相對穩定狀態下比特幣和黃金etf的一個具有吸引力的投資替代品。

Also read: Bitcoin Blasts Through $88,000 As Market 'Euphoria,' Regulatory Optimism Take Hold

另請閱讀:隨着"狂熱"市場和監管樂觀情緒佔據主導地位,比特幣飆升至88,000美元以上

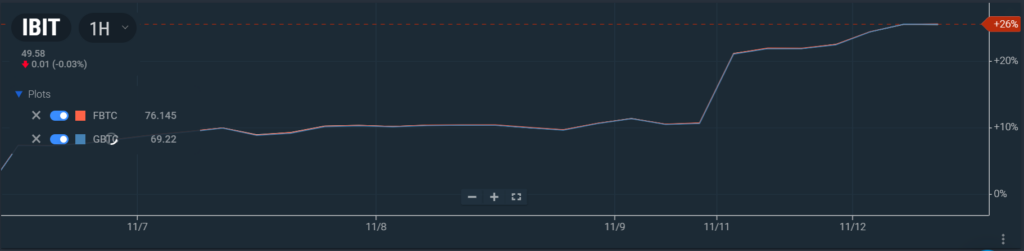

Why It Matters: Comparing the ETFs of all three assets, we see that gold and silver ETFs have underperformed bitcoin ETFs. Gold spot rates (NASDAQ:XAU) were down 1.05% at $2,591.34 per ounce, Silver spot rates (NASDAQ:XAG) were down by 1.25% at $30.30 per ounce and Bitcoin (CRYPTO: BTC) trading at $87,504.28 per coin at the time of publication.

爲何重要:比較所有三種資產的etf,我們發現黃金和白銀etf的表現不及比特幣etf。黃金現貨價格(納斯達克:XAU)每盎司下跌了1.05%,跌至2,591.34美元,白銀現貨價格(納斯達克:XAG)每盎司下跌了1.25%,跌至30.30美元,比特幣(CRYPTO: BTC)在發表時每枚以87,504.28美元交易。

Also read: Here's How Much $100 In Dogecoin Today Could Be Worth If DOGE Hits New All-Time Highs

此外閱讀:如果狗狗幣創下新的歷史最高價,今天100美元的狗狗幣可能價值多少

The iShares Bitcoin Trust (NASDAQ:IBIT) was up by 13.5% as of Monday's close. Additionally, the Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) and the Grayscale Bitcoin Trust (NYSE:GBTC) ETFs rose by 13.4% on Monday, as per Benzinga Pro data.

iShares比特幣信託基金(納斯達克:IBIT)在週一收盤時上漲了13.5%。此外,Fidelity智慧起源比特幣基金(BATS:FBTC)和Grayscale比特幣信託(紐交所:GBTC)ETF週一上漲了13.4%,根據Benzinga Pro數據。

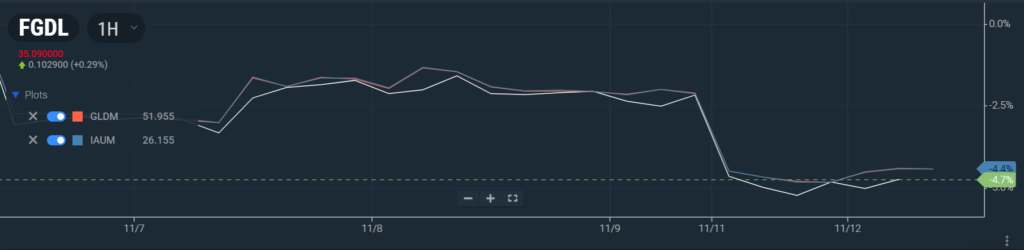

According to Benzinga Pro, Franklin Responsibility Sourced Gold ETF (NYSE:FGDL) declined 2.25% as of Monday's close, whereas the SPDR Gold MiniShares Trust (NYSE:GLDM) was down by 2.35% on the same day. iShares Gold Trust Micro Shares (NYSE:IAUM) declined by 2.39% on Monday.

根據Benzinga Pro的數據,富蘭克林負責任來源黃金etf基金(紐交所:FGDL)截至週一收盤下跌2.25%,而SPDR Gold MiniShares Trust(紐交所:GLDM)當天下跌2.35%。 iShares Gold Trust Micro Shares(紐交所:IAUM)週一下跌2.39%。

Also Read: Gold ETF Hit With $1 Billion Outflow: Investors Dump Safe Haven Asset After Trump Win

閱讀更多:黃金etf因特朗普勝選後遭受10億美元流出:投資者拋售避險資產

While the gold ETFs fell by over 2% on Monday, silver ETFs were down too. As per Benzinga Pro data, iShares Silver Trust (NYSE:SLV) was down 1.79% on Monday. Similarly, Global X Silver Miners ETF (NYSE:SIL) and Amplify ETF Trust Amplify Junior Silver Miners ETF (NYSE:SILJ) were down by 4.39% and 5.77% as of Monday's close.

黃金etf週一下跌超過2%,白銀etf也出現下跌。根據Benzinga Pro的數據,白銀etf-ishares(紐交所:SLV)週一下跌1.79%。 類似地,全球白銀礦工etf(紐交所:SIL)和Amplify ETF Trust Amplify Junior Silver Miners ETF(紐交所:SILJ)截至週一收盤分別下跌4.39%和5.77%。

Also read: Why Trump's Win Has 2 Market Experts Betting On Small Caps, Financials

閱讀更多:爲什麼特朗普的勝選令2位市場專家看好小盤股、金融股

Image Via Shutterstock

圖片來自shutterstock

譯文內容由第三人軟體翻譯。