With EPS Growth And More, H World Group (NASDAQ:HTHT) Makes An Interesting Case

With EPS Growth And More, H World Group (NASDAQ:HTHT) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

對於一些投機者來說,投資於能夠逆轉命運的公司的激動人心的吸引力很大,因此即使沒有營業收入、利潤以及連續失利記錄的公司也能找到投資者。有時這些故事會使投資者的頭腦變得混亂,使他們根據情感而不是根據良好的公司基本面去投資。一家虧損的公司尚未通過盈利證明自己,最終外部資本的流入可能會枯竭。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like H World Group (NASDAQ:HTHT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide H World Group with the means to add long-term value to shareholders.

因此,如果這種高風險高回報的思路不適合您,您可能更感興趣的是像華住(納斯達克:HTHT)這樣盈利穩健、增長穩健的公司。即使市場認爲該公司的估值合理,投資者也會同意,持續產生穩定利潤將繼續爲華住提供增加股東長期價值的手段。

H World Group's Improving Profits

華住業績改善

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that H World Group's EPS went from CN¥3.70 to CN¥12.15 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

強勁的每股收益(EPS)業績是公司實現穩健利潤的指標,投資者對此持樂觀態度,因此股價往往反映出出色的EPS業績。這就是爲什麼EPS增長如此受歡迎。令人驚歎的是,華住的EPS僅在一年內從3.70人民幣增長到12.15人民幣。雖然很難以那個水平維持增長,但這對公司未來的前景是一個好兆頭。這可能意味着業務已經達到了一個拐點。

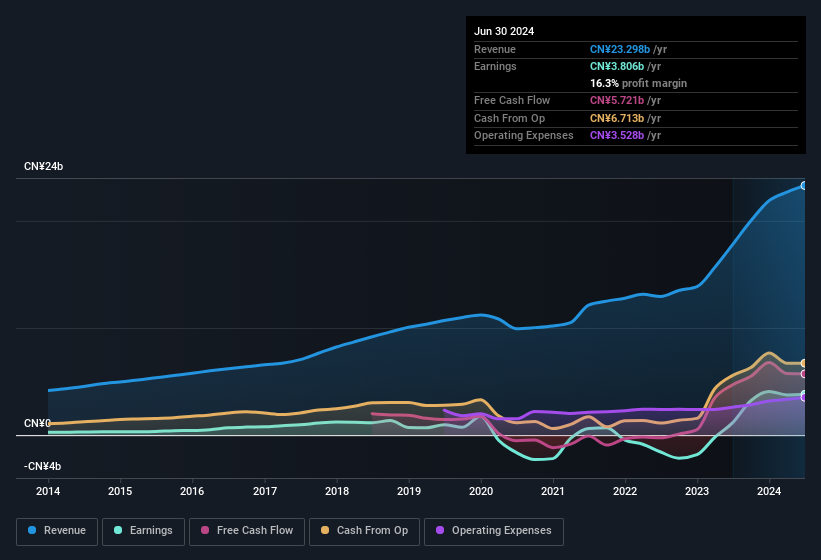

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of H World Group shareholders is that EBIT margins have grown from 12% to 23% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

仔細考慮營業收入增長和利息稅前利潤(EBIT)利潤率可以幫助判斷最近利潤增長的可持續性。華住股東欣喜的是,過去12個月的EBIT利潤率已從12%增長至23%,收入也呈上升趨勢。在我們看來,滿足這兩個條件是增長的一個良好跡象。

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

下圖顯示了該公司底線和頂線隨着時間的推移而發展的情況。點擊圖片以獲取更精細的詳細信息。

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for H World Group's future EPS 100% free.

作爲投資者,訣竅在於找到未來表現良好的公司,而不僅僅是過去的表現。雖然並不存在水晶球,但您可以免費查看我們對華住未來每股收益的共識分析師預測的可視化展示。

Are H World Group Insiders Aligned With All Shareholders?

華住內部人員與所有股東保持一致嗎?

We would not expect to see insiders owning a large percentage of a US$11b company like H World Group. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth CN¥3.6b. That equates to 31% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

我們不會期望看到內部人員持有像華住這樣規模達110億美元的公司的大比例股份。但由於他們對公司的投資,很高興看到仍然有激勵措施與股東保持一致。我們注意到他們在公司中令人印象深刻的股份價值36億人民幣。這相當於公司的31%,使內部人員強大且與其他股東保持一致。對投資者來說看起來非常樂觀。

Is H World Group Worth Keeping An Eye On?

值得密切關注華住嗎?

H World Group's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering H World Group for a spot on your watchlist. You still need to take note of risks, for example - H World Group has 1 warning sign we think you should be aware of.

華住的收益以相當驚人的方式起飛。這種每股收益增長水平對吸引投資起了奇蹟作用,而公司內部人員對公司的大量投資則是額外加分項。當然,希望是,強勁的增長標誌着業務經濟基礎的根本改善。因此基於這個快速分析,我們認爲值得考慮將華住納入您的自選名單。您仍需注意風險,例如 - 華住有1個警示標誌,我們認爲您應該注意。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

總是有可能買入未增長收益並且內部人員不買入股票的股票表現良好。但是對於那些認爲這些重要指數的人,我們鼓勵您查看具有這些功能的公司。您可以訪問定製列表,其中列出了已經展示出增長並得到內幕人員認可的公司。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of H World Group shareholders is that EBIT margins have grown from 12% to 23% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of H World Group shareholders is that EBIT margins have grown from 12% to 23% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.