Decoding NIO's Options Activity: What's the Big Picture?

Decoding NIO's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on NIO (NYSE:NIO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in NIO often signals that someone has privileged information.

高風險投資者已經看好NIO(紐交所:NIO),對零售交易者來說重要的是要留意。\ 通過Benzinga追蹤公開期權數據,今天我們注意到了這一活動。 這些投資者的身份尚不明確,但NIO出現如此重大的變動往往表明某人掌握了內幕信息。

Today, Benzinga's options scanner spotted 19 options trades for NIO. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了NIO的19筆期權交易。 這並不是一個典型的模式。

The sentiment among these major traders is split, with 89% bullish and 5% bearish. Among all the options we identified, there was one put, amounting to $56,202, and 18 calls, totaling $1,532,034.

這些主要交易者之間的情緒分爲兩派,89%看漲,5%看跌。 在我們確認的所有期權中,有一個看跌,金額爲56202美元,還有18個看漲,總計1532034美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.

根據這些合約的成交量和未平倉合約,似乎鯨魚在過去3個月內一直將NIO的目標價區間定在3.0至17.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

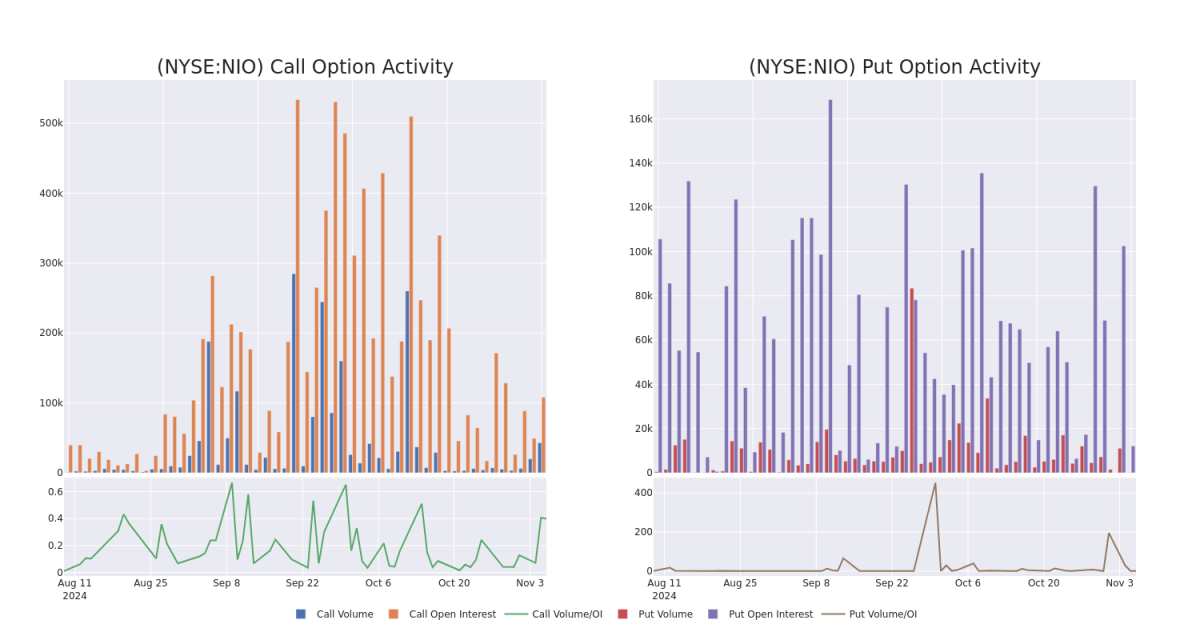

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for NIO's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NIO's whale trades within a strike price range from $3.0 to $17.0 in the last 30 days.

在期權交易時查看成交量和未平倉合約是一個強大的舉措。 這些數據可以幫助您跟蹤NIO期權在特定行使價的流動性和興趣。 下面,我們可以觀察過去30天內所有NIO鯨魚交易的看漲和看跌的成交量和未平倉合約的演變,行使價區間爲3.0至17.0美元。

NIO Option Volume And Open Interest Over Last 30 Days

NIO過去30天的期權成交量和持倉量

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $2.33 | $1.85 | $2.33 | $5.00 | $233.4K | 45.6K | 1.1K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $0.43 | $0.43 | $0.43 | $17.00 | $225.7K | 13.1K | 5.2K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.78 | $1.75 | $1.78 | $5.00 | $151.1K | 45.6K | 6.3K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.78 | $1.75 | $1.77 | $5.00 | $146.9K | 45.6K | 5.3K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.77 | $1.77 | $1.77 | $5.00 | $107.5K | 45.6K | 3.2K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | 看漲 | Sweep | 看好 | 01/16/26 | $2.33 | $1.85 | $2.33 | $5.00 | 233.4千美元 | 45.6千 | 1.1千 |

| NIO | 看漲 | Sweep | 看好 | 01/16/26 | $0.43 | $0.43 | $0.43 | $17.00 | $225.7K | 13.1K | 5.2K |

| NIO | 看漲 | Sweep | 看好 | 01/16/26 | $1.78 | $1.75 | $1.78 | $5.00 | $151.1K | 45.6千 | 6.3K |

| NIO | 看漲 | Sweep | 看好 | 01/16/26 | $1.78 | $1.75 | $1.77 | $5.00 | $146.9千 | 45.6千 | 5.3K |

| NIO | 看漲 | Sweep | 看好 | 01/16/26 | $1.77 | $1.77 | $1.77 | $5.00 | $107.5K | 45.6千 | 3.2K |

About NIO

關於NIO

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

蔚來是一家領先的新能源車製造商,專注於高端市場。成立於2014年11月,蔚來設計、研發、合作製造和銷售高端智能新能源車。該公司通過持續的技術突破和創新,如電池交換和自動駕駛技術,實現了自身的差異化。蔚來於2017年12月推出了其首款車型——ES8七座電動SUV,並於2018年6月開始交付。目前的車型組合包括中大型轎車和SUV。2023年該公司銷售了超過16萬輛新能源車,佔據中國乘用車新能源市場約2%的份額。

Having examined the options trading patterns of NIO, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對NIO期權交易模式的研究,我們現在將注意力直接轉向該公司。這一轉變使我們能夠深入了解其當前的市場地位和表現

Where Is NIO Standing Right Now?

蔚來現在處於什麼位置?

- Trading volume stands at 64,729,005, with NIO's price down by -5.11%, positioned at $5.01.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 27 days.

- 交易量爲64,729,005,NIO的價格下跌了-5.11%,位於$5.01。

- RSI指標顯示該股票可能正接近超賣。

- 將在27天內公佈收益報告。

What The Experts Say On NIO

關於NIO的專家意見

1 market experts have recently issued ratings for this stock, with a consensus target price of $6.6.

1位市場專家最近對這支股票發表了評級,一致看好其目標價爲6.6美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Macquarie upgraded its action to Outperform with a price target of $6.

Benzinga Edge的期權異動板塊可以提前發現潛在的市場變動。查看大資金在您鍾愛的股票上的持倉情況。點擊這裏查看詳情。* 來自麥格理的分析師將其評級調升爲表現優異,目標價爲6美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.