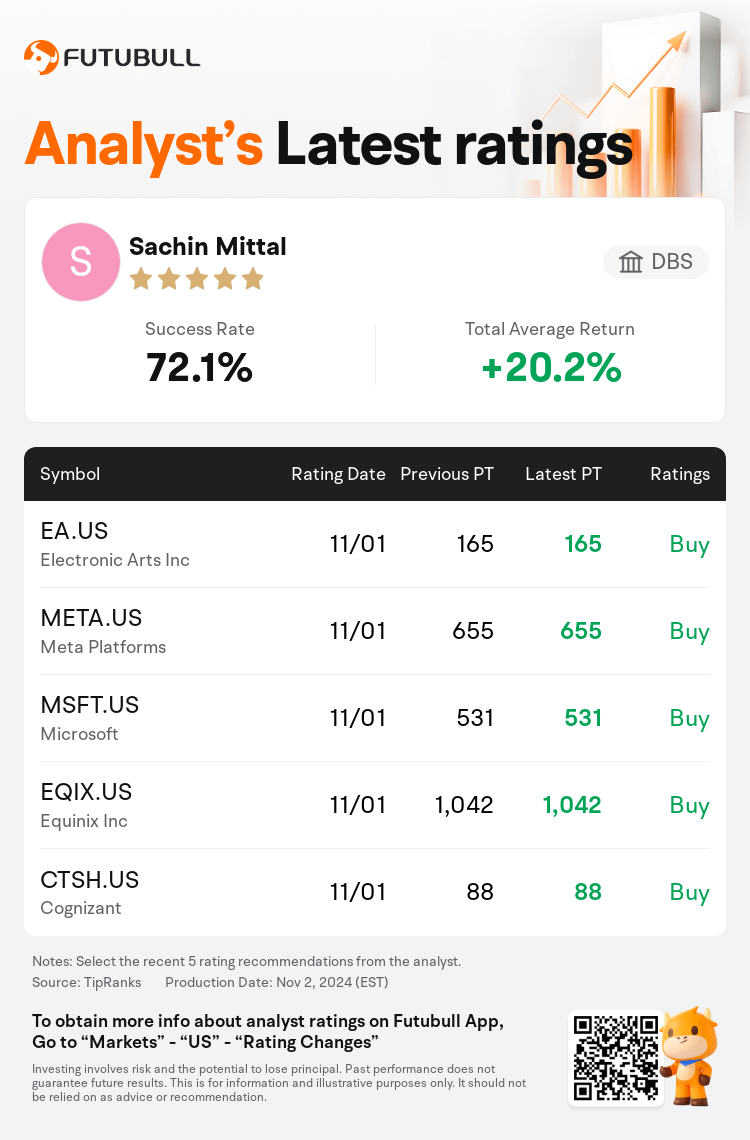

DBS analyst Sachin Mittal maintains $Meta Platforms (META.US)$ with a buy rating, and maintains the target price at $655.

According to TipRanks data, the analyst has a success rate of 72.1% and a total average return of 20.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Meta Platforms (META.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Meta Platforms (META.US)$'s main analysts recently are as follows:

Meta Platforms has been signaling a notable rise in capital expenditures for 2025, while also showcasing various factors that demonstrate the expected benefits from these investments. This includes an anticipated increase in revenue growth by approximately $28 billion in 2024. Additionally, there is a possibility for an upward trajectory in advertising revenue for the year 2026 and beyond, driven by the potential generation of additional revenue from new products leveraging GenAI technology.

Following the Q3 earnings announcement, expectations of a robust Q4 revenue forecast were balanced by projected substantial increases in capex and infrastructure-related outlays for 2025. The analyst acknowledged a shift in focus from immediate earnings to longer-term potential and noted that the company has seen significant benefits from AI in its core advertising business. With a strong product pipeline, including Meta AI, Llama, and other initiatives, the company's consistent core revenue growth and solid execution history provide the latitude for sizeable investments in AI. Revenue projections for 2025 and 2026 have been moderately raised post-earnings report.

Following Meta Platforms' third-quarter revenue and EPS surpassing forecasts and a fourth-quarter outlook that aligns with market expectations, revenue predictions for 2025 have been increased by 3% and EPS estimates by 6%. This adjustment takes into account enhanced ad revenue, though it is somewhat tempered by anticipated increases in research and development as well as capital expenditures.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

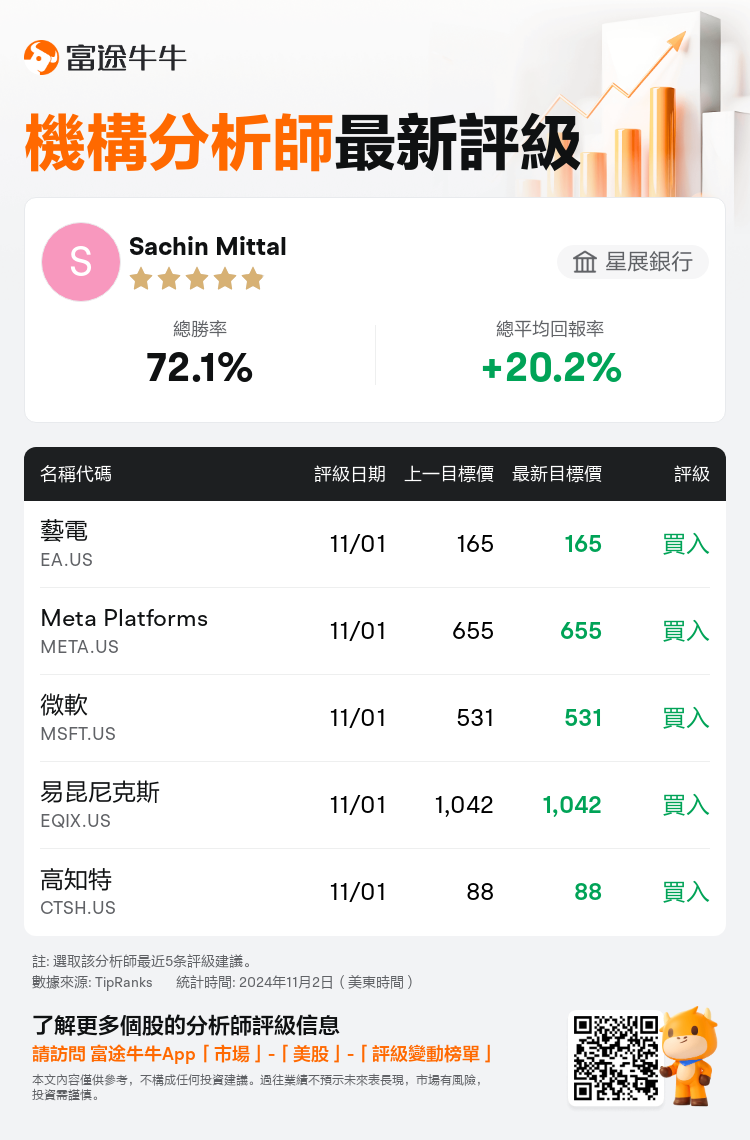

星展銀行分析師Sachin Mittal維持$Meta Platforms (META.US)$買入評級,維持目標價655美元。

根據TipRanks數據顯示,該分析師近一年總勝率為72.1%,總平均回報率為20.2%。

此外,綜合報道,$Meta Platforms (META.US)$近期主要分析師觀點如下:

此外,綜合報道,$Meta Platforms (META.US)$近期主要分析師觀點如下:

meta platforms已經在2025年資本支出上表現出顯著增長的跡象,同時展示了各種因素,證明了這些投資預期收益的好處。其中包括2024年營業收入增長約280億美元。此外,2026年及以後廣告營收有望出現上升軌跡,這是由於利用GenAI技術的新產品可能帶來額外收入的潛力。

在第三季度業績公告之後,預計強勁的第四季度收入預測與2025年基礎設施建設和相關支出的大幅增加相互抵消。分析師承認業務重心從即時收益轉向長期潛力,並指出公司在其核心廣告業務中從人工智能中獲得了顯著的好處。憑藉強大的產品管線,包括Meta AI、Llama和其他倡議,公司始終保持着核心收入增長和紮實的執行歷史,爲在人工智能領域進行大規模投資提供了空間。根據業績報告後的調整,2025年和2026年的營業收入預測已經適度上調。

在meta platforms第三季度營收和每股收益超過預期並且第四季度展望符合市場預期之後,2025年的營收預測增加了3%,每股收益預估增加了6%。這一調整考慮到廣告收入的增加,儘管預計研發支出和資本支出的增加會有所抑制。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Meta Platforms (META.US)$近期主要分析師觀點如下:

此外,綜合報道,$Meta Platforms (META.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of