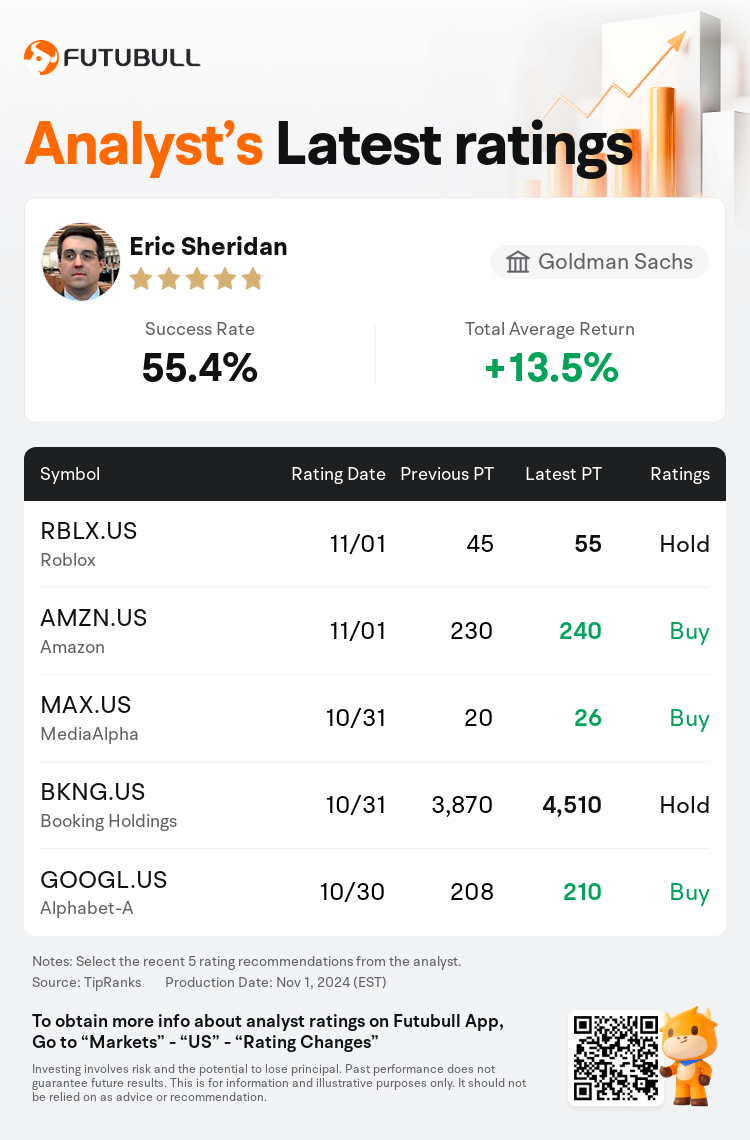

Goldman Sachs analyst Eric Sheridan maintains $Roblox (RBLX.US)$ with a hold rating, and adjusts the target price from $45 to $55.

According to TipRanks data, the analyst has a success rate of 55.4% and a total average return of 13.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Roblox (RBLX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Roblox (RBLX.US)$'s main analysts recently are as follows:

Roblox reported a third-quarter performance that surpassed expectations and increased its 2024 forecasts across the board. The expectation is that these projections may be on the lower side, given discussions indicating that booking trends are continuing to be robust.

Roblox's key performance metrics are showing signs of acceleration, with bookings, daily active users, and engagement hours reaching all-time highs. While safety concerns are not unique to the platform and exist across many social applications, they are considered addressable issues that the management is actively working to resolve.

Roblox's recent financial results showcased record-setting metrics. The increase in PlayStation 5 availability significantly contributed to this success, with the console now accounting for 8% of total bookings and aiding in improved monetization. It is anticipated that console bookings will surpass mobile bookings by 2025, given the console's lower penetration among Roblox developers and its ability to monetize more effectively, thanks to an older and more affluent player demographic.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

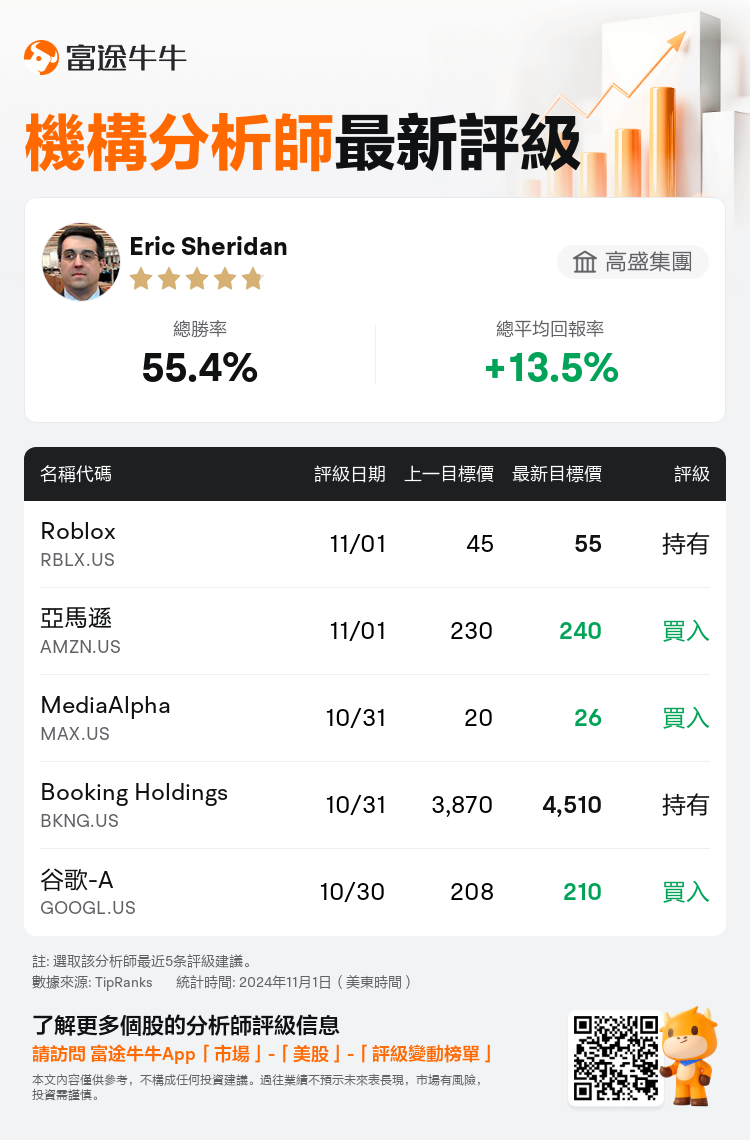

高盛集團分析師Eric Sheridan維持$Roblox (RBLX.US)$持有評級,並將目標價從45美元上調至55美元。

根據TipRanks數據顯示,該分析師近一年總勝率為55.4%,總平均回報率為13.5%。

此外,綜合報道,$Roblox (RBLX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Roblox (RBLX.US)$近期主要分析師觀點如下:

Roblox報告第三季度的業績超出預期,並全面提高了2024年的預測。預期這些預測可能偏低,因爲討論表明預訂趨勢仍然強勁。

Roblox的關鍵業績指標顯示出加速的跡象,預訂量、日活躍用戶數和參與時長達到歷史最高水平。雖然安全問題並非平台獨有,而是存在於許多社交應用中,但這些問題被認爲是可以解決的,管理層正在積極努力解決。

Roblox最近的財務業績展示了創紀錄的指標。PlayStation 5供應增加顯著促成了這一成功,該主機現在佔總預訂量的8%,有助於改善貨幣化。預計到2025年,主機預訂將超過移動設備預訂,這是因爲相對於Roblox開發者來說,主機的滲透率較低,並且能夠更有效地實現貨幣化,這要歸功於更老齡化和更富有的玩家人口。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Roblox (RBLX.US)$近期主要分析師觀點如下:

此外,綜合報道,$Roblox (RBLX.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of