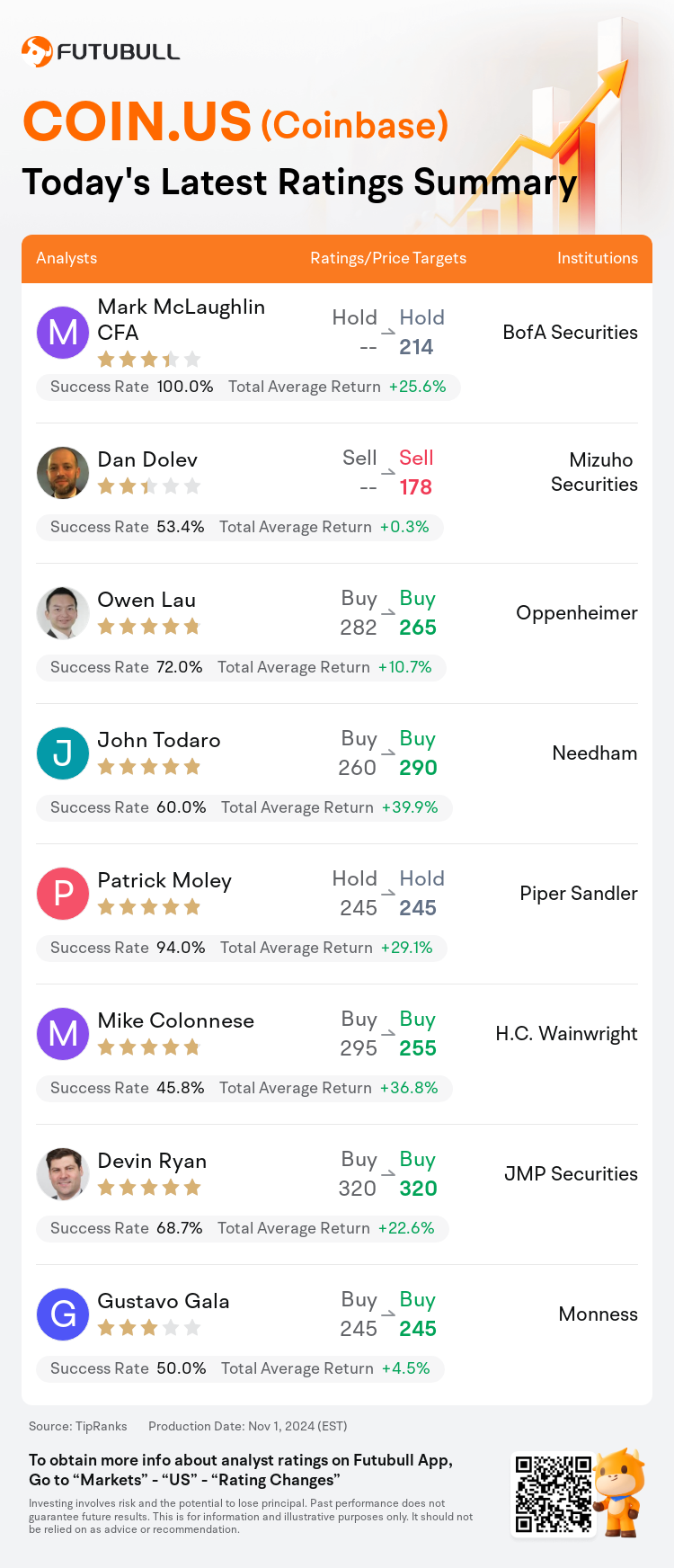

On Nov 01, major Wall Street analysts update their ratings for $Coinbase (COIN.US)$, with price targets ranging from $178 to $320.

BofA Securities analyst Mark McLaughlin CFA maintains with a hold rating, and sets the target price at $214.

Mizuho Securities analyst Dan Dolev maintains with a sell rating, and sets the target price at $178.

Oppenheimer analyst Owen Lau maintains with a buy rating, and adjusts the target price from $282 to $265.

Oppenheimer analyst Owen Lau maintains with a buy rating, and adjusts the target price from $282 to $265.

Needham analyst John Todaro maintains with a buy rating, and adjusts the target price from $260 to $290.

Piper Sandler analyst Patrick Moley maintains with a hold rating, and maintains the target price at $245.

Furthermore, according to the comprehensive report, the opinions of $Coinbase (COIN.US)$'s main analysts recently are as follows:

Coinbase continues to solidify its position to capitalize on the long-term adoption of cryptocurrency through persistent product introductions and innovations. The anticipated increases in EPS for 2025 and 2026 reflect a positive adjustment in future earnings expectations.

Coinbase's Q3 revenue and adjusted EBITDA fell short of estimates with volumes slightly under expectations. The significant portion of low-/no-fee stablecoin pair trading contributed to a more pronounced miss in retail transaction revenue. Despite potential near-term pressure on the shares, attention is shifting back towards the election.

While the company surpassed the firm's projections, it did not meet the wider market's expectations, primarily due to trading activity in cryptocurrency that was less than anticipated. Nevertheless, there is a possibility that subdued activity could shift positively with certain political outcomes, potentially broadening the range of cryptocurrency products offered and stimulating heightened trading activity.

It was noted that despite a decline in consumer take rates by 40 basis points quarter over quarter, Coinbase has maintained its fee rate structure in the Consumer app, which was viewed positively. However, there is concern that the growing approvals of ETFs may be shifting user preference away from alt-coins and more towards Bitcoin and Ethereum, potentially casting doubt on Coinbase's enduring competitive advantage.

Here are the latest investment ratings and price targets for $Coinbase (COIN.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

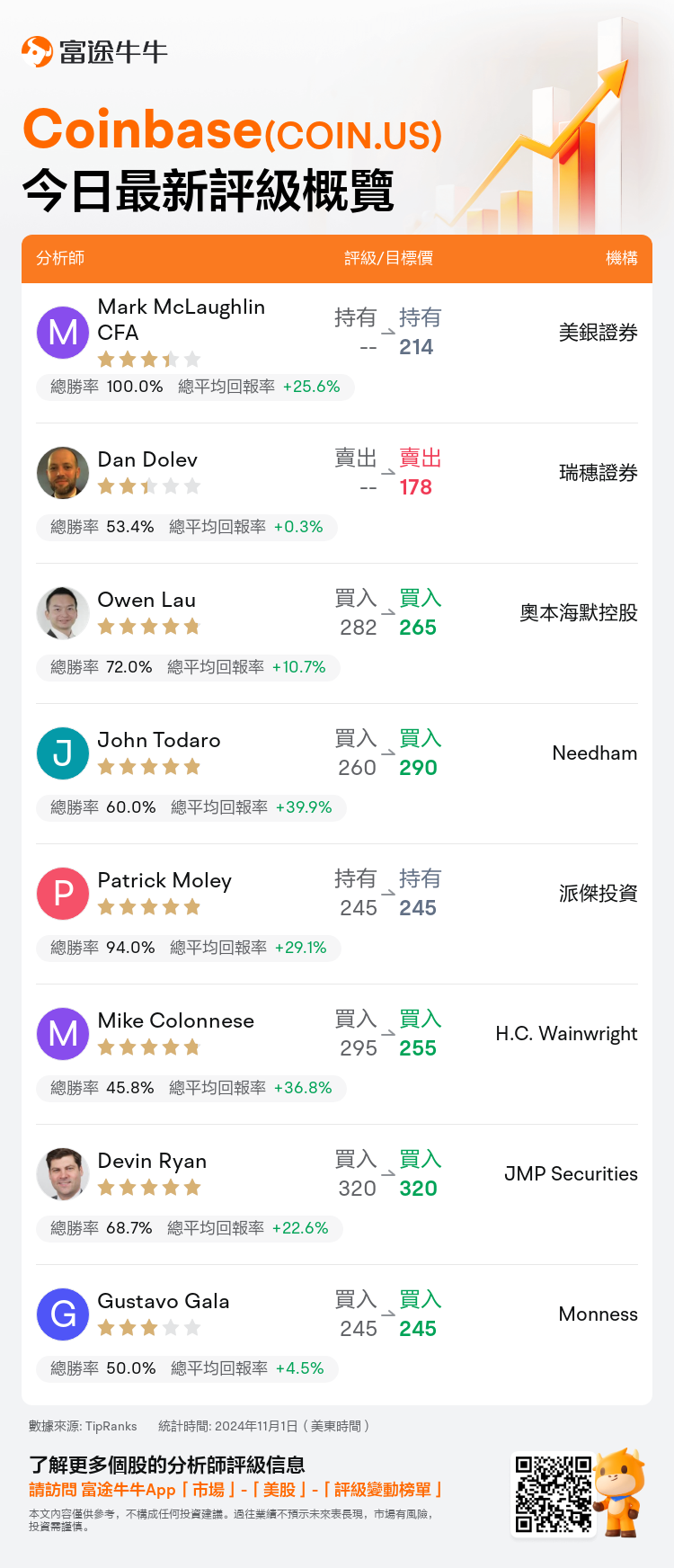

美東時間11月1日,多家華爾街大行更新了$Coinbase (COIN.US)$的評級,目標價介於178美元至320美元。

美銀證券分析師Mark McLaughlin CFA維持持有評級,目標價214美元。

瑞穗證券分析師Dan Dolev維持賣出評級,目標價178美元。

奧本海默控股分析師Owen Lau維持買入評級,並將目標價從282美元下調至265美元。

奧本海默控股分析師Owen Lau維持買入評級,並將目標價從282美元下調至265美元。

Needham分析師John Todaro維持買入評級,並將目標價從260美元上調至290美元。

派傑投資分析師Patrick Moley維持持有評級,維持目標價245美元。

此外,綜合報道,$Coinbase (COIN.US)$近期主要分析師觀點如下:

Coinbase繼續穩固其地位,通過持續推出產品和創新來 capitalize 數字貨幣的長期接受。2025年和2026年 EPS 預期上升反映了未來收益預期的積極調整。

Coinbase第三季度的 營業收入 和調整後的 EBITDA 低於預期,交易量略低於預期。低/無費用穩定幣交易的大部分使得零售交易 營收 出現更爲明顯的落差。儘管股票可能面臨近期壓力,但注意力正在轉向選舉。

儘管公司超過了公司的預期, 但未能達到更廣泛市場的期望, 主要是因爲數字貨幣交易活動低於預期。然而,存在一種可能性,即減少的活動可能會隨着某些政策結果積極轉變,潛在地擴大提供的數字貨幣產品範圍,並刺激較高的交易活動。

儘管消費者費率季度環比下降了40點子,Coinbase 在 消費 應用程序中保持了費率結構,這一點被視爲積極。然而,有人擔心 ETFs 的增加可能會改變用戶偏好,使其從另類幣更多地轉向 比特幣 和 以太幣,潛在地對Coinbase持續的競爭優勢產生質疑。

以下爲今日8位分析師對$Coinbase (COIN.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

奧本海默控股分析師Owen Lau維持買入評級,並將目標價從282美元下調至265美元。

奧本海默控股分析師Owen Lau維持買入評級,並將目標價從282美元下調至265美元。

Oppenheimer analyst Owen Lau maintains with a buy rating, and adjusts the target price from $282 to $265.

Oppenheimer analyst Owen Lau maintains with a buy rating, and adjusts the target price from $282 to $265.