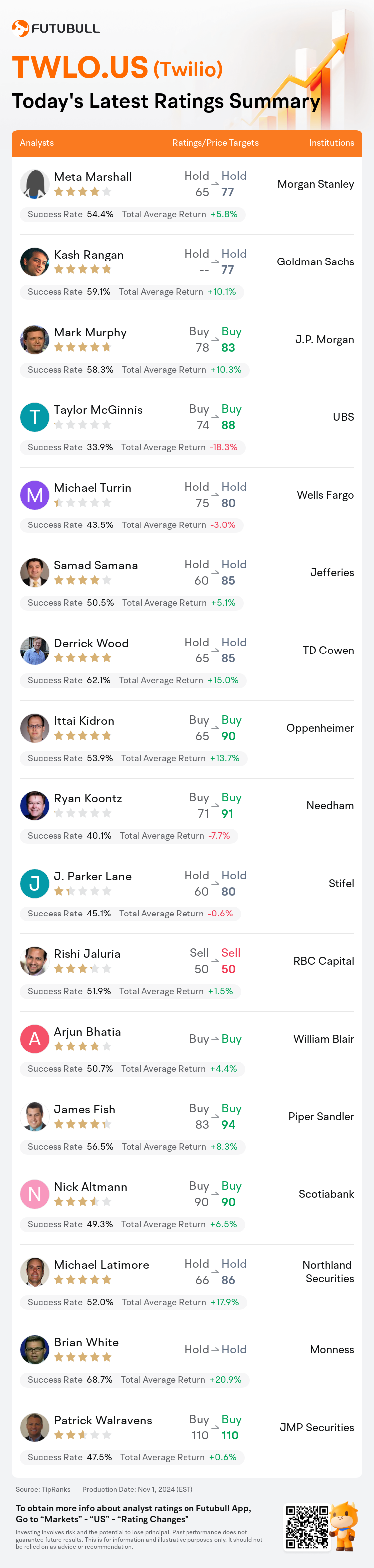

On Nov 01, major Wall Street analysts update their ratings for $Twilio (TWLO.US)$, with price targets ranging from $50 to $110.

Morgan Stanley analyst Meta Marshall maintains with a hold rating, and adjusts the target price from $65 to $77.

Goldman Sachs analyst Kash Rangan maintains with a hold rating, and sets the target price at $77.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

UBS analyst Taylor McGinnis maintains with a buy rating, and adjusts the target price from $74 to $88.

Wells Fargo analyst Michael Turrin maintains with a hold rating, and adjusts the target price from $75 to $80.

Furthermore, according to the comprehensive report, the opinions of $Twilio (TWLO.US)$'s main analysts recently are as follows:

The company is witnessing an upswing in momentum within its primary channels currently.

The company's robust second-quarter performance exceeded expectations in all areas, encompassing revenue, operating margin, and free cash flow. Analyst sentiment has improved regarding the company's notable success in Diversified Communications and the initial indications of substantial returns on investment from AI products.

Twilio's return to double-digit revenue growth has come sooner than anticipated, as evidenced by a reported acceleration to 10% year-over-year growth in Q3, an increase from the 7% year-over-year organic growth observed in the first half of the year. This performance surge is credited to robust areas like Messaging, email, and various growth endeavors involving Independent Software Vendors, self-service options, and cross-selling opportunities. The shares are perceived as holding appeal due to prospects of sustaining over 10% growth and ongoing margin improvement. Furthermore, an upcoming Investor Day could serve as a pivotal moment should the company present an effective AI narrative and affirm that the growth can maintain its current rate.

Following a 'strong' Q3 performance, Twilio has shown a return to double-digit revenue growth alongside continued operating leverage. The forecast for 2025 appears increasingly plausible. Although there is potential in terms of valuation, a more solid perspective on the forward growth outlook is necessary.

The anticipation of potential growth acceleration has been a key focus, and Twilio's recent uptick in growth during Q3 is seen as a significant positive move, aligning with the overall objective of returning to a consistent double-digit revenue growth trajectory.

Here are the latest investment ratings and price targets for $Twilio (TWLO.US)$ from 17 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

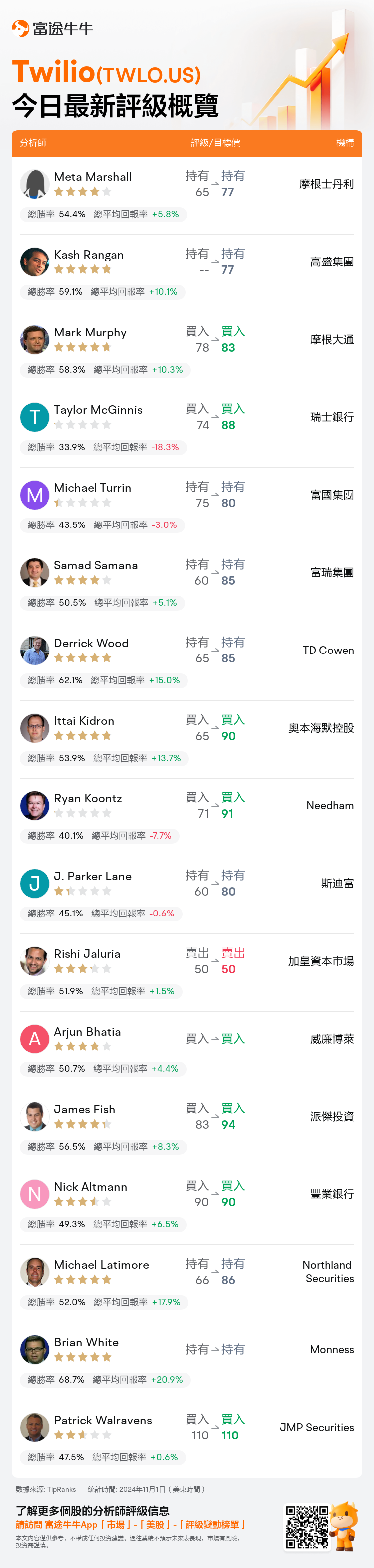

美東時間11月1日,多家華爾街大行更新了$Twilio (TWLO.US)$的評級,目標價介於50美元至110美元。

摩根士丹利分析師Meta Marshall維持持有評級,並將目標價從65美元上調至77美元。

高盛集團分析師Kash Rangan維持持有評級,目標價77美元。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從78美元上調至83美元。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從78美元上調至83美元。

瑞士銀行分析師Taylor McGinnis維持買入評級,並將目標價從74美元上調至88美元。

富國集團分析師Michael Turrin維持持有評級,並將目標價從75美元上調至80美元。

此外,綜合報道,$Twilio (TWLO.US)$近期主要分析師觀點如下:

公司目前在其主要渠道中正在經歷動量上升。

公司強勁的第二季度表現超出了所有領域的預期,包括營業收入、營業利潤率和自由現金流。分析師情緒已經改善,針對公司在多元化通信方面取得顯著成功以及人工智能產品初步顯示出的可觀回報的狀況。

twilio的回歸到兩位數的收入增長比預期提前,據報告,在Q3年同比增長加速至10%,較年初觀察到的7%年同比增長有機增長有所增加。這一表現激增歸因於像消息傳遞、電子郵件以及包括獨立軟件供應商、自助選項和跨銷售機會在內的各種增長努力等強勁領域。股票被認爲具有吸引力,因爲有望維持超過10%的增長並持續改善利潤率。此外,即將到來的投資者日可能成爲一個關鍵時刻,如果公司提出一個有效的人工智能故事,並確認增長能夠保持目前的速度。

在一次'強勁'的Q3業績之後,twilio展示了回到兩位數的收入增長以及持續的營業槓桿效應。到2025年的預測似乎變得越來越可能。儘管在估值方面存在潛力,但對前瞻性增長前景更爲堅實的看法是必要的。

對潛在增長加速的預期已成爲一個關鍵焦點,twilio在Q3期間的增長上升被視爲一個重要的積極舉措,符合重新回歸一致的兩位數營業收入增長軌跡的總體目標。

以下爲今日17位分析師對$Twilio (TWLO.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從78美元上調至83美元。

摩根大通分析師Mark Murphy維持買入評級,並將目標價從78美元上調至83美元。

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.