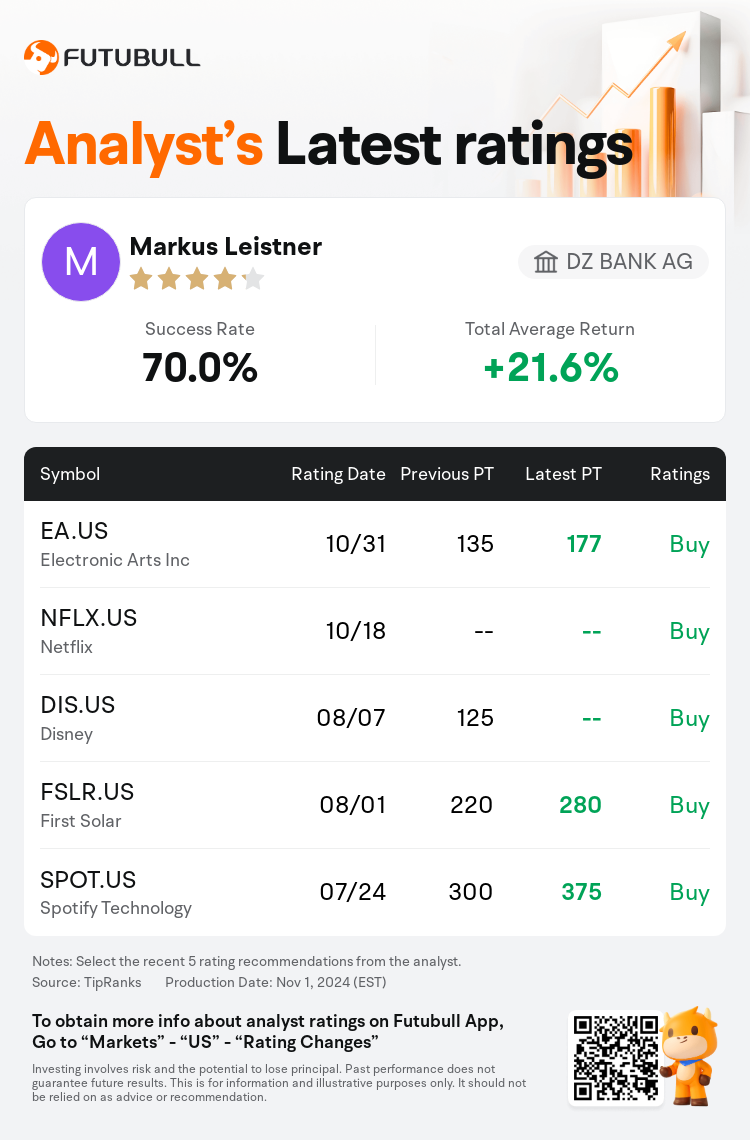

DZ BANK AG analyst Markus Leistner upgrades $Electronic Arts Inc (EA.US)$ to a buy rating, and adjusts the target price from $135 to $177.

According to TipRanks data, the analyst has a success rate of 70.0% and a total average return of 21.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Electronic Arts Inc (EA.US)$'s main analysts recently are as follows:

Electronic Arts (EA) reported fiscal Q2 bookings and adjusted earnings that surpassed the upper end of their guidance and increased their fiscal 2025 forecast. Nevertheless, the analyst indicates a need for more consistent delivery on non-sports titles, expressing a preference for Take-Two (TTWO) as the launch of GTA VI approaches in Fall 2025.

The company experienced a robust earnings beat-and-raise in Q2 amidst heightened expectations, driven by the performance of sports titles which balanced the weaker results from Apex Legends. Additionally, the significant increase in hours played across American Football titles indicates that the introduction of College Football is likely to add value to the overall portfolio rather than detract from it.

The firm indicated that Electronic Arts' second-quarter results surpassed expectations, aligning with the robust initial engagement and monetization seen with College Football. The effective pairing of Madden and College Football appears to be cultivating a broader American football gaming community. This, together with Electronic Arts' established presence in global football (soccer), suggests a foundation for increased recurring revenues.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

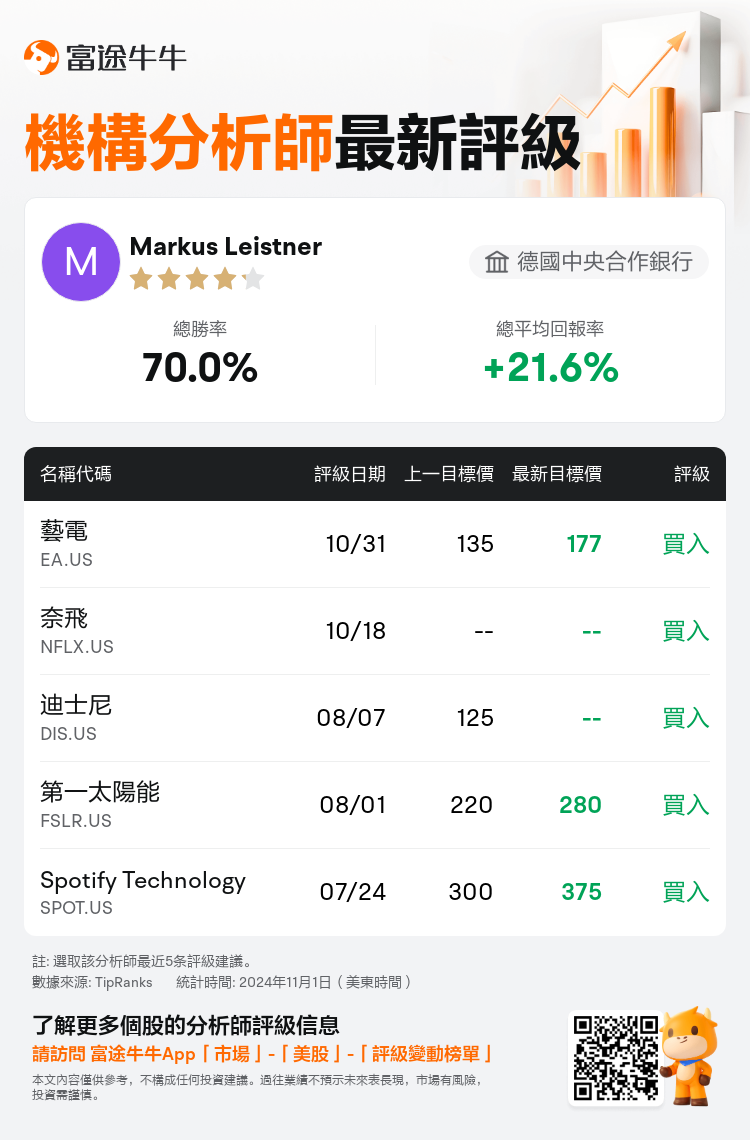

德國中央合作銀行分析師Markus Leistner上調$藝電 (EA.US)$至買入評級,並將目標價從135美元上調至177美元。

根據TipRanks數據顯示,該分析師近一年總勝率為70.0%,總平均回報率為21.6%。

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

美國藝電(EA)報告了財政Q2的預訂額和調整後收益,超過了他們的指導範圍的上限,並增加了他們的2025財政預測。儘管如此,分析師指出需要更加一致地提供非體育類遊戲,表明在2025年秋季《俠盜獵車手VI》推出之際更傾向於Take-Two(TTWO)。

該公司在Q2中經歷了強勁的盈利超預期以及業績提升,受到增加的預期的推動,體育類遊戲的表現強勁,平衡了《Apex 英雄》的較弱業績。此外,美式橄欖球遊戲時間的顯著增加表明,推出《大學橄欖球》可能會爲整體組合增加價值,而不是減損價值。

該公司表示,美國藝電的第二季度業績超出了預期,與學院橄欖球所見的強勁初期參與度和貨幣化情況相一致。《麥登橄欖球》和《大學橄欖球》的有效搭配似乎正在培育更廣泛的美式橄欖球遊戲社區。這,再加上美國藝電在全球足球領域的奠定地位,表明了增加可重複收入的基礎。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

此外,綜合報道,$藝電 (EA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of