Financial giants have made a conspicuous bullish move on Affirm Holdings. Our analysis of options history for Affirm Holdings (NASDAQ:AFRM) revealed 20 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $334,950, and 16 were calls, valued at $849,725.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $32.5 to $57.5 for Affirm Holdings during the past quarter.

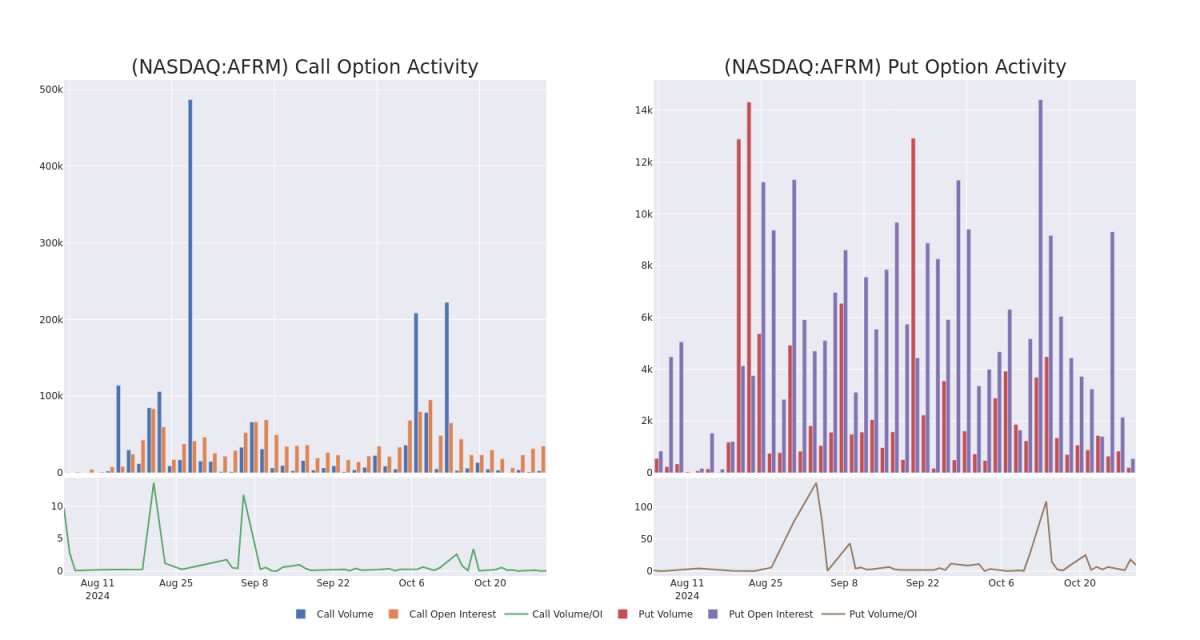

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.

Affirm Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| AFRM | CALL | TRADE | BULLISH | 01/17/25 | $5.85 | $5.7 | $5.8 | $47.50 | $147.3K | 2.8K | 327 |

| AFRM | PUT | SWEEP | BULLISH | 01/16/26 | $19.25 | $19.1 | $19.1 | $55.00 | $120.3K | 186 | 63 |

| AFRM | CALL | SWEEP | BEARISH | 11/08/24 | $2.59 | $2.58 | $2.58 | $48.50 | $110.2K | 27 | 377 |

| AFRM | PUT | SWEEP | BULLISH | 01/16/26 | $17.6 | $17.4 | $17.4 | $52.50 | $92.2K | 99 | 53 |

| AFRM | CALL | SWEEP | NEUTRAL | 11/08/24 | $4.85 | $4.75 | $4.85 | $44.00 | $72.7K | 399 | 247 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Following our analysis of the options activities associated with Affirm Holdings, we pivot to a closer look at the company's own performance.

Current Position of Affirm Holdings

- With a trading volume of 8,273,583, the price of AFRM is down by -1.0%, reaching $42.44.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 8 days from now.

What Analysts Are Saying About Affirm Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $51.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from BTIG has elevated its stance to Buy, setting a new price target at $68. * An analyst from Wells Fargo upgraded its action to Overweight with a price target of $52. * In a positive move, an analyst from Wedbush has upgraded their rating to Neutral and adjusted the price target to $45. * In a positive move, an analyst from Morgan Stanley has upgraded their rating to Equal-Weight and adjusted the price target to $37. * An analyst from Goldman Sachs has decided to maintain their Buy rating on Affirm Holdings, which currently sits at a price target of $54.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Affirm Holdings options trades with real-time alerts from Benzinga Pro.

金融巨頭對Affirm Holdings採取了明顯的看漲舉動。我們對Affirm Holdings(納斯達克股票代碼:AFRM)期權歷史的分析顯示了20筆不尋常的交易。

深入研究細節,我們發現55%的交易者看漲,而35%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有4筆是看跌期權,價值爲334,950美元,16筆是看漲期權,價值849,725美元。

預期的價格走勢

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注Affirm Holdings在過去一個季度的價格範圍從32.5美元到57.5美元不等。

交易量和未平倉合約趨勢

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤Affirm Holdings期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內Affirm Holdings所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在32.5美元至57.5美元之間。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤Affirm Holdings期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內Affirm Holdings所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在32.5美元至57.5美元之間。

Affirm Holdings 期權活動分析:過去 30 天

檢測到的重要期權交易:

符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|

農場 | 打電話 | 貿易 | 看漲 | 01/17/25 | 5.85 美元 | 5.7 美元 | 5.8 美元 | 47.50 美元 | 147.3 萬美元 | 2.8K | 327 |

農場 | 放 | 掃 | 看漲 | 01/16/26 | 19.25 美元 | 19.1 美元 | 19.1 美元 | 55.00 美元 | 120.3 萬美元 | 186 | 63 |

農場 | 打電話 | 掃 | 看跌 | 11/08/24 | 2.59 美元 | 2.58 美元 | 2.58 美元 | 48.50 美元 | 110.2 萬美元 | 27 | 377 |

農場 | 放 | 掃 | 看漲 | 01/16/26 | 17.6 美元 | 17.4 美元 | 17.4 美元 | 52.50 美元 | 92.2 萬美元 | 99 | 53 |

農場 | 打電話 | 掃 | 中立 | 11/08/24 | 4.85 美元 | 4.75 美元 | 4.85 美元 | 44.00 美元 | 72.7 萬美元 | 399 | 247 |

關於 Affirm 控股公司

Affirm Holdings Inc爲數字和移動優先商務提供了一個平台。它包括面向消費者的銷售點支付解決方案、商戶商務解決方案和以消費者爲中心的應用程序。該公司的收入來自商戶網絡以及虛擬卡網絡等。從地理上講,它的大部分收入來自美國。

在分析了與Affirm Holdings相關的期權活動之後,我們將轉向仔細研究公司自身的業績。

Affirm Holdings的當前狀況

分析師對Affirm Holdings的看法

5位市場專家最近發佈了該股的評級,共識目標價爲51.2美元。

在短短 20 天內將 1000 美元變成 1270 美元?

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處查看。* BTIG的一位分析師已將其立場上調至買入,將新的目標股價定爲68美元。* 富國銀行的一位分析師將其持倉上調至增持,目標股價爲52美元。* Wedbush的一位分析師將其評級上調至中性,並將目標股價調整至45美元。*積極的舉動是,摩根士丹利的一位分析師將其評級上調至等權重並進行了調整目標股價爲37美元。*高盛的一位分析師已決定維持目前對Affirm Holdings的買入評級目標股價爲54美元。

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解Affirm Holdings的最新期權交易。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤Affirm Holdings期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內Affirm Holdings所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在32.5美元至57.5美元之間。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤Affirm Holdings期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內Affirm Holdings所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在32.5美元至57.5美元之間。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.