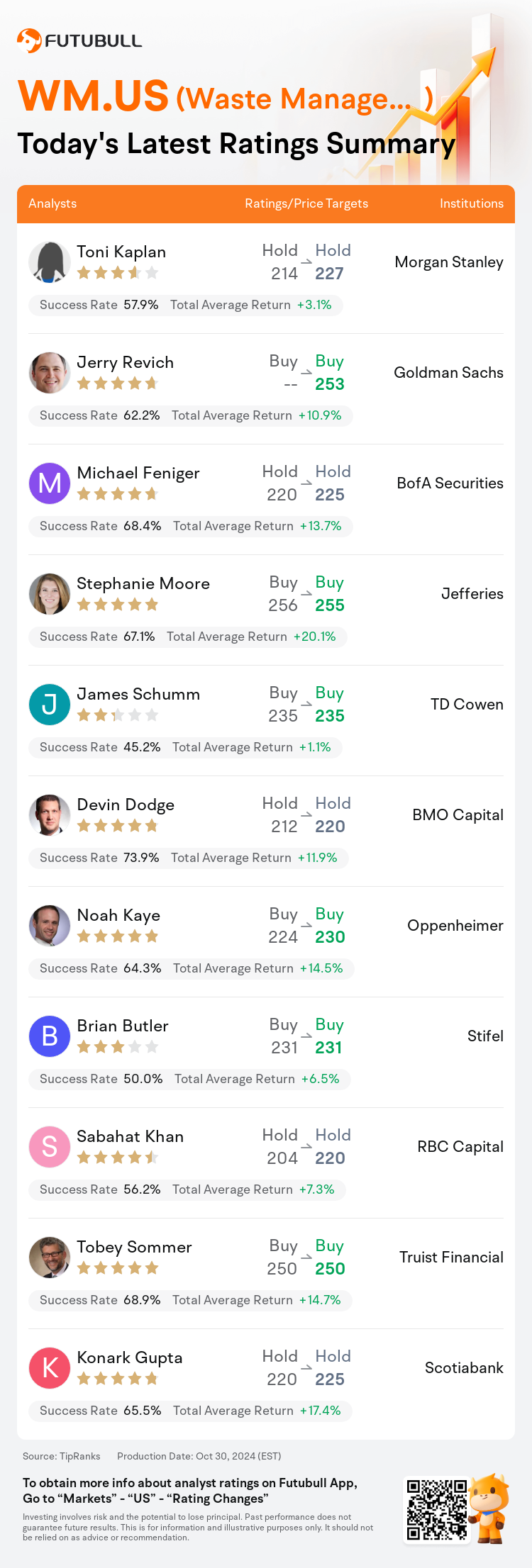

On Oct 30, major Wall Street analysts update their ratings for $Waste Management (WM.US)$, with price targets ranging from $220 to $255.

Morgan Stanley analyst Toni Kaplan maintains with a hold rating, and adjusts the target price from $214 to $227.

Goldman Sachs analyst Jerry Revich maintains with a buy rating, and sets the target price at $253.

BofA Securities analyst Michael Feniger maintains with a hold rating, and adjusts the target price from $220 to $225.

BofA Securities analyst Michael Feniger maintains with a hold rating, and adjusts the target price from $220 to $225.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

TD Cowen analyst James Schumm maintains with a buy rating, and maintains the target price at $235.

Furthermore, according to the comprehensive report, the opinions of $Waste Management (WM.US)$'s main analysts recently are as follows:

Following a solid Q3 report, the anticipated Q4 outlook seems quite attainable, and the prospects for 2025 are becoming significantly more compelling.

The firm is optimistic regarding the company's sustained growth in core unit profitability, the noticeable increase in earnings due to maturing green capital expenditure investments, and the improvement in free cash flow conversion.

WM's shares experienced an uptick following the company's outperformance in Q3 with both top and bottom lines surpassing consensus, alongside a raised free cash flow guidance for FY24 that exceeded analyst expectations by 2.4%. WM's strategic focus on technology-driven productivity investments is enhancing its position, taking advantage of beneficial industry pricing and cost trends, which is expected to contribute to significant core margin growth into FY25.

Following the company's third-quarter earnings surpassing expectations, it was noted that strong pricing and volume growth contributed to a new high in Adjusted EBITDA margin at 30.5%. The company is reaping benefits from a wider price-cost spread, the shedding of low-margin volumes, enhanced employee retention, and investments in technology. Additionally, with a positive outlook on the Solid Waste business, contributions from sustainability investments, and the integration of a recent acquisition, expectations are set for a significant increase in revenue, earnings, and free cash flow.

Here are the latest investment ratings and price targets for $Waste Management (WM.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

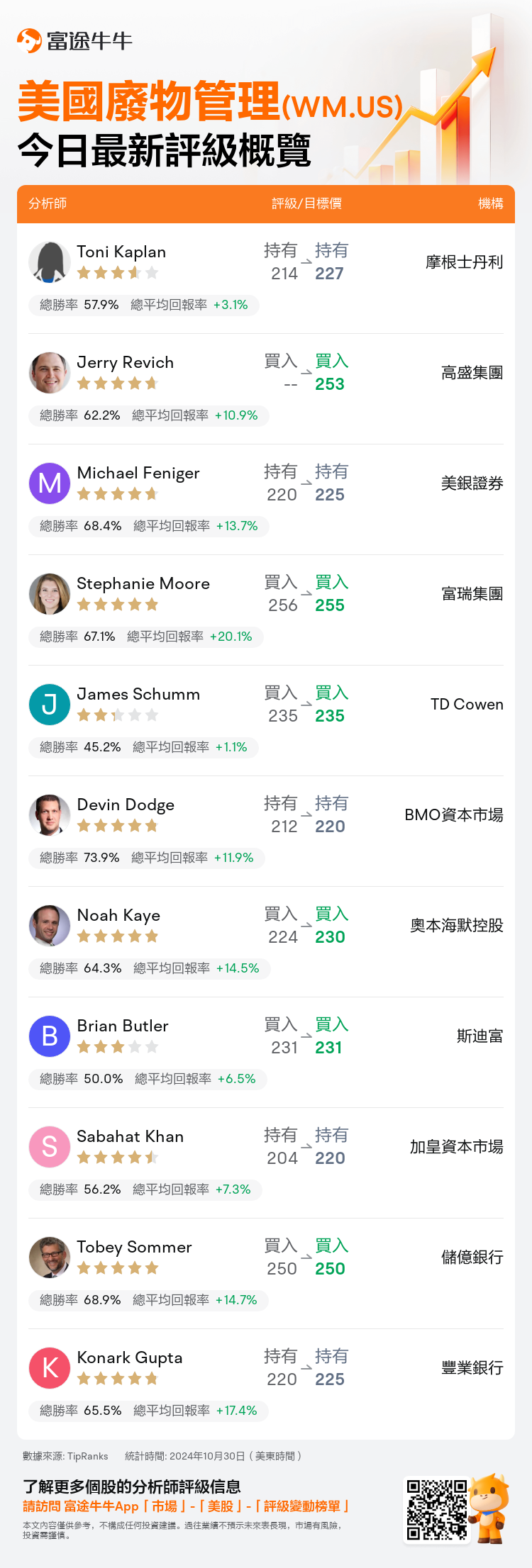

美東時間10月30日,多家華爾街大行更新了$美國廢物管理 (WM.US)$的評級,目標價介於220美元至255美元。

摩根士丹利分析師Toni Kaplan維持持有評級,並將目標價從214美元上調至227美元。

高盛集團分析師Jerry Revich維持買入評級,目標價253美元。

美銀證券分析師Michael Feniger維持持有評級,並將目標價從220美元上調至225美元。

美銀證券分析師Michael Feniger維持持有評級,並將目標價從220美元上調至225美元。

富瑞集團分析師Stephanie Moore維持買入評級,並將目標價從256美元下調至255美元。

TD Cowen分析師James Schumm維持買入評級,維持目標價235美元。

此外,綜合報道,$美國廢物管理 (WM.US)$近期主要分析師觀點如下:

在一份紮實的第三季度報告之後,預期的第四季度展望似乎相當可實現,並且2025年的前景變得更加引人注目。

該公司對核心單位盈利能力持續增長持樂觀態度,收益顯著增長源自成熟的綠色資本支出投資,同時自由現金流轉化率的提高。

WM股票在第三季度表現優異後有所上漲,收入和利潤雙雙超出共識,同時將財年24年度的自由現金流指引提升至超出分析師預期2.4%。WM將重點放在以技術驅動的生產力投資上,增強其地位,並充分利用有利的行業定價和成本趨勢,預計將在財年25年度爲核心利潤率增長做出重大貢獻。

在公司第三季度盈利超出預期後,強勁的定價和成交量增長導致調整後的EBITDA利潤率達到30.5%的新高。公司從更廣泛的價格成本差異、擺脫低毛利潤的成交量、增強員工保留以及科技投資中受益。此外,對於固體廢物業務的積極展望,來源於可持續性投資的貢獻以及最近收購的整合,預計將會在營業收入、盈利和自由現金流方面實現顯著增長。

以下爲今日11位分析師對$美國廢物管理 (WM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Michael Feniger維持持有評級,並將目標價從220美元上調至225美元。

美銀證券分析師Michael Feniger維持持有評級,並將目標價從220美元上調至225美元。

BofA Securities analyst Michael Feniger maintains with a hold rating, and adjusts the target price from $220 to $225.

BofA Securities analyst Michael Feniger maintains with a hold rating, and adjusts the target price from $220 to $225.