What's Next: Transocean's Earnings Preview

What's Next: Transocean's Earnings Preview

Transocean (NYSE:RIG) is gearing up to announce its quarterly earnings on Wednesday, 2024-10-30. Here's a quick overview of what investors should know before the release.

transocean(NYSE:RIG)正加速準備於2024年10月30日(星期三)公佈季度業績。在公佈前,投資者應了解以下要點。

Analysts are estimating that Transocean will report an earnings per share (EPS) of $-0.04.

分析師預計Transocean將報告每股收益(EPS)爲-0.04美元。

Anticipation surrounds Transocean's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

投資者對Transocean的公告充滿期待,希望聽到超越預期和獲得下一季度積極指引的消息。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

新投資者應該了解,儘管收益表現很重要,但市場反應往往受到指引的推動。

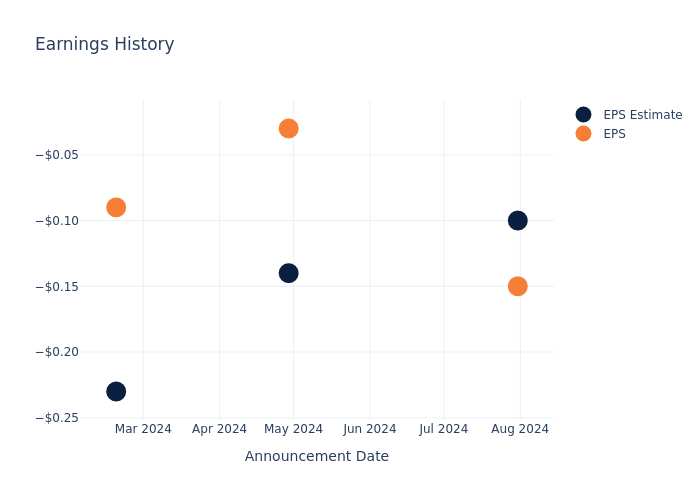

Historical Earnings Performance

歷史業績表現

In the previous earnings release, the company missed EPS by $0.05, leading to a 5.7% drop in the share price the following trading session.

在上一次業績發佈中,公司每股收益低於0.05美元,導致隨後的交易日股價下跌了5.7%。

Here's a look at Transocean's past performance and the resulting price change:

讓我們回顧Transocean過去的表現以及隨之產生的股價變動:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.10 | -0.14 | -0.23 | -0.23 |

| EPS Actual | -0.15 | -0.03 | -0.09 | -0.36 |

| Price Change % | -6.0% | -10.0% | -4.0% | -0.0% |

| 季度 | 2024年第二季度 | Q1 2024 | 2023年第四季度 | 2023年第三季度 |

|---|---|---|---|---|

| 每股收益預估值 | -0.10 | -0.14 | -0.23 | -0.23 |

| 每股收益實際值 | -0.15 | -0.03 | -0.09 | -0.36 |

| 價格變更% | -6.0% | -10.0% | -4.0% | -0.0% |

Transocean Share Price Analysis

transocean股價分析

Shares of Transocean were trading at $4.03 as of October 28. Over the last 52-week period, shares are down 40.81%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

截至10月28日,transocean股票交易價爲$4.03。在過去52周內,股價下跌了40.81%。鑑於這些回報通常是負面的,長期股東可能對本次業績日持看淡態度。

To track all earnings releases for Transocean visit their earnings calendar on our site.

要跟蹤transocean的所有業績發佈,請訪問我們網站上的業績日曆。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。

譯文內容由第三人軟體翻譯。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.