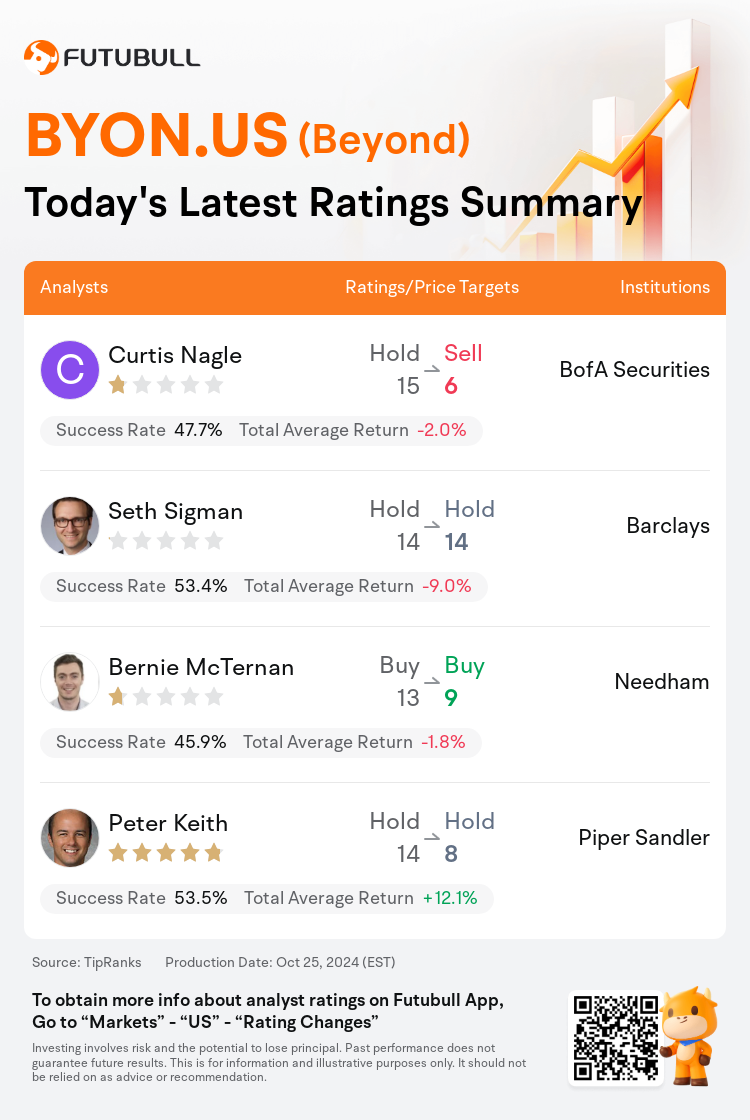

On Oct 25, major Wall Street analysts update their ratings for $Beyond (BYON.US)$, with price targets ranging from $6 to $14.

BofA Securities analyst Curtis Nagle downgrades to a sell rating, and adjusts the target price from $15 to $6.

Barclays analyst Seth Sigman maintains with a hold rating, and maintains the target price at $14.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Piper Sandler analyst Peter Keith maintains with a hold rating, and adjusts the target price from $14 to $8.

Furthermore, according to the comprehensive report, the opinions of $Beyond (BYON.US)$'s main analysts recently are as follows:

The strategic measures Beyond is implementing to reduce fixed expenses and expand the business are anticipated to result in substantial value for shareholders in the upcoming years. Analysts believe that the company's leadership has a robust plan for propelling profitable revenue growth. Significant enhancements in revenue and earnings are projected starting in 2025, driven by the expansion of the close-out business, the re-establishment of an online presence by Zulily, and Bed Bath & Beyond's increased physical retail presence through broader partnerships.

The potential risk-reward scenario for Beyond is described as 'intriguing with significant upside' based on the possibility of effectively consolidating the operations of Bed, Bath and Beyond, Overstock, and Zulily. Despite these brands having individual peaks and troughs of success, the combined outcome could be favorable. There is an acknowledgement of the considerable number of tasks management faces, which introduces a degree of execution risk. Additional insights regarding the core operations of the three brands are anticipated at the investor event scheduled for later in the week.

Here are the latest investment ratings and price targets for $Beyond (BYON.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月25日,多家華爾街大行更新了$Beyond (BYON.US)$的評級,目標價介於6美元至14美元。

美銀證券分析師Curtis Nagle下調至賣出評級,並將目標價從15美元下調至6美元。

巴克萊銀行分析師Seth Sigman維持持有評級,維持目標價14美元。

Needham分析師Bernie McTernan維持買入評級,並將目標價從13美元下調至9美元。

Needham分析師Bernie McTernan維持買入評級,並將目標價從13美元下調至9美元。

派傑投資分析師Peter Keith維持持有評級,並將目標價從14美元下調至8美元。

此外,綜合報道,$Beyond (BYON.US)$近期主要分析師觀點如下:

Beyond正在實施的戰略措施,旨在減少固定支出並擴大業務,預計將在未來幾年爲股東帶來可觀價值。分析師認爲公司領導層擁有推動盈利性營業收入增長的強有力計劃。2025年開始預計會出現營收和利潤顯著增長,這將受到總部關閉業務擴張、Zulily重新建立線上業務以及Bed Bath & Beyond通過更廣泛的合作伙伴關係擴大實體零售業務影響。

Beyond的潛在風險回報情景被描述爲「令人感到困惑,且具有相當大的上行空間」,原因在於有效整合Bed、Bath和Beyond、Overstock以及Zulily的運營可能性。儘管這些品牌各自經歷成功的巔峯和低谷,但綜合結果可能是有利的。對管理層面臨的大量任務的認可引入了一定的執行風險。對這三個品牌核心運營的更多見解預計將在本週晚些時候安排的投資者活動中公佈。

以下爲今日4位分析師對$Beyond (BYON.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Needham分析師Bernie McTernan維持買入評級,並將目標價從13美元下調至9美元。

Needham分析師Bernie McTernan維持買入評級,並將目標價從13美元下調至9美元。

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.