On Oct 24, major Wall Street analysts update their ratings for $TransUnion (TRU.US)$, with price targets ranging from $119 to $135.

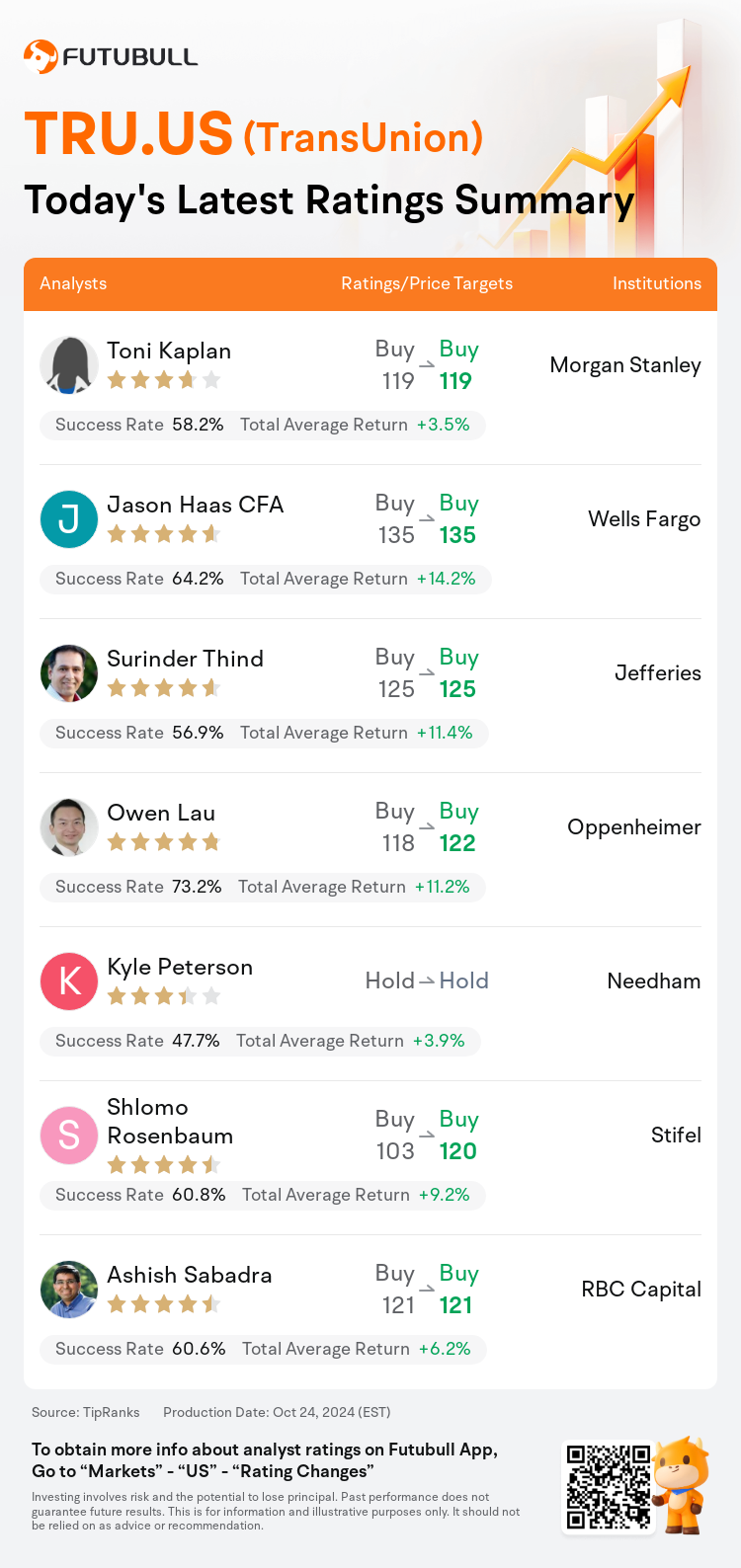

Morgan Stanley analyst Toni Kaplan maintains with a buy rating, and maintains the target price at $119.

Wells Fargo analyst Jason Haas CFA maintains with a buy rating, and maintains the target price at $135.

Jefferies analyst Surinder Thind maintains with a buy rating, and maintains the target price at $125.

Jefferies analyst Surinder Thind maintains with a buy rating, and maintains the target price at $125.

Oppenheimer analyst Owen Lau maintains with a buy rating, and adjusts the target price from $118 to $122.

Needham analyst Kyle Peterson maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $TransUnion (TRU.US)$'s main analysts recently are as follows:

The firm acknowledges another solid performance from TransUnion, accompanied by an uptick in guidance. There is an anticipation of continued positive momentum with the normalization of credit markets.

The company's Q3 results were noted for their strength, with an adjusted EPS of $1.04, surpassing both the estimated $1.03 and the consensus of $1.01. Furthermore, the company's management has increased FY24 guidance, citing sustained business momentum.

It's indicated that TransUnion's robust structural growth, favorable macroeconomic conditions, and specific company factors are expected to fuel significant multi-year growth, and the valuation is appealing when adjusted for macroeconomic and consumer credit cycles.

Optimism towards TransUnion is growing after the company demonstrated another quarter of consistent improvement. The potential for increased earnings is seen from a revival in the mortgage sector, robust growth in Emerging Verticals, strong performance in India, and the transition to the OneTru Platform.

Here are the latest investment ratings and price targets for $TransUnion (TRU.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

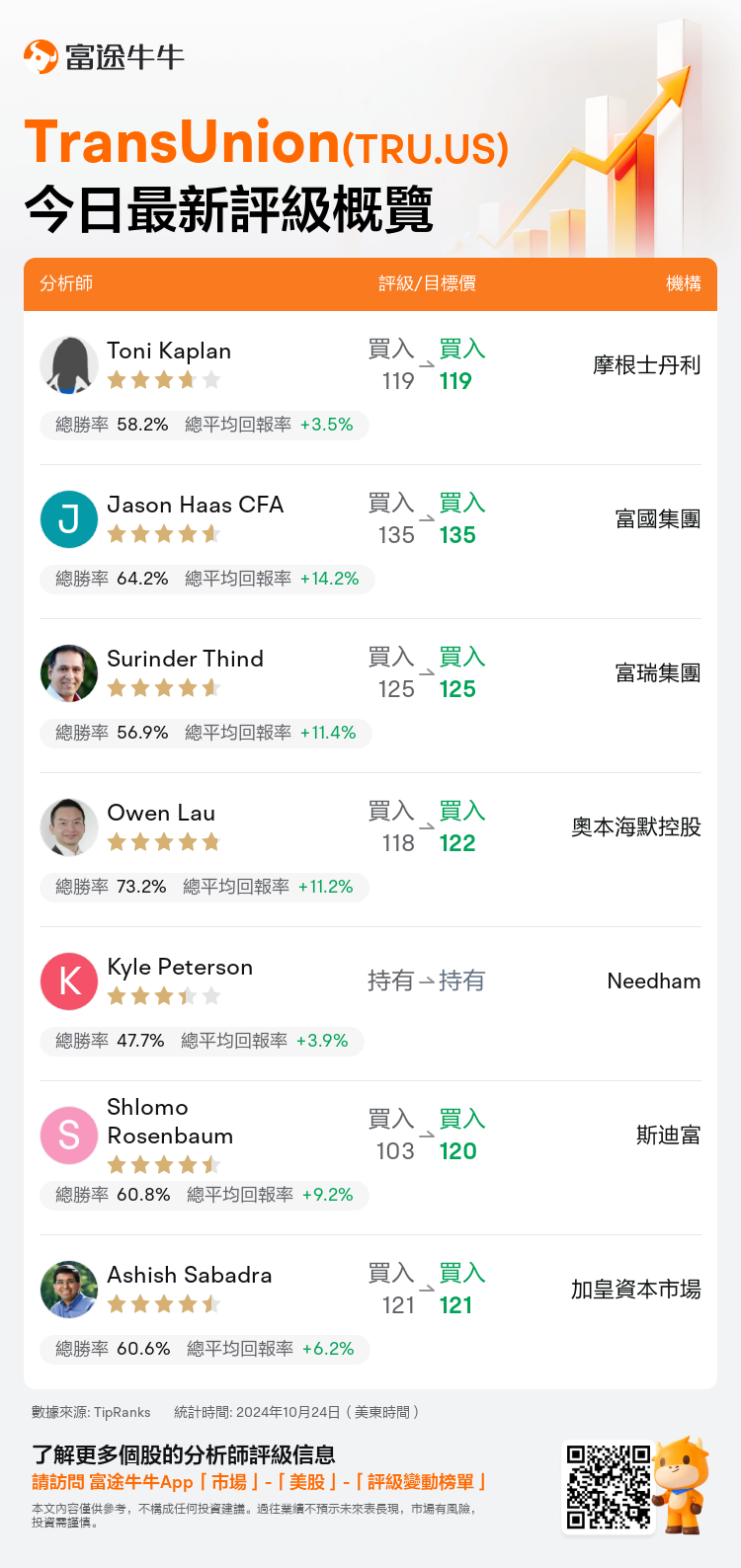

美東時間10月24日,多家華爾街大行更新了$TransUnion (TRU.US)$的評級,目標價介於119美元至135美元。

摩根士丹利分析師Toni Kaplan維持買入評級,維持目標價119美元。

富國集團分析師Jason Haas CFA維持買入評級,維持目標價135美元。

富瑞集團分析師Surinder Thind維持買入評級,維持目標價125美元。

富瑞集團分析師Surinder Thind維持買入評級,維持目標價125美元。

奧本海默控股分析師Owen Lau維持買入評級,並將目標價從118美元上調至122美元。

Needham分析師Kyle Peterson維持持有評級。

此外,綜合報道,$TransUnion (TRU.US)$近期主要分析師觀點如下:

公司承認TransUnion再次表現強勁,指導預期上升。預期在信貸市場正常化的背景下將持續保持積極勢頭。

該公司Q3的業績表現強勁,調整後的每股收益爲$1.04,超過了預計的$1.03和共識的$1.01。此外,公司管理層提高了FY24的指導,稱業務勢頭持續。

據指出,TransUnion強勁的結構增長,有利的宏觀經濟條件和特定公司因素預計將推動重要的多年增長,並且在調整宏觀經濟和消費信貸週期後,估值具吸引力。

對TransUnion的樂觀情緒正在增長,公司展示了連續改善的另一個季度。從抵押貸款板塊的復甦、新興行業的強勁增長、印度的強勁表現以及轉向OneTru平台中可看到盈利增長的潛力。

以下爲今日7位分析師對$TransUnion (TRU.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Surinder Thind維持買入評級,維持目標價125美元。

富瑞集團分析師Surinder Thind維持買入評級,維持目標價125美元。

Jefferies analyst Surinder Thind maintains with a buy rating, and maintains the target price at $125.

Jefferies analyst Surinder Thind maintains with a buy rating, and maintains the target price at $125.