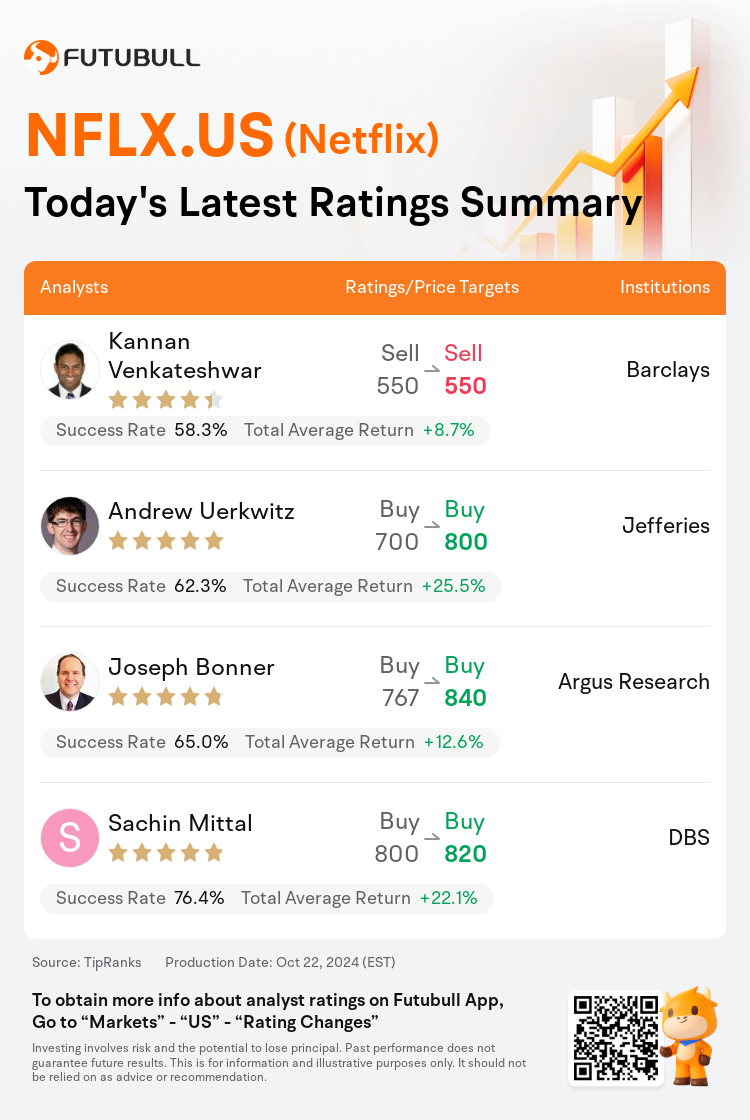

On Oct 22, major Wall Street analysts update their ratings for $Netflix (NFLX.US)$, with price targets ranging from $550 to $840.

Barclays analyst Kannan Venkateshwar maintains with a sell rating, and maintains the target price at $550.

Jefferies analyst Andrew Uerkwitz maintains with a buy rating, and adjusts the target price from $700 to $800.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

DBS analyst Sachin Mittal maintains with a buy rating, and adjusts the target price from $800 to $820.

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

Netflix exhibited a robust third-quarter performance with impressive overall financial results. This includes exceeding expectations in operating income, earnings per share, and free cash flow. The company stands out as a leading entity in the media sector with multiple avenues for growth. Notably, the rapid expansion of its advertising business is projected to see a significant increase by 2025 and is anticipated to spur continued growth in subsequent years.

Q3 outcomes and Q4 forecasts surpassed expectations, with indications pointing towards sustained robust double-digit revenue growth and ongoing margin improvement. Analysts note that Netflix is well-positioned to maintain its status as the world's preeminent and most rapidly expanding streaming service, with projections to enhance earnings by 20%-30% yearly over an extended period. This growth is anticipated to be supported by the introduction of additional growth avenues, including monetized account sharing, advertising, live streaming content, and gaming expansions.

Netflix's Q3 outcomes surpassed expectations, and the discussions highlighted a continuation of robust double-digit revenue growth with margin expansion anticipated in 2025. Analysts perceive Netflix as a primary beneficiary amid a stabilizing streaming market. The platform's advertising subscriber base is projected to achieve significant scale by 2025.

Following the Q3 report, Netflix has demonstrated robust financial performance with an increase in Q3 revenue and operating income, leading to an elevated 2024 forecast in terms of revenue growth, operating margin, and free cash flow. The company has also shared a projection for 2025 revenue, suggesting a growth rate of 11%-13%, and an anticipated operating margin of 28%. The company continues to be a highly favored selection.

Following Netflix's 'Beat & Raise Q3 EPS results,' it is noted that a record high operating margin of 30% seems fairly sustainable. The outlook for Q4 suggests significant potential for surpassing Street subscriber estimates, which is attributed to an exceptionally compelling content lineup and the announcement of selective price increases, with expectations of additional hikes.

Here are the latest investment ratings and price targets for $Netflix (NFLX.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

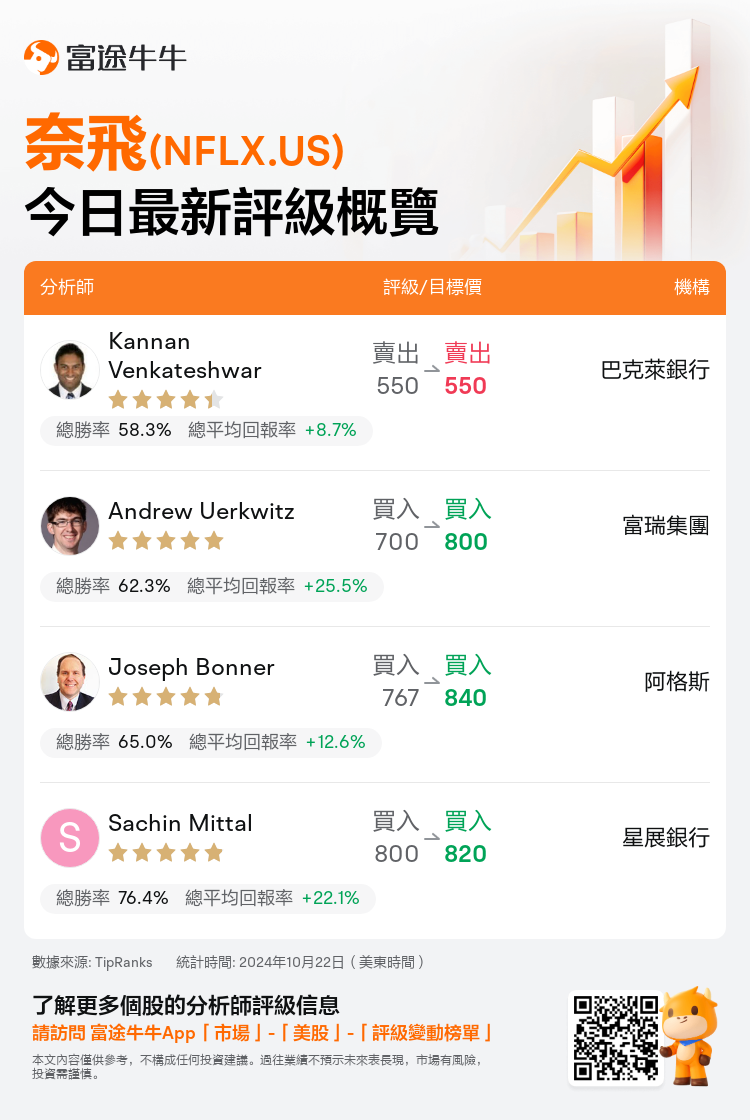

美東時間10月22日,多家華爾街大行更新了$奈飛 (NFLX.US)$的評級,目標價介於550美元至840美元。

巴克萊銀行分析師Kannan Venkateshwar維持賣出評級,維持目標價550美元。

富瑞集團分析師Andrew Uerkwitz維持買入評級,並將目標價從700美元上調至800美元。

阿格斯分析師Joseph Bonner維持買入評級,並將目標價從767美元上調至840美元。

阿格斯分析師Joseph Bonner維持買入評級,並將目標價從767美元上調至840美元。

星展銀行分析師Sachin Mittal維持買入評級,並將目標價從800美元上調至820美元。

此外,綜合報道,$奈飛 (NFLX.US)$近期主要分析師觀點如下:

奈飛在第三季度表現強勁,整體財務業績令人印象深刻。這包括超出營業收入、每股收益和自由現金流的預期。該公司憑藉多種增長途徑在媒體行業脫穎而出。值得注意的是,其廣告業務的快速擴張預計到2025年將有顯著增長,並有望在隨後的幾年繼續推動增長。

第三季度業績和第四季度預測超出預期,跡象表明持續強勁的兩位數營收增長和持續的利潤率改善。分析師指出,奈飛有望保持世界領先和增長最迅速的流媒體概念地位,預計會在未來數年每年以20%-30%的速度提高收入。這種增長預計將得到支持,包括帳戶分享的商業化、廣告、直播內容和arvr遊戲擴展。

奈飛的第三季度業績超出預期,討論突出了2025年預計繼續強勁的兩位數營收增長和利潤率擴張。分析師認爲,在流媒體市場穩定之際,奈飛是主要受益者。預計平台的廣告訂戶基數將在2025年實現顯著規模。

根據第三季度報告,奈飛展示了強勁的財務表現,導致第三季度營收和營業利潤增加,從而推動了2024年營收增長、營業利潤率和自由現金流的擴張預測。該公司還分享了2025年的營收預測,預計增長率爲11%-13%,預期的營業利潤率爲28%。該公司繼續受到高度青睞。

在奈飛的「超額完成Q3每股收益」後,值得注意的是,30%的創紀錄營業利潤率似乎非常持續。第四季度的前景表明有望顯著超越街道訂戶預期,這歸因於極具吸引力的內容陣容以及宣佈選擇性價格上漲,預計還會有額外的漲價。

以下爲今日4位分析師對$奈飛 (NFLX.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

阿格斯分析師Joseph Bonner維持買入評級,並將目標價從767美元上調至840美元。

阿格斯分析師Joseph Bonner維持買入評級,並將目標價從767美元上調至840美元。

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.