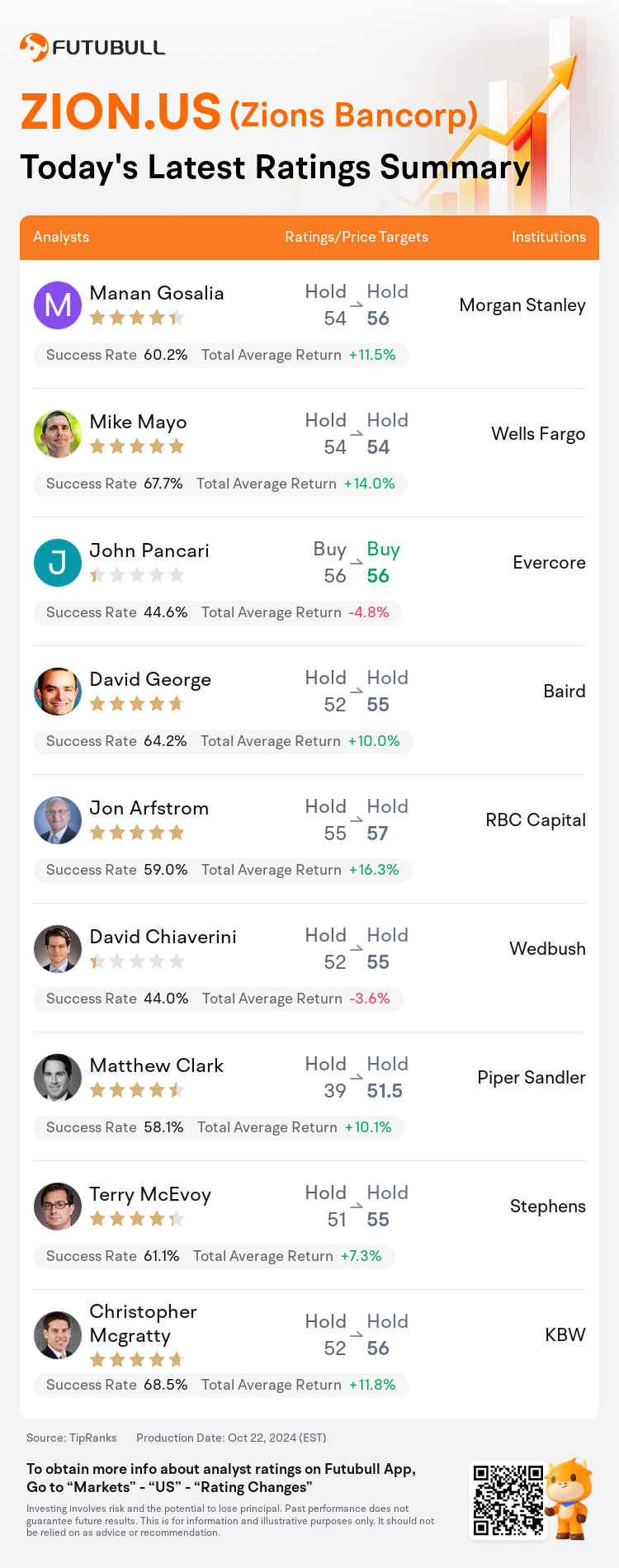

On Oct 22, major Wall Street analysts update their ratings for $Zions Bancorp (ZION.US)$, with price targets ranging from $51.5 to $57.

Morgan Stanley analyst Manan Gosalia maintains with a hold rating, and adjusts the target price from $54 to $56.

Wells Fargo analyst Mike Mayo maintains with a hold rating, and maintains the target price at $54.

Evercore analyst John Pancari maintains with a buy rating, and maintains the target price at $56.

Evercore analyst John Pancari maintains with a buy rating, and maintains the target price at $56.

Baird analyst David George maintains with a hold rating, and adjusts the target price from $52 to $55.

RBC Capital analyst Jon Arfstrom maintains with a hold rating, and adjusts the target price from $55 to $57.

Furthermore, according to the comprehensive report, the opinions of $Zions Bancorp (ZION.US)$'s main analysts recently are as follows:

The third quarter earnings per share for Zions Bancorp showed a comprehensive outperformance, and the forward guidance suggests potential for earnings surpassing analyst expectations. Consequently, expectations for 2025 earnings per share have been increased by 2% due to anticipated growth in net interest income and a reduction in expenses.

Following the Q3 report, there was an enhancement in Zions Bancorp's earnings as a result of net interest income, provision, fees, expenses, and tax rate outperforming the consensus expectations.

Following Q3 earnings that surpassed expectations, the firm has recognized Zions Bancorp's robust core trends. Positive revenue trajectories coupled with disciplined expense management were underscored as the primary achievements. Despite observing some ongoing risk migration in multifamily/commercial classifieds and non-performing assets, the bank's credit costs have been noted as minimal. Additionally, there is an anticipation that loss content will be kept in check moving forward.

The firm noted that Zions Bancorp's core pre-provision net revenue was above expectations and future guidance suggests potential for further positive results. Additionally, the credit quality remains robust.

Zions Bancorp exceeded expectations by 16% on account of capital markets and net interest income performance. Despite net interest income surpassing projections, the bank's rate sensitivity profile remains consistent and elevated compared to its peers. The guidance language persists unchanged, albeit from an increased base.

Here are the latest investment ratings and price targets for $Zions Bancorp (ZION.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間10月22日,多家華爾街大行更新了$齊昂銀行 (ZION.US)$的評級,目標價介於51.5美元至57美元。

摩根士丹利分析師Manan Gosalia維持持有評級,並將目標價從54美元上調至56美元。

富國集團分析師Mike Mayo維持持有評級,維持目標價54美元。

Evercore分析師John Pancari維持買入評級,維持目標價56美元。

Evercore分析師John Pancari維持買入評級,維持目標價56美元。

貝雅分析師David George維持持有評級,並將目標價從52美元上調至55美元。

加皇資本市場分析師Jon Arfstrom維持持有評級,並將目標價從55美元上調至57美元。

此外,綜合報道,$齊昂銀行 (ZION.US)$近期主要分析師觀點如下:

齊昂銀行第三季度每股收益表現全面超越,前瞻指引表明盈利有望超出分析師預期。因此,預計2025年每股收益增加2%,預計淨利息收入增長和費用減少。

根據第三季度報告,齊昂銀行的盈利增長主要源於淨利息收入、準備金、費用、以及稅率表現超出共識預期。

在超出預期的第三季度盈利後,公司認識到齊昂銀行穩健的核心趨勢。積極的營收趨勢與嚴謹的費用管理被強調爲主要成就。儘管觀察到一些多戶型/商業分類廣告和不良資產風險遷移,但銀行的信貸成本被指出爲最低。此外,預計損失內容將在未來受到控制。

公司指出,齊昂銀行的核心稅前淨收入超出預期,未來指引表明有進一步積極結果的潛力。此外,信貸質量保持強勁。

齊昂銀行由於資本市場表現和淨利息收入表現,超出預期16%。儘管淨利息收入超過預期,但銀行的利率敏感性配置與同行相比仍然保持一致。指引語言保持不變,儘管基數有所增加。

以下爲今日9位分析師對$齊昂銀行 (ZION.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師John Pancari維持買入評級,維持目標價56美元。

Evercore分析師John Pancari維持買入評級,維持目標價56美元。

Evercore analyst John Pancari maintains with a buy rating, and maintains the target price at $56.

Evercore analyst John Pancari maintains with a buy rating, and maintains the target price at $56.