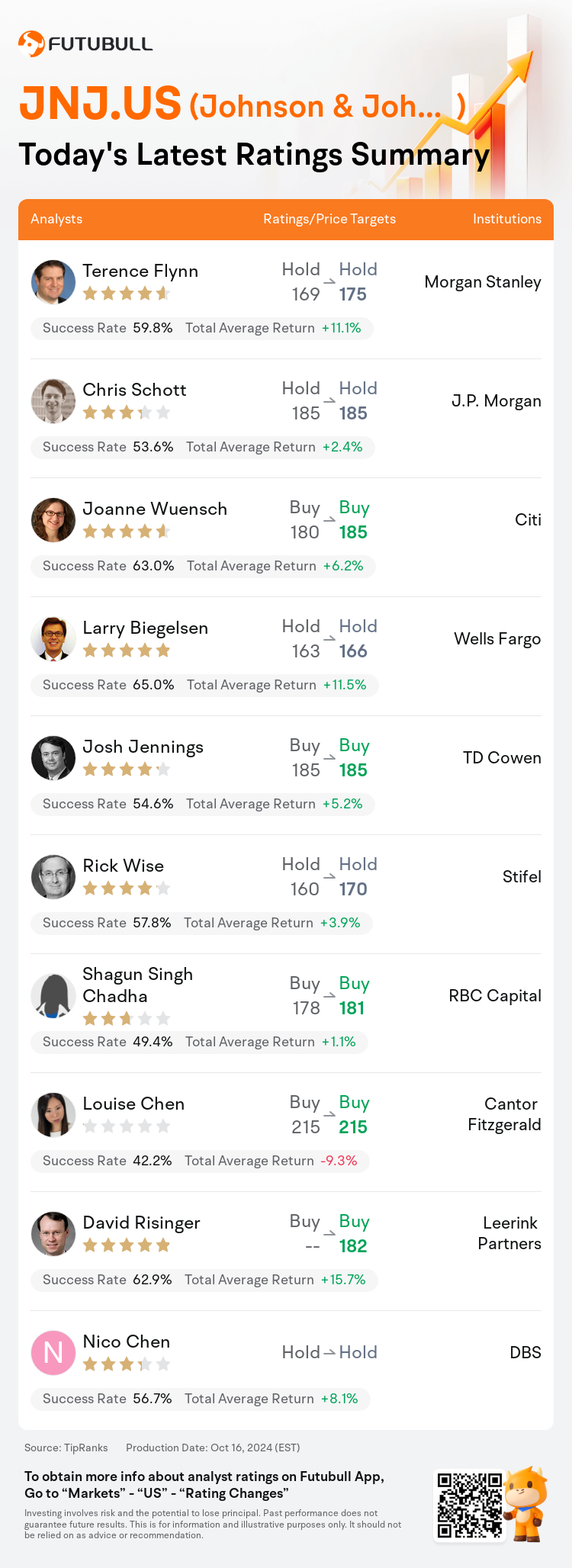

On Oct 16, major Wall Street analysts update their ratings for $Johnson & Johnson (JNJ.US)$, with price targets ranging from $166 to $215.

Morgan Stanley analyst Terence Flynn maintains with a hold rating, and adjusts the target price from $169 to $175.

J.P. Morgan analyst Chris Schott maintains with a hold rating, and maintains the target price at $185.

Citi analyst Joanne Wuensch maintains with a buy rating, and adjusts the target price from $180 to $185.

Citi analyst Joanne Wuensch maintains with a buy rating, and adjusts the target price from $180 to $185.

Wells Fargo analyst Larry Biegelsen maintains with a hold rating, and adjusts the target price from $163 to $166.

TD Cowen analyst Josh Jennings maintains with a buy rating, and maintains the target price at $185.

Furthermore, according to the comprehensive report, the opinions of $Johnson & Johnson (JNJ.US)$'s main analysts recently are as follows:

Following a Q3 report that matched general expectations, with the Pharmaceuticals segment outperforming and the MedTech segment underperforming, it was noted that adjustments to estimates were slightly modified. The 2025 outlook commentary was also reported to align with prior expectations.

Following Johnson & Johnson's quarterly report, the company's positioning has been reinforced by the progression of the talc litigation settlement proposal, multiple acquisitions in the medical technology field, and 'level-set 2025 commentary.'

Johnson & Johnson's third-quarter earnings surpassed expectations, with a notable 5.6% growth excluding Covid-related sales, primarily fueled by Innovative Medicine's performance. Despite MedTech's lag, which can be attributed to usual seasonal patterns and challenges in the Asia Pacific region, the company is recognized for making significant operational strides. The focus on executing its pipeline is starting to manifest positively.

The anticipated sales growth for 2024 suggests a decrease in growth during Q4; however, management commentary pertaining to 2025 appears promising for potential EPS growth. Additionally, there is an indication that significant headway has been achieved in addressing the talc litigation.

Johnson & Johnson's recent performance exceeded expectations, particularly within its Pharmaceutical division, which contributed to surpassing third-quarter sales and EPS projections. The company's early outlook for 2025 indicates that its business fundamentals remain consistent. However, when considering the company's valuation, it seems that the shares are appropriately priced.

Here are the latest investment ratings and price targets for $Johnson & Johnson (JNJ.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

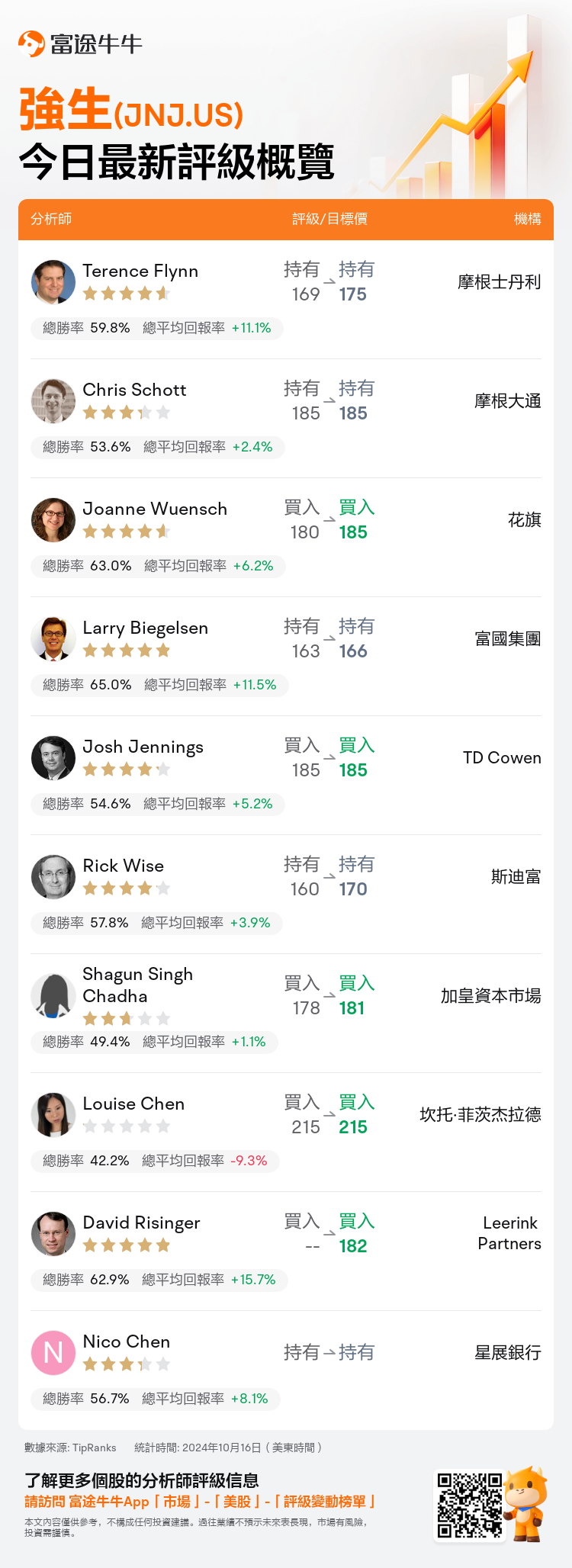

美東時間10月16日,多家華爾街大行更新了$強生 (JNJ.US)$的評級,目標價介於166美元至215美元。

摩根士丹利分析師Terence Flynn維持持有評級,並將目標價從169美元上調至175美元。

摩根大通分析師Chris Schott維持持有評級,維持目標價185美元。

花旗分析師Joanne Wuensch維持買入評級,並將目標價從180美元上調至185美元。

花旗分析師Joanne Wuensch維持買入評級,並將目標價從180美元上調至185美元。

富國集團分析師Larry Biegelsen維持持有評級,並將目標價從163美元上調至166美元。

TD Cowen分析師Josh Jennings維持買入評級,維持目標價185美元。

此外,綜合報道,$強生 (JNJ.US)$近期主要分析師觀點如下:

在符合一般預期的第三季度報告中,藥品業務表現優異,醫療技術業務表現不佳,調整預估略有修改。2025年展望也被報道爲與先前預期一致。

在強生公司的季度報告後,該公司的定位得到了加強,因滑石訴訟解決方案的進展,醫療技術領域的多個收購以及「平穩2025年展望」。

強生公司第三季度收入超出預期,不包括與Covid相關銷售的5.6%增長顯著,主要由創新藥品表現驅動。儘管醫療技術業務落後,這可以歸因於常規季節性模式和亞太地區的挑戰,但該公司因取得重大運營進展而受到認可。專注於推進其產品線的工作開始積極顯現。

2024年銷售增長預期表明四季度增長有所減緩;然而,關於2025年的管理評論對潛在的每股收益增長前景令人鼓舞。此外,有跡象表明在解決滑石訴訟方面取得了重大進展。

強生公司最近的表現超出了預期,特別是在其藥品部門,在超出第三季度銷售和每股收益預期方面做出了貢獻。公司對2025年的早期展望表明其業務基本面保持一致。然而,在考慮公司估值時,股價似乎定價合理。

以下爲今日10位分析師對$強生 (JNJ.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Joanne Wuensch維持買入評級,並將目標價從180美元上調至185美元。

花旗分析師Joanne Wuensch維持買入評級,並將目標價從180美元上調至185美元。

Citi analyst Joanne Wuensch maintains with a buy rating, and adjusts the target price from $180 to $185.

Citi analyst Joanne Wuensch maintains with a buy rating, and adjusts the target price from $180 to $185.