P/E Ratio Insights for Intuit

P/E Ratio Insights for Intuit

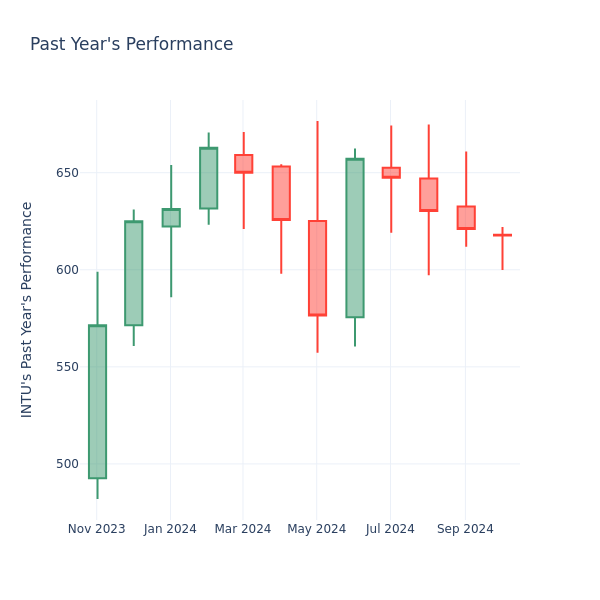

Looking into the current session, Intuit Inc. (NASDAQ:INTU) shares are trading at $617.59, after a 0.65% drop. Over the past month, the stock fell by 4.44%, but over the past year, it actually went up by 15.88%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company's price-to-earnings ratio.

查看當前交易日,Intuit Inc.(納斯達克:INTU)股價爲617.59美元,下跌了0.65%。過去一個月,股價下跌了4.44%,但過去一年實際上上漲了15.88%。像這樣疑似短期表現不佳,但長期表現卻不錯的情況下,長期股東可能想開始關注公司的市盈率。

A Look at Intuit P/E Relative to Its Competitors

看一下Intuit的市盈率相對於其競爭對手

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

市盈率衡量公司的每股收益與當前股價的比例。長期投資者使用該比率分析公司當前業績與其過去收益、歷史數據和行業或指數的市場數據進行比較,如標普500。更高的市盈率表明投資者預計公司未來表現將更好,股票可能被高估,但不一定如此。它還可以表明,投資者當前願意支付更高的股票價格,因爲他們預計公司在未來季度內表現更好。這使投資者也對未來的分紅保持樂觀。

Intuit has a lower P/E than the aggregate P/E of 89.69 of the Software industry. Ideally, one might believe that the stock might perform worse than its peers, but it's also probable that the stock is undervalued.

Intuit的市盈率低於軟件行業板塊的89.69的總平均市盈率。理想情況下,有人可能認爲該股票表現可能不如同行,但也有可能是該股被低估了。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

總之,市盈率是分析公司市場表現的有用指標,但它也有其侷限性。較低的P/E值可能表明公司被低估,但也可能暗示股東並不期待未來增長。此外,P/E比率不應孤立使用,因爲行業趨勢和業務週期等其他因素也會影響公司股價。因此,投資者應該結合其他財務指標和定性分析來使用市盈率,以做出明智的投資決策。

譯文內容由第三人軟體翻譯。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.