Walt Disney Unusual Options Activity

Walt Disney Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Walt Disney.

有大量資金的投資者對華特迪士尼采取了顯著的看好態度。

Looking at options history for Walt Disney (NYSE:DIS) we detected 15 trades.

根據迪士尼(NYSE:DIS)期權歷史數據,我們檢測到有15筆交易。

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

如果我們考慮每個交易的細節,準確地說,46%的投資者懷着看漲期待開了倉位,46%的投資者懷着看跌期待開了倉位。

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

在所有被發現的交易中,有4筆看跌,總金額爲403,422美元,有11筆看漲,總金額爲531,075美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $110.0 for Walt Disney, spanning the last three months.

在評估交易成交量和未平倉合約量後,顯而易見市場主要關注迪士尼股票價格在80.0美元和110.0美元之間的價格區間,跨越過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

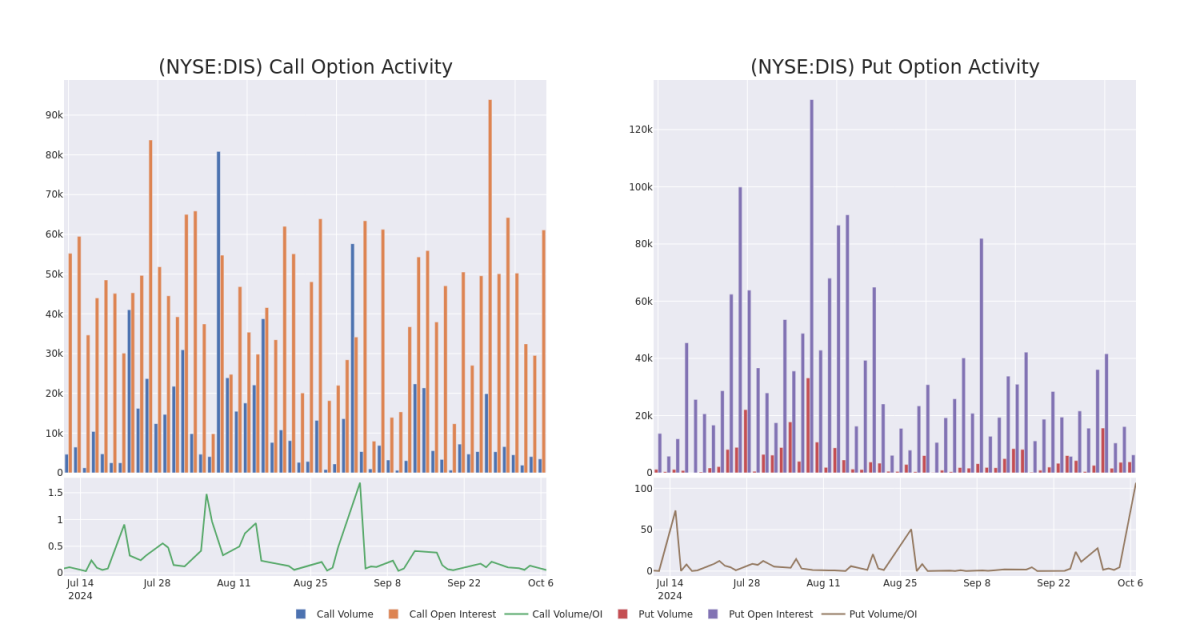

In today's trading context, the average open interest for options of Walt Disney stands at 5183.77, with a total volume reaching 7,325.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $80.0 to $110.0, throughout the last 30 days.

在今天的交易背景下,迪士尼期權的平均未平倉合約達到5183.77,總成交量達到7,325.00。伴隨圖表詳細描述了過去30天內迪士尼股票高價交易的看漲和看跌期權成交量及未平倉合約變化情況,位於80.0美元至110.0美元的行權價格走廊內。

Walt Disney Option Volume And Open Interest Over Last 30 Days

迪士尼期權的成交量和持倉量過去30天的情況

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | TRADE | BEARISH | 11/08/24 | $0.7 | $0.64 | $0.68 | $86.00 | $238.0K | 33 | 3.5K |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $11.5 | $11.0 | $11.3 | $100.00 | $135.6K | 3.5K | 120 |

| DIS | PUT | SWEEP | BEARISH | 04/17/25 | $7.25 | $7.15 | $7.25 | $95.00 | $100.7K | 317 | 139 |

| DIS | CALL | TRADE | NEUTRAL | 10/18/24 | $1.43 | $1.31 | $1.36 | $95.00 | $73.1K | 11.0K | 562 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $10.85 | $10.65 | $10.7 | $100.00 | $64.2K | 3.5K | 205 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 項目8.01 | 看跌 | 交易 | 看淡 | 11/08/24 | 0.7美元 | $0.64 | $0.68 | $86.00 | 238.0千美元 | 33 | 3.5K |

| 項目8.01 | 看漲 | 交易 | 看好 | 01/16/26 | $11.5 | $11.0 | $11.3 | $100.00。 | $135.6K | 3.5K | 120 |

| 項目8.01 | 看跌 | SWEEP | 看淡 | 04/17/25 | $7.25 | $7.15 | $7.25 | $ 95.00 | $100.7K | 317 | 139 |

| 項目8.01 | 看漲 | 交易 | 中立 | 10/18/24 | $1.43應翻譯爲1.43美元 | $1.31 | $1.36 | $ 95.00 | $73.1K | 11.0K | 562 |

| 項目8.01 | 看漲 | 交易 | 看淡 | 01/16/26 | $10.85 | $10.65 | $10.7 | $100.00。 | 64.2K美元 | 3.5K | 205 |

About Walt Disney

關於迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼分爲三個全球業務板塊:娛樂、體育和體驗。娛樂和體驗都受益於公司一世紀以來創造的特許經營權和角色。娛樂包括ABC廣播網絡、幾個有線電視網絡、迪士尼+和Hulu流媒體服務。在這個板塊中,迪士尼還進行電影和電視製作和分銷,將內容授權給電影院、其他內容提供商,或者越來越多地在自己的流媒體平台和電視網絡內使用。體育板塊包括ESPN和ESPN+流媒體服務。體驗包括迪士尼的主題公園和度假勝地,還受益於商品授權。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對迪士尼周邊期權交易進行全面審查後,我們開始對公司進行更詳細的評估。這包括對迪士尼當前市場地位和表現的評估。

Walt Disney's Current Market Status

迪士尼的當前市場狀況

- With a trading volume of 2,189,917, the price of DIS is down by -1.94%, reaching $93.31.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 38 days from now.

- 成交量爲2,189,917,迪士尼的價格下跌了-1.94%,達到93.31美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一份收益報告將於38天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.