A Closer Look at Intuit's Options Market Dynamics

A Closer Look at Intuit's Options Market Dynamics

Financial giants have made a conspicuous bearish move on Intuit. Our analysis of options history for Intuit (NASDAQ:INTU) revealed 8 unusual trades.

金融巨頭已經對 Intuit 採取了明顯的看淡舉措。我們對 Intuit(納斯達克:INTU)的期權歷史進行分析發現了 8 筆異常交易。

Delving into the details, we found 25% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $135,320, and 5 were calls, valued at $344,908.

深入研究後,我們發現25%的交易員持買入看好態度,而37%則展現出看淡傾向。在所有我們發現的交易中,有 3 筆爲看跌,價值爲 $135,320,而有 5 筆爲看漲,價值爲 $344,908。

Expected Price Movements

預期價格波動

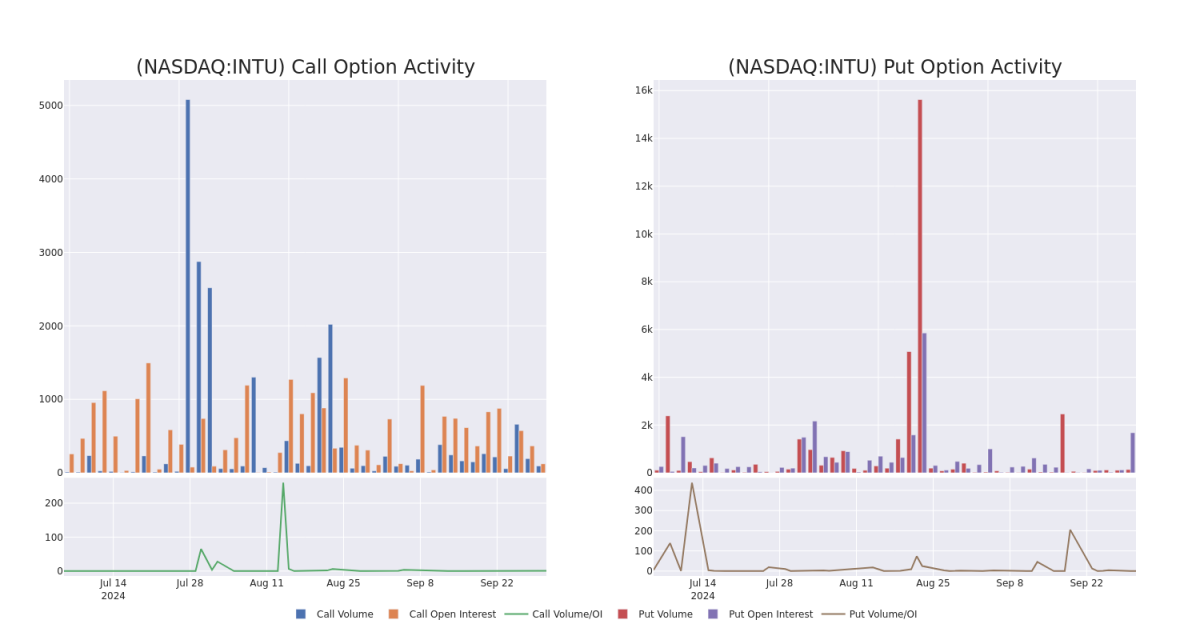

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $670.0 for Intuit during the past quarter.

分析這些合約的成交量和未平倉量,似乎大戶在過去一季度一直關注着 Intuit 在 $400.0 到 $670.0 之間的價格區間。

Insights into Volume & Open Interest

成交量和持倉量分析

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.

就流動性和利息而言,今天 Intuit 期權交易的平均未平倉量爲 257.0,總成交量爲 230.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuit's big money trades within a strike price range of $400.0 to $670.0 over the last 30 days.

在接下來的圖表中,我們可以追蹤過去 30 天內 Intuit 大手交易的看漲和看跌期權的成交量和未平倉量發展,涵蓋了 $400.0 到 $670.0 的行權價區間。

Intuit Option Activity Analysis: Last 30 Days

Intuit 期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | SWEEP | BEARISH | 01/16/26 | $66.0 | $65.5 | $65.5 | $670.00 | $157.2K | 71 | 32 |

| INTU | CALL | TRADE | NEUTRAL | 01/17/25 | $39.0 | $38.2 | $38.55 | $610.00 | $65.5K | 46 | 45 |

| INTU | PUT | TRADE | BULLISH | 10/18/24 | $12.4 | $11.9 | $12.0 | $600.00 | $60.0K | 1.5K | 104 |

| INTU | CALL | SWEEP | BEARISH | 04/17/25 | $42.7 | $40.6 | $40.95 | $640.00 | $53.0K | 5 | 15 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $22.6 | $22.0 | $22.3 | $590.00 | $44.6K | 101 | 21 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 財捷 | 看漲 | SWEEP | 看淡 | 01/16/26 | $66.0 | $65.5 | $65.5 | 670.00美元 | $157.2K | 71 | 32 |

| 財捷 | 看漲 | 交易 | 中立 | 01/17/25 | $39.0 | 38.2美元 | $38.55 | $610.00 | $65.5K | 46 | 45 |

| 財捷 | 看跌 | 交易 | 看好 | 10/18/24 | $12.4 | $11.9 | $12.0 | $600.00 | $60.0K | 1.5K | 104 |

| 財捷 | 看漲 | SWEEP | 看淡 | 04/17/25 | $42.7 | $40.6 | $40.95 | $640.00 | 53.0千美元 | 5 | 15 |

| 財捷 | 看跌 | 交易 | 中立 | 12/20/24 | $22.6 | $22.0 | $22.3 | 590.00美元 | 44.6千美元 | 101 | 21 |

About Intuit

關於Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Intuit是小型企業會計軟件(QuickBooks)、個人稅務解決方案(TurboTax)和專業稅務服務(Lacerte)的提供商。成立於1980年代中期,Intuit控制着美國小型企業會計和自助報稅軟件的大部分市場份額。

Following our analysis of the options activities associated with Intuit, we pivot to a closer look at the company's own performance.

在對Intuit的期權交易活動進行分析後,我們轉而更詳細地研究了該公司自身的表現。

Present Market Standing of Intuit

Intuit的現有市場地位

- Trading volume stands at 859,127, with INTU's price down by -1.66%, positioned at $610.68.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 56 days.

- 交易量達到859,127,INTU的價格下跌了-1.66%,位於$610.68。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 盈利公告將於56天后發佈。

Expert Opinions on Intuit

有關Intuit的專家意見

In the last month, 1 experts released ratings on this stock with an average target price of $768.0.

在過去一個月裏,有1位專家對這隻股票發佈了評級,平均目標價爲$768.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Piper Sandler has decided to maintain their Overweight rating on Intuit, which currently sits at a price target of $768.

20年期權交易專家揭示了他的一行圖表技巧,可以顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處進行訪問。* 派傑投資的分析師決定維持對Intuit的超配評級,目標價目前爲$768。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.