ARM Holdings Unusual Options Activity

ARM Holdings Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on ARM Holdings.

擁有大量資金的鯨魚已經明顯看淡了ARM Holdings。

Looking at options history for ARM Holdings (NASDAQ:ARM) we detected 51 trades.

查看ARM控股(納斯達克:ARM)期權交易歷史,我們發現51筆交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 45% with bearish.

如果我們考慮每筆交易的具體情況,準確地說,37%的投資者持有看好期權,45%持有看淡期權。

From the overall spotted trades, 17 are puts, for a total amount of $1,424,621 and 34, calls, for a total amount of $3,876,751.

在所有發現的交易中,有17筆看跌期權,總金額爲$1,424,621,34筆看漲期權,總金額爲$3,876,751。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $240.0 for ARM Holdings, spanning the last three months.

經過評估交易成交量和未平倉合約後,顯而易見主要市場參與者正專注於ARM控股的價格區間,介於$50.0和$240.0之間,在過去三個月內波動。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

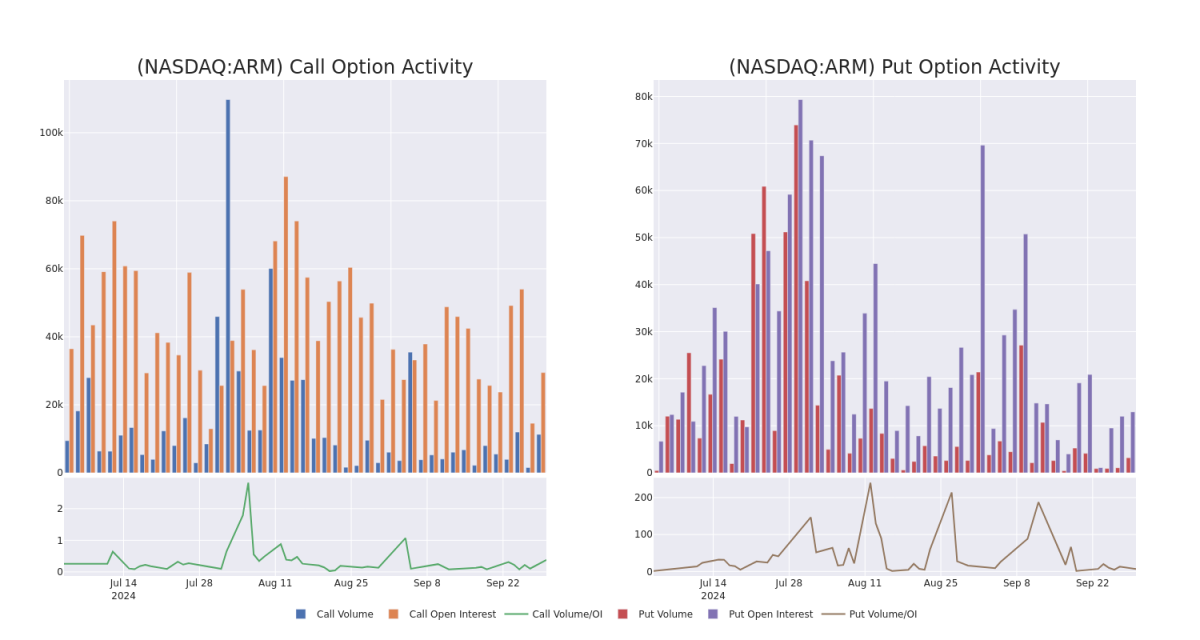

In terms of liquidity and interest, the mean open interest for ARM Holdings options trades today is 1247.74 with a total volume of 13,141.00.

就流動性和興趣而言,今天ARM控股期權交易的平均未平倉合約爲1247.74,總成交量爲13,141.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for ARM Holdings's big money trades within a strike price range of $50.0 to $240.0 over the last 30 days.

在下圖中,我們能夠跟蹤ARM控股的大手交易的看漲和看跌期權的成交量和未平倉量的發展情況,範圍爲50.0美元到240.0美元,在過去的30天內。

ARM Holdings Call and Put Volume: 30-Day Overview

ARM Holdings看漲期權和看跌期權成交量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | TRADE | BEARISH | 01/17/25 | $5.8 | $5.6 | $5.62 | $200.00 | $1.8M | 2.3K | 3.2K |

| ARM | PUT | SWEEP | BEARISH | 07/18/25 | $23.1 | $23.05 | $23.1 | $130.00 | $284.1K | 975 | 223 |

| ARM | PUT | SWEEP | BEARISH | 07/18/25 | $23.2 | $22.75 | $23.2 | $130.00 | $232.0K | 975 | 100 |

| ARM | PUT | TRADE | BULLISH | 07/18/25 | $23.3 | $23.1 | $23.1 | $130.00 | $166.3K | 975 | 296 |

| ARM | CALL | SWEEP | BULLISH | 01/15/27 | $54.7 | $53.2 | $54.75 | $165.00 | $164.2K | 37 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | 看漲 | 交易 | 看淡 | 01/17/25 | $5.8 | $5.6 | $5.62 | 。 | $1.8M | 2.3K | 3.2K |

| ARM | 看跌 | SWEEP | 看淡 | 07/18/25 | $23.1 | $23.05 | $23.1 | $130.00 | $284.1K | 975 | 223 |

| ARM | 看跌 | SWEEP | 看淡 | 07/18/25 | $23.2 | $22.75 | $23.2 | $130.00 | $232.0千 | 975 | 100 |

| ARM | 看跌 | 交易 | 看好 | 07/18/25 | 23.3美元 | $23.1 | $23.1 | $130.00 | $166.3K | 975 | 296 |

| ARM | 看漲 | SWEEP | 看好 | 01/15/27 | 54.7 | $53.2 | $54.75 | 165.00美元 | $164.2K | 37 | 30 |

About ARM Holdings

關於ARM控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM體系結構(IP)的所有者和開發者,該體系結構在全球99%的智能手機CPU核心中使用,在其他電池供電設備(如可穿戴設備、平板電腦或傳感器)中也佔有很高的市場份額。Arm根據用戶的需求提供不同類型的許可證,客戶如蘋果或高通購買體系結構許可證,這使他們可以修改體系結構並添加/刪除指令以使芯片更符合其特定需求。其他客戶直接從Arm購買現成的設計。現成的和架構客戶每出貨一顆芯片,就會支付一定的版稅。

In light of the recent options history for ARM Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到ARm Holdings的最近期權歷史,現在應該關注該公司本身。我們旨在探討其當前表現。

Current Position of ARM Holdings

ARM Holdings當前的持倉

- With a trading volume of 2,695,722, the price of ARM is down by -2.0%, reaching $142.67.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 46 days from now.

- 交易成交量爲2,695,722,ARm的價格下跌-2.0%,達到$142.67。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個收益報告將於46天后發佈。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大風險,但也提供更高利潤的潛力。精明的交易員通過持續的教育、戰略性的交易調整、利用各種因子以及保持對市場動態的關注來降低這些風險。通過Benzinga Pro及時了解ARm Holdings的最新期權交易以獲取實時警報。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 17 are puts, for a total amount of $1,424,621 and 34, calls, for a total amount of $3,876,751.

From the overall spotted trades, 17 are puts, for a total amount of $1,424,621 and 34, calls, for a total amount of $3,876,751.