Decoding Carnival's Options Activity: What's the Big Picture?

Decoding Carnival's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on Carnival (NYSE:CCL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CCL often signals that someone has privileged information.

投機性投資者在嘉年華存託憑證(紐交所:CCL)上看好,對零售交易者來說這很重要。 這一活動是通過Benzinga追蹤公開可獲得的期權數據而引起我們的注意的。這些投資者的身份尚不確定,但CCL股票的如此重大變動常常意味着有人掌握了內幕信息。

Today, Benzinga's options scanner spotted 8 options trades for Carnival. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了8筆針對嘉年華的期權交易。這並不是一個典型的模式。

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $33,000, and 7 calls, totaling $518,532.

這些主要交易者中情緒分爲兩派,有50%看好,50%看淡。在我們識別的所有期權中,有一個看跌,金額爲33,000美元,還有7個看漲,總額爲518,532美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

分析這些合同的成交量和未平倉量,似乎大戶一直在關注嘉年華在過去一個季度的12.5美元至19.0美元的價格區間內的窗口。

Insights into Volume & Open Interest

成交量和持倉量分析

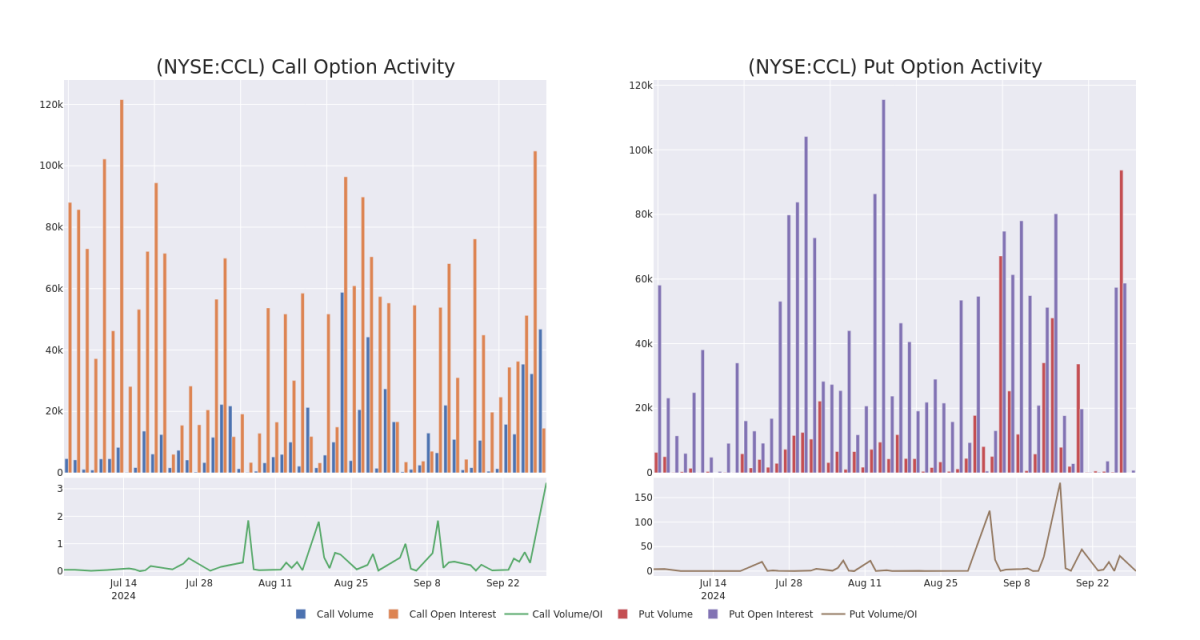

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carnival's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carnival's significant trades, within a strike price range of $12.5 to $19.0, over the past month.

檢查成交量和未平倉量爲股票研究提供了重要見解。這些信息對於衡量在特定行權價格上有關嘉年華期權的流動性和興趣水平至關重要。在下面,我們展示在過去一個月內關於嘉年華重大交易中看漲和看跌期權成交量和未平倉量的趨勢快照,範圍爲12.5至19.0美元之間的行權價格。

Carnival Option Activity Analysis: Last 30 Days

嘉年華存託憑證期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | TRADE | BEARISH | 10/04/24 | $0.75 | $0.73 | $0.73 | $17.50 | $242.1K | 1.6K | 8.3K |

| CCL | CALL | SWEEP | BULLISH | 10/04/24 | $0.86 | $0.83 | $0.85 | $17.50 | $65.3K | 1.6K | 11.9K |

| CCL | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.5 | $1.52 | $19.00 | $64.6K | 9.3K | 569 |

| CCL | CALL | TRADE | BULLISH | 10/04/24 | $1.01 | $0.98 | $1.01 | $17.50 | $50.5K | 1.6K | 12.8K |

| CCL | CALL | SWEEP | BEARISH | 10/11/24 | $4.95 | $4.85 | $4.95 | $12.50 | $34.1K | 1 | 86 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 嘉年華郵輪 | 看漲 | 交易 | 看淡 | 10/04/24 | 0.75美元 | 0.73美元 | 0.73美元 | $17.50 | $242.1K | 1.6K | 8.3K |

| 嘉年華郵輪 | 看漲 | SWEEP | 看好 | 10/04/24 | 每股0.86美元 | 0.83美元 | $0.85 | $17.50 | $65.3K | 1.6K | 11.9K |

| 嘉年華郵輪 | 看漲 | SWEEP | 看好 | 01/17/25 | $1.52 | $1.5 | $1.52 | 19.00美元 | $64.6K | 9.3K | 569 |

| 嘉年華郵輪 | 看漲 | 交易 | 看好 | 10/04/24 | $1.01 | $0.98 | $1.01 | $17.50 | $50.5K | 1.6K | 12.8K |

| 嘉年華郵輪 | 看漲 | SWEEP | 看淡 | 10/11/24 | $4.95 | $4.85 | $4.95 | 該公司股價收盤價爲10.54美元。 | $34.1K | 1 | 86 |

About Carnival

關於Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

Carnival是全球最大的遊輪公司,在2023財年結束時擁有92艘船隻。其品牌組合包括北美的Carnival Cruise Lines,Holland America,Princess Cruises和Seabourn;英國的P&O Cruises和Cunard Line;德國的Aida;南歐的Costa Cruises。它目前正在將其P&O Australia品牌整合到Carnival中。該公司還擁有Alaska的Holland America Princess Alaska Tours和加拿大育空地區的公司。在2019年新冠肺炎疫情之前,Carnival的品牌吸引了近1300萬客人,這個水平在2023年恢復。

Where Is Carnival Standing Right Now?

嘉年華存託憑證目前處於什麼位置?

- With a trading volume of 21,317,495, the price of CCL is down by -3.86%, reaching $17.82.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

- 成交量爲21,317,495,CCL的價格下跌了-3.86%,達到$17.82。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次盈利報告計劃在0天內發佈。

What Analysts Are Saying About Carnival

關於嘉年華存託憑證有多少分析師表示

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

過去一個月,有2位行業分析師分享了他們對這隻股票的見解,提出了26.0美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Stifel persists with their Buy rating on Carnival, maintaining a target price of $27. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Carnival with a target price of $25.

Benzinga Edge的飛凡期權板塊在潛在市場走勢發生前發現了潛在的市場動向。看看大筆資金在你喜愛的股票上持有何種頭寸。點擊這裏進行查看。*斯蒂芬爾的一位分析師堅持給予嘉年華買入評級,並維持目標價27美元。*米酒的一位分析師持續看好嘉年華,保持目標價25美元,並對其評級爲表現優異。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子,並密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報及時了解最新的嘉年華存託憑證期權交易。

譯文內容由第三人軟體翻譯。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.