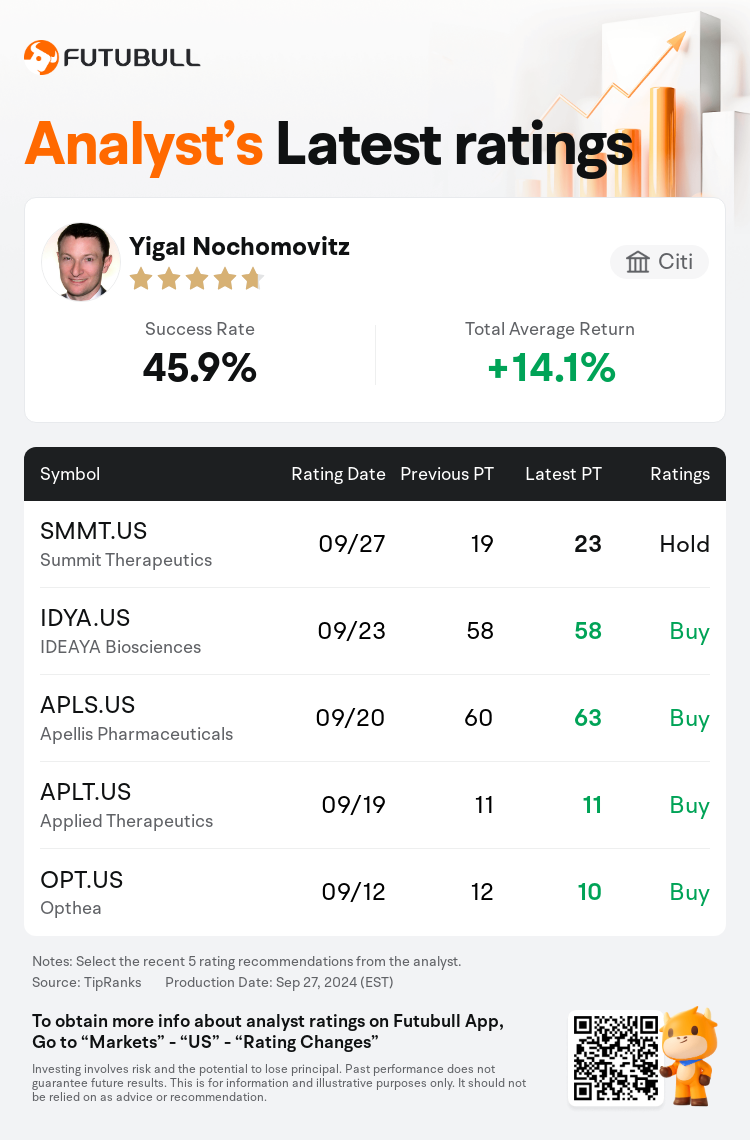

Citi analyst Yigal Nochomovitz downgrades $Summit Therapeutics (SMMT.US)$ to a hold rating, and adjusts the target price from $19 to $23.

According to TipRanks data, the analyst has a success rate of 45.9% and a total average return of 14.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Summit Therapeutics (SMMT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Summit Therapeutics (SMMT.US)$'s main analysts recently are as follows:

Since May, following significant share price appreciation, Summit Therapeutics has exceeded prior market expectations. The company's value has surged with a market capitalization reaching $16B, propelled by optimistic results from the HARMONi-2 study. While acknowledging the potential for shares to rise swiftly with further positive outcomes from HARMONi-2/3/6 studies or pivotal data in areas other than lung cancer, visibility on the timing remains low. The current valuation is perceived as reasonable for the time being.

Investor focus is appropriately centered on the outcomes from the HARMONi-2 study, which compares ivonescimab directly with pembrolizumab. Nonetheless, a range of significant data presentations at WCLC24 and ESMO24 concerning the PD-[L]1/VEGF class for various solid tumor types deserves attention. The array of data presented at ESMO24 has led to an increase in the perceived likelihood of success for all indications within this class.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

花旗分析師Yigal Nochomovitz下調$Summit Therapeutics (SMMT.US)$至持有評級,並將目標價從19美元上調至23美元。

根據TipRanks數據顯示,該分析師近一年總勝率為45.9%,總平均回報率為14.1%。

此外,綜合報道,$Summit Therapeutics (SMMT.US)$近期主要分析師觀點如下:

此外,綜合報道,$Summit Therapeutics (SMMT.US)$近期主要分析師觀點如下:

自5月以來,summit therapeutics的股價顯著上漲,已超過先前市場預期。公司價值飆升,市值達到160億美元,推動力來自於HARMONi-2研究的樂觀結果。儘管肯定股價在HARMONi-2/3/6研究或肺癌以外其他領域的進一步正面結果下可能迅速上漲,但關於時間的可見度仍較低。目前的估值被視爲合理。

投資者關注點在於HARMONi-2研究的結果,該研究直接比較了ivonescimab和pembrolizumab。然而,在WCLC24和ESMO24上關於PD-[L]1/VEGF類針對各種實體瘤類型的一系列重要數據報告也值得關注。在ESMO24上呈現的數據組合已經導致人們增加了對該類別內所有適應症成功可能性的看法。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Summit Therapeutics (SMMT.US)$近期主要分析師觀點如下:

此外,綜合報道,$Summit Therapeutics (SMMT.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of