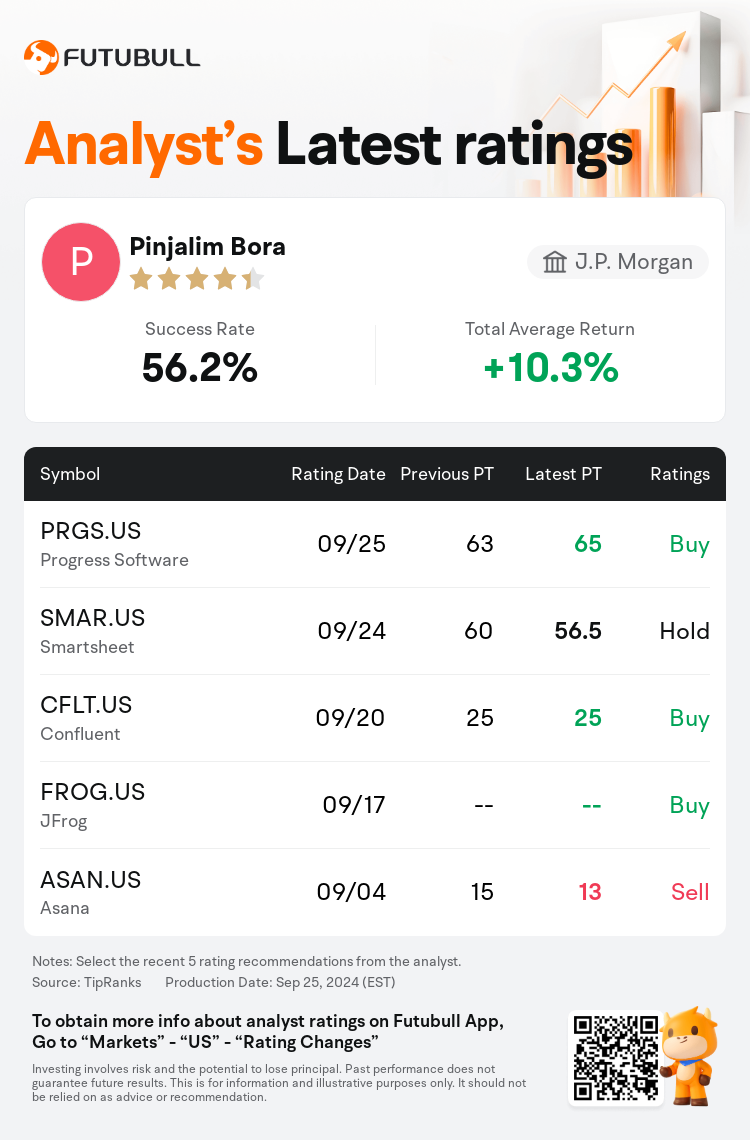

J.P. Morgan analyst Pinjalim Bora maintains $Progress Software (PRGS.US)$ with a buy rating, and adjusts the target price from $63 to $65.

According to TipRanks data, the analyst has a success rate of 56.2% and a total average return of 10.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Progress Software (PRGS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Progress Software (PRGS.US)$'s main analysts recently are as follows:

Progress Software's recent results have surpassed Q3 consensus expectations, leading to an improved outlook for Q4 estimates, excluding the anticipated impact from the ShareFile acquisition. There's a notable opportunity to enhance margins and increase free cash flow on a larger scale. While acknowledging that success is not guaranteed and risks are inherent in the process, a review of historical performance suggests promising potential.

Progress Software has reported a strong third quarter, surpassing estimates due to widespread demand for its products and notable profitability. Importantly, the company has experienced minimal impact from the MOVEit security incident, and has been exonerated from any misconduct by the SEC. As the company progresses beyond this incident with little effect, it is anticipated that the concerns affecting the stock will fade. In terms of mergers and acquisitions, the company's leadership has conveyed a strong belief in their capacity to assimilate ShareFile and to enhance operating margins significantly. The overall sentiment towards the company is favorable, with the belief that the management is capable of maintaining solid revenue growth and high profitability.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根大通分析師Pinjalim Bora維持$Progress Software (PRGS.US)$買入評級,並將目標價從63美元上調至65美元。

根據TipRanks數據顯示,該分析師近一年總勝率為56.2%,總平均回報率為10.3%。

此外,綜合報道,$Progress Software (PRGS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Progress Software (PRGS.US)$近期主要分析師觀點如下:

progress software最近的業績超過了第三季度的共識預期,爲第四季度的估計展望帶來了改善,不包括來自ShareFile收購的預期影響。在更大規模上存在顯着的機會來提升利潤率,增加自由現金流。儘管承認成功並非保證,風險固有於此過程中,對歷史表現的回顧表明了有希望的潛力。

progress software報告了強勁的第三季度,超過了預期,這要歸功於其產品的普遍需求和顯著的盈利能力。重要的是,該公司受到了MOVEit安全事故的最小影響,並且已經被SEC證實沒有任何不當行爲。隨着公司在這起事件中進展順利而影響較小,預計影響股票的擔憂將會減弱。在併購方面,該公司的領導層對能夠吸收ShareFile並顯著增加營運利潤率有着堅定的信念。人們對公司整體的態度是積極的,相信管理層有能力保持穩健的營業收入增長和高盈利能力。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Progress Software (PRGS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Progress Software (PRGS.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of