Insiders At Synaptics Sold US$2.0m In Stock, Alluding To Potential Weakness

Insiders At Synaptics Sold US$2.0m In Stock, Alluding To Potential Weakness

Many Synaptics Incorporated (NASDAQ:SYNA) insiders ditched their stock over the past year, which may be of interest to the company's shareholders. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

過去一年來,許多Synaptics Incorporated(納斯達克股票代碼:SYNA)內部人士拋售了他們的股票,這可能會引起公司股東的興趣。了解內部人士是否在買入通常在評估內部交易時更有幫助,因爲內部人士的賣出可能有各種解釋。然而,如果有多名內部人士在特定時期拋售股票,股東應該更深入地觀察。

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

儘管我們永遠不會建議投資者僅基於公司董事的行動做出決策,但邏輯推斷您應該關注內部人士是否買賣股票。

The Last 12 Months Of Insider Transactions At Synaptics

在Synaptics的最近12個月內部交易中

In the last twelve months, the biggest single sale by an insider was when the insider, Kermit Nolan, sold US$1.1m worth of shares at a price of US$104 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$73.78. So it may not tell us anything about how insiders feel about the current share price.

在過去的十二個月中,一位內部人士Kermit Nolan以每股104美元的價格出售了價值110萬美元的股票,這是最大規模的單筆交易。雖然內部賣出是負面的,但對我們來說,如果股票以更低的價格出售,那將更加負面。令人安慰的是,這次交易以遠高於當前股價73.78美元的價格進行,因此這可能不會告訴我們內部人士對當前股價的看法。

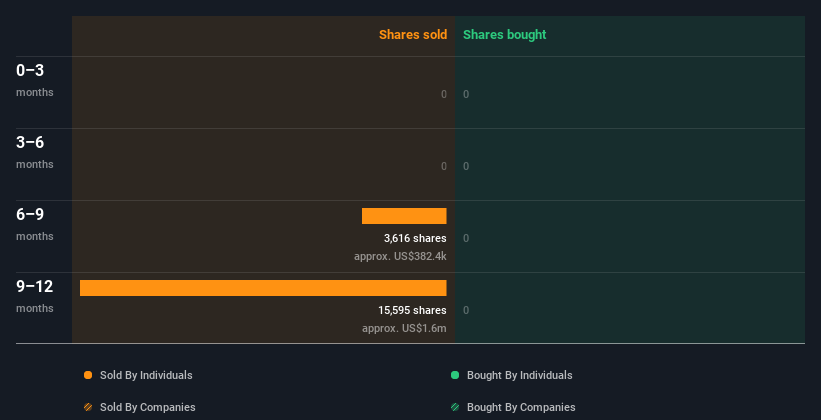

In the last year Synaptics insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

在過去一年中,Synaptics的內部人士沒有購買任何公司股票。您可以看到過去12個月內部交易(由公司和個人)的可視化展示,如下所示。如果您想了解到底是誰以什麼價格在什麼時候賣出,只需點擊下方的圖表!

I will like Synaptics better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

如果我看到一些大宗內部買入交易,我會更喜歡synaptics。在我們等待的時候,可以查看這份免費的低估和小盤股票清單,其中包括最近有相當規模內部買入的股票。

Insider Ownership Of Synaptics

synaptics的內部所有權

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 0.5% of Synaptics shares, worth about US$15m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

我喜歡看內部人在公司中擁有多少股份,以幫助我了解他們與內部人的利益是否對齊。如果內部人在公司中擁有顯著數量的股份,我認爲這是一個好跡象。內部人擁有synaptics股份的0.5%,價值約1500萬美元。我們在其他地方確實看到過更高水平的內部所有權,但這些持股足以表明內部人和其他股東之間的利益一致。

So What Do The Synaptics Insider Transactions Indicate?

那麼synaptics的內部交易是什麼意味着?

It doesn't really mean much that no insider has traded Synaptics shares in the last quarter. We don't take much encouragement from the transactions by Synaptics insiders. But it's good to see that insiders own shares in the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Synaptics. Be aware that Synaptics is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us...

在上個季度沒有內部人交易synaptics股票並不意味着太多。我們並不太受synaptics內部人交易的鼓舞。但看到內部人擁有公司股份是好事。除了了解正在發生的內部人交易外,識別synaptics可能面臨的風險也是很有益的。請注意,我們的投資分析顯示synaptics出現了3個警示信號,其中有1個讓我們感到不太舒服...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

當然,您可能會在其他地方找到一項出色的投資。因此,請查看此免費的有趣公司列表。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

對於本文而言,內部人是指向相關監管機構報告其交易的個人。我們目前僅考慮公開市場交易和直接利益的私人處置,但不包括衍生交易或間接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

譯文內容由第三人軟體翻譯。

In the last year Synaptics insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

In the last year Synaptics insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!