3 Stocks to Buy and Hold for the Next Decade

3 Stocks to Buy and Hold for the Next Decade

When considering stocks to buy and hold for the next decade, it's crucial to select companies with robust profit generation, strong balance sheets, and promising growth trajectories. Here are three top TSX stocks that offer exceptional long-term value – provided you buy at the right price. Timing is everything, so look to purchase these gems during market dips for optimal returns.

在考慮到下一個十年持有的股票時,選擇具有良好利潤生成能力、強勁資產負債表和增長前景的公司至關重要。以下是三隻提供長期卓越價值的頂級tsx股票,只要你以正確的價格買入。時機至關重要,因此請在市場下跌時購買這些寶石,以獲得最佳回報。

Brookfield Asset Management stock: A foundation for long-term wealth creation

布魯克菲爾德資產管理股票:長期財富創造的基石

Brookfield Asset Management (TSX:BAM) is a cornerstone of the financial services sector that you'll want in your portfolio. This global giant has spent 25 years delivering impressive, risk-adjusted returns across a diversified portfolio of assets including renewable power, infrastructure, private equity, real estate, and credit.

布魯克菲爾德資產管理(tsx:BAM)是金融服務領域的支柱,您會希望將其納入投資組合。這家全球巨頭在過去25年中通過多元化的資產組合,包括可再生能源、基礎設施、私募股權、房地產和信貸,取得了令人印象深刻的風險調整回報。

With nearly US$1 trillion in assets under management – over half of which are fee-bearing capital – Brookfield boasts a reliable revenue stream from management fees and lucrative performance fees tied to its stellar investment outcomes.

擁有近1萬億美元資產管理規模,其中逾一半是收費資本的布魯克菲爾德擁有可靠的營收來源,來自管理費和其恒星投資回報所帶來的豐厚績效費。

Currently, the stock is fairly valued with a dividend yield of approximately 3.8%. The company's growth potential is substantial, as evidenced by its recent 18% dividend increase in February 2024. This combination of high growth potential and solid dividends makes Brookfield a prime candidate for long-term holding.

目前,該股票的估值相對合理,股息率約爲3.8%。公司的增長潛力巨大,這得以體現在其2024年2月18%的股息增長上。這種高增長潛力和穩固的分紅結合使布魯克菲爾德成爲長揸的首選候選。

RBC: A reliable blue chip stock in any portfolio

加拿大皇家銀行:任何投資組合中可靠的藍籌股

Royal Bank of Canada (TSX:RY) stands as one of the oldest and most lucrative institutions in Canada. Its diversified operations span personal and commercial banking, wealth management, capital markets, and insurance.

加拿大皇家銀行(tsx:RY)是加拿大最古老和最具收益性的機構之一。其業務涵蓋個人和商業銀行、财富管理、資本市場和保險。

Over the past decade, RBC has consistently delivered impressive results, with revenue per share growing at a compound annual growth rate (CAGR) of over 12% and diluted earnings per share rising at a CAGR of 6.6%. The bank has more than doubled its dividend over the same period, reflecting a CAGR of approximately 7.8%.

在過去的十年中,加拿大皇家銀行始終取得令人印象深刻的業績,每股營收以每股複合年增長率(CAGR)超過12%增長,每股攤薄收益也以CAGR 6.6%的速度增長。該銀行在同一時期將股息翻了一番多,反映出大約7.8%的CAGR。

However, priced at $165 per share, RBC is currently trading at the high end of its historical valuation range. For those looking to invest in this stellar bank, it would be wise to wait for a market pullback. For instance, in 2023, RBC shares fell 19% from peak to trough, which was a spectacular buying opportunity.

然而,以每股165美元的價格,加拿大皇家銀行(RBC)目前正在其歷史估值區間的高端交易。對於那些希望投資於這家出色銀行的人來說,最好等待市場回調。例如,在2023年,RBC股票從最高點跌至最低點19%,這是一個令人矚目的買入機會。

Loblaw: A defensive retail giant you don't want to miss

Loblaw:一家您不想錯過的防禦性零售巨頭

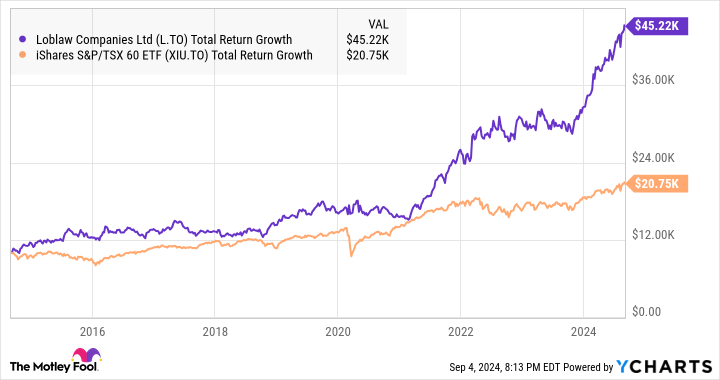

Loblaw (TSX:L) was once overlooked due to its modest dividend yield, but that was a significant oversight. Over the past decade, Loblaw stock has outperformed the Canadian stock market by a factor of three, turning an initial $10,000 investment into a remarkable $45,220.

Loblaw (tsx:l)曾經因爲其適度的股息收益率而被忽視,但這是一個重大的疏忽。在過去的十年中,Loblaw股票的表現超過了加拿大股市三倍,將初始的10000美元投資增長到了驚人的45220美元。

L and XIU Total Return Level data by YCharts

L和XIU的總回報水平數據由YCharts提供

Loblaw dominates the Canadian retail landscape with its strong banners, including Real Canadian Superstore, No Frills, Shoppers Drug Mart, and T&T Supermarket. Its flagship brands, President's Choice and No Name, are household names across Canada.

Loblaw以其強大的旗幟品牌主導加拿大零售業,包括加拿大真正的超級市場,沒有名字,Shoppers藥品店和T&t超市。其旗艦品牌President's Choice和No Name在加拿大家喻戶曉。

The stock has surged 37% year to date, and analysts suggest it remains reasonably valued. For long-term investors, this stock offers a compelling opportunity. Consider acquiring shares now and adding more during market corrections or periods of consolidation.

該股票年初至今上漲了37%,分析師建議它仍然具有合理的估值。對於長期投資者來說,這支股票提供了一個引人注目的機會。考慮現在購買股票,並在市場調整或整合期間增加更多倉位。

The Foolish investor takeaway

愚笨的投資者教訓

In summary, these three stocks – Brookfield Asset Management, Royal Bank of Canada, and Loblaw – offer strong potential for long-term growth. Keep an eye out for market dips to ensure you buy at advantageous prices and maximize your returns over the next decade.

總之,這三隻股票 - 布魯克菲爾德資產管理、加拿大皇家銀行和Loblaw - 爲長期增長提供了強大的潛力。請密切關注市場的下跌,以確保您以有利的價格購買,並在未來十年最大化您的回報。

譯文內容由第三人軟體翻譯。

Currently, the stock is fairly valued with a dividend yield of approximately 3.8%. The company's growth potential is substantial, as evidenced by its recent 18% dividend increase in February 2024. This combination of high growth potential and solid dividends makes Brookfield a prime candidate for long-term holding.

Currently, the stock is fairly valued with a dividend yield of approximately 3.8%. The company's growth potential is substantial, as evidenced by its recent 18% dividend increase in February 2024. This combination of high growth potential and solid dividends makes Brookfield a prime candidate for long-term holding.