With EPS Growth And More, DBS Group Holdings (SGX:D05) Makes An Interesting Case

With EPS Growth And More, DBS Group Holdings (SGX:D05) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

很多投資者,尤其是那些缺乏經驗的投資者,常常會購買那些有好故事的公司的股票,即使這些公司在虧損。有時候這些故事會影響投資者的判斷,導致他們根據情感而非良好的公司基本面投資。儘管一個充分資金的公司可能會持續虧損數年,卻仍必須最終實現盈利,否則投資者將會撤離,公司將會衰落。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like DBS Group Holdings (SGX:D05). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

儘管處於科技股藍天投資時代,許多投資者仍然採用更傳統的策略;購買像星展集團控股(SGX:D05)這樣盈利的公司股票。現在這並不是說該公司提供了最佳的投資機會,但盈利能力是業務成功的關鍵組成部分。

How Quickly Is DBS Group Holdings Increasing Earnings Per Share?

星展集團控股的每股盈餘增長速度有多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that DBS Group Holdings' EPS has grown 21% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

如果一家公司能夠持續增長每股收益(EPS)足夠長的時間,其股價最終應該會跟隨。這使得EPS增長對於任何公司來說都是一種吸引人的品質。股東們會很高興地得知,星展集團控股的每股盈餘在過去三年內以每年21%的複合增長。如果公司能保持這種增長,我們預計股東們將會滿意。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that DBS Group Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. DBS Group Holdings maintained stable EBIT margins over the last year, all while growing revenue 10.0% to S$21b. That's a real positive.

通常有助於查看息稅前利潤(EBIT)利潤率以及營業收入增長,從另一個角度了解公司增長的質量。我們的分析強調了星展集團控股在過去12個月內的營業收入沒有佔據其所有營業收入,因此我們對其利潤率的分析可能無法準確反映潛在的業務。星展集團控股在過去一年內保持了穩定的EBIT利潤率,同時營業收入增長了10.0%,達到了新幣210億。這是一個真正的積極信號。

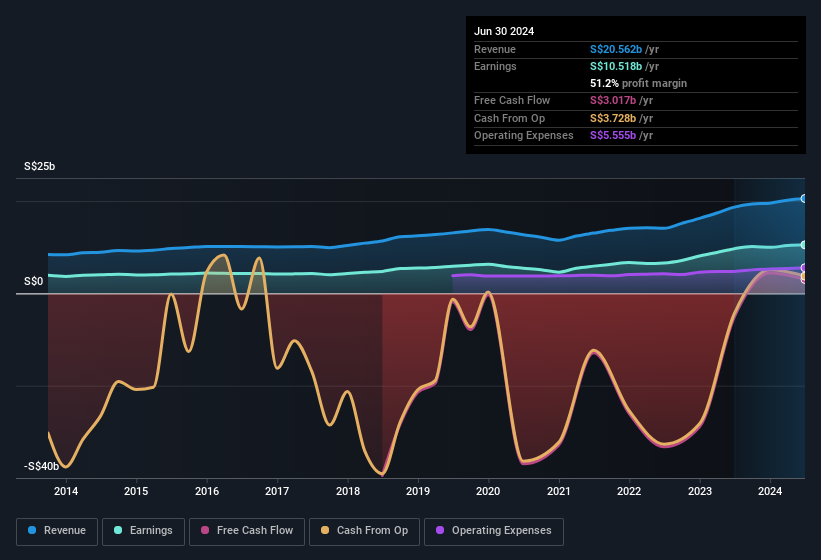

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

您可以查看下圖中企業的營收和收益增長趨勢。要查看實際數字,請單擊圖表。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for DBS Group Holdings?

儘管我們活在當下,但毫無疑問,未來對於投資決策過程最爲重要。那麼,爲什麼不查看一下這個交互圖表,展示DBS集團控股的未來每股收益預測呢?

Are DBS Group Holdings Insiders Aligned With All Shareholders?

DBS集團控股的內部人員與所有股東保持一致嗎?

Owing to the size of DBS Group Holdings, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at S$303m. This comes in at 0.3% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

由於DBS集團控股的規模,我們不會期望內部人持有公司的重大比例。但由於他們對公司的投資,很高興看到他們仍然有動機與股東保持一致的行動。事實上,他們在公司中投資了相當大的財富,目前價值爲3,0300萬新元。這佔公司股份的0.3%,在這個規模的業務中是相當可觀的數額。因此,儘管他們所持比例較低,公司管理層仍然有充足的理由爲投資者提供最佳結果。

Is DBS Group Holdings Worth Keeping An Eye On?

DBS集團控股值得關注嗎?

If you believe that share price follows earnings per share you should definitely be delving further into DBS Group Holdings' strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Even so, be aware that DBS Group Holdings is showing 1 warning sign in our investment analysis , you should know about...

如果您相信股價會按每股收益走勢,那麼您一定應該進一步研究DBS集團控股的強勁每股收益增長。這種每股收益增長率是公司應該引以爲傲的,因此也不足爲奇地,內部人員持有相當大比例的股份。在其優點的平衡考量下,強勁的每股收益增長和與股東保持一致的內部人員意味着一個值得進一步研究的企業。儘管如此,請注意DBS集團控股在我們的投資分析中顯示有1個警示信號,您應該了解一下...

Although DBS Group Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Singaporean companies that not only boast of strong growth but have strong insider backing.

儘管星展集團控股顯然表現良好,但如果內部人士開始購買股票,可能會吸引更多投資者。如果你喜歡看到內部人士更加投入的公司,請查看這些經過精心挑選的新加坡公司,它們不僅擁有強勁的增長,還有內部人士的強大支持。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

譯文內容由第三人軟體翻譯。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that DBS Group Holdings' revenue

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that DBS Group Holdings' revenue