Wall Street's Most Accurate Analysts Spotlight On 3 Materials Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Materials Stocks Delivering High-Dividend Yields

華爾街最準確的分析師聚焦於3家材料股,提供高股息回報。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga讀者可以訪問分析師股票評級頁面,查看對他們最喜歡的股票的最新分析師觀點。交易員可以篩選Benzinga廣泛的分析師評級數據庫,包括按分析師準確性進行篩選。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the materials sector.

以下是三隻材料板塊高股息股票最準確的分析師的評級。

Compass Minerals International, Inc. (NYSE:CMP)

羅盤礦物國際公司(紐交所:CMP)

- Dividend Yield: 6.63%

- Loop Capital analyst Chris Kapsch upgraded the stock from Hold to Buy and cut the price target from $26 to $23 on April 26. This analyst has an accuracy rate of 67%.

- JP Morgan analyst Jeffrey Zekauskas maintained a Neutral rating and cut the price target from $24 to $21 on Feb. 9. This analyst has an accuracy rate of 71%.

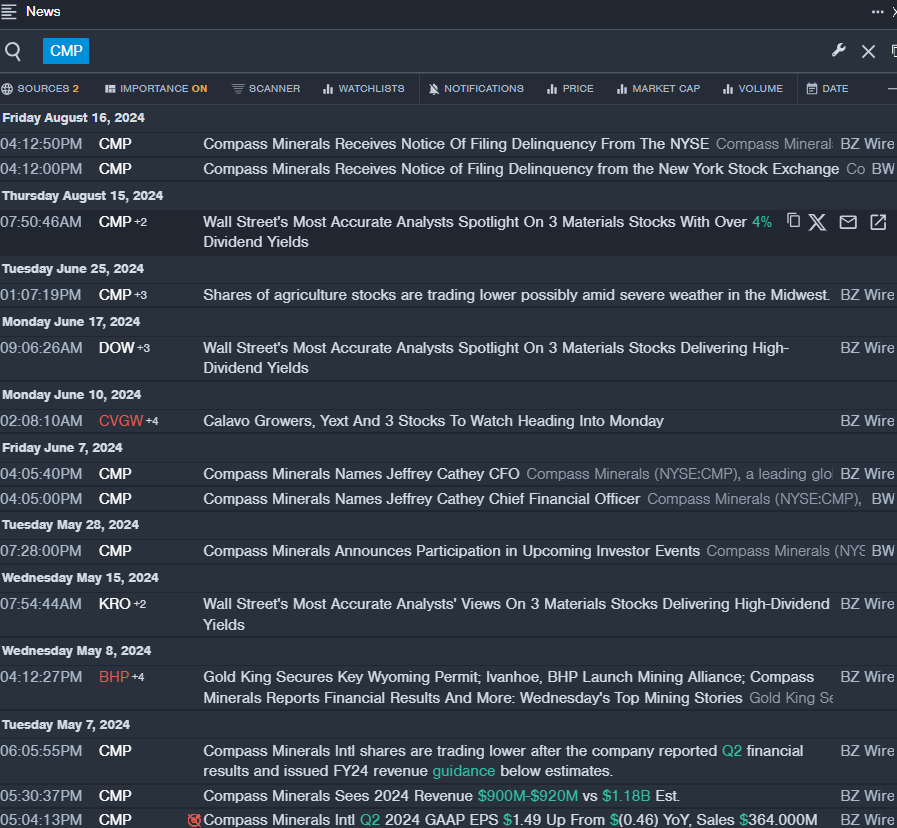

- Recent News: On Aug. 16, Compass Minerals received notice of filing delinquency from the NYSE.

- Benzinga Pro's real-time newsfeed alerted to latest CMP news.

- 股息率:6.63%

- Loop Capital分析師克里斯·卡普斯在4月26日將股票評級從持有升級爲買入,並將目標價從26美元下調至23美元。該分析師的準確率爲67%。

- JP Morgan分析師傑弗裏·澤考斯卡斯在2月9日維持中立評級,並將目標價從24美元下調至21美元。該分析師的準確率爲71%。

- 最近的資訊:羅盤礦物於8月16日收到紐交所提交拖欠通知。

- Benzinga Pro的實時新聞提醒了最新的CMP新聞。

The Chemours Company (NYSE:CC)

the chemours公司(紐交所:CC)

- Dividend Yield: 5.16%

- JP Morgan analyst Jeffrey Zekauskas maintained a Neutral rating and cut the price target from $25 to $18 on Aug. 6. This analyst has an accuracy rate of 71%.

- BMO Capital analyst John McNulty maintained an Outperform rating and slashed the price target from $35 to $30 on Aug. 6. This analyst has an accuracy rate of 65%.

- Recent News: On Aug. 1, Chemours reported mixed second-quarter financial results and issued weak third-quarter net sales guidance.

- Benzinga Pro's charting tool helped identify the trend in CC stock.

- 股息率:5.16%

- JP Morgan分析師Jeffrey Zekauskas於8月6日維持中立評級,並將目標價從25美元下調至18美元。該分析師準確率爲71%。

- BMO Capital分析師John McNulty於8月6日維持超出表現評級,並將目標價從35美元下調至30美元。該分析師準確率爲65%。

- 最新新聞:在8月1日,The Chemours報告了混合的第二季度財務業績,併發布了欠佳的第三季度淨銷售額指導。

- Benzinga Pro的圖表工具幫助識別CC股票的趨勢。

Sonoco Products Company (NYSE:SON)

Sonoco產品公司(紐交所:SON)

- Dividend Yield: 3.86%

- Wells Fargo analyst Gabe Hajde downgraded the stock from Equal-Weight to Underweight and cut the price target from $54 to $52 on Aug. 21. This analyst has an accuracy rate of 78%.

- Raymond James analyst Matt Roberts initiated coverage on the stock with an Outperform rating and a price target of $62 on July 19. This analyst has an accuracy rate of 62%.

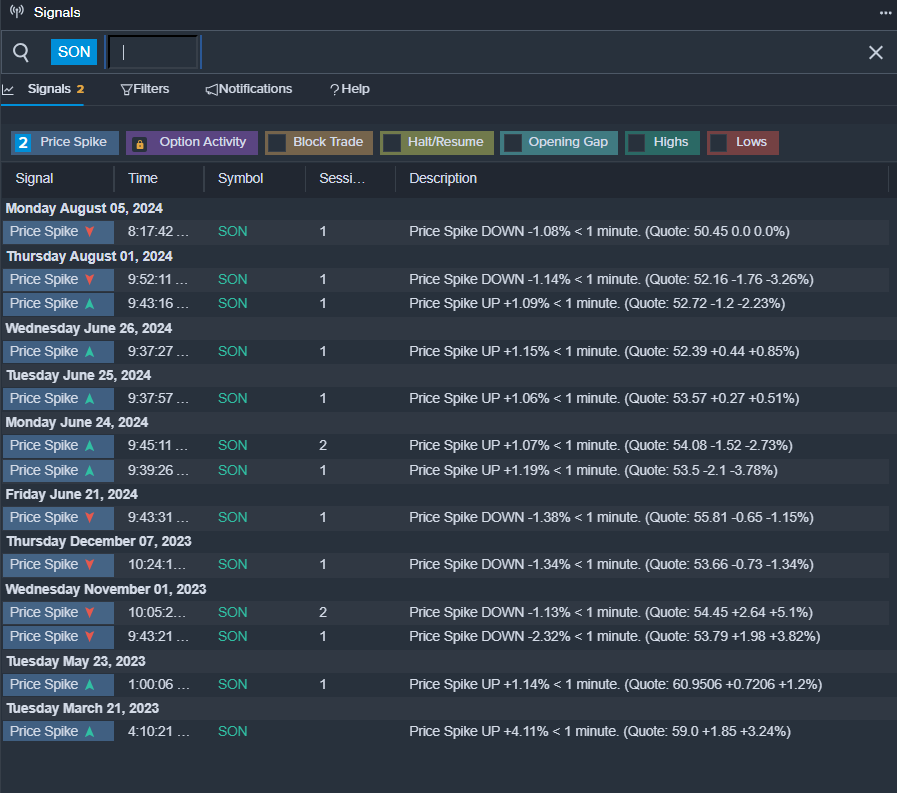

- Recent News: On July 31, Sonoco Prods posted better-than-expected quarterly earnings.

- Benzinga Pro's signals feature notified of a potential breakout in SON shares.

- 股息率:3.86%

- Wells Fargo分析師Gabe Hajde於8月21日將該股票的評級從等權降級到弱勢,並將價格目標從54美元下調至52美元。該分析師的準確率爲78%。

- Raymond James分析師Matt Roberts於7月19日對該股票進行了買入評級,並設定了62美元的價格目標。該分析師的準確率爲62%。

- 最新消息:7月31日,Sonoco Prods發佈了超出預期的季度盈利報告。

- Benzinga Pro的信號功能通知了有關SON股票潛在突破的情況。

Read More:

閱讀更多:

- $4.5M Bet On This Consumer Cyclical Stock? Check Out These 3 Stocks Executives Are Buying

- 450萬美元押注這家消費週期股票?查看這3家高管正在購買的股票

譯文內容由第三人軟體翻譯。

以上內容僅用作資訊或教育之目的,不構成與富途相關的任何投資建議。富途竭力但無法保證上述全部內容的真實性、準確性和原創性。

Read More:

Read More: