Is John Wiley & Sons, Inc. (NYSE:JW.A) A Volatile Stock?

Is John Wiley & Sons, Inc. (NYSE:JW.A) A Volatile Stock?

If you own shares in John Wiley & Sons, Inc. (NYSE:JW.A) then it’s worth thinking about how it contributes to the volatility of your portfolio, overall. In finance, Beta is a measure of volatility. Volatility is considered to be a measure of risk in modern finance theory. Investors may think of volatility as falling into two main categories. First, we have company specific volatility, which is the price gyrations of an individual stock. Holding at least 8 stocks can reduce this kind of risk across a portfolio. The second sort is caused by the natural volatility of markets, overall. For example, certain macroeconomic events will impact (virtually) all stocks on the market.

如果您持有以下股票约翰·威利父子公司,Inc.(纽约证券交易所代码:JW.A)那么就值得考虑它是如何导致整体投资组合的波动性的。在金融领域,贝塔系数是衡量波动性的指标。在现代金融理论中,波动率被认为是风险的一种衡量标准。投资者可能认为波动性分为两大类。首先,我们有公司特有的波动率,这是个别股票的价格波动。持有至少8只股票可以降低投资组合中的这种风险。第二种是由市场的自然波动造成的,总的来说。例如,某些宏观经济事件将(实际上)影响市场上的所有股票。

Some stocks mimic the volatility of the market quite closely, while others demonstrate muted, exagerrated or uncorrelated price movements. Some investors use beta as a measure of how much a certain stock is impacted by market risk (volatility). While we should keep in mind that Warren Buffett has cautioned that ‘Volatility is far from synonymous with risk’, beta is still a useful factor to consider. To make good use of it you must first know that the beta of the overall market is one. A stock with a beta greater than one is more sensitive to broader market movements than a stock with a beta of less than one.

一些股票非常接近地模仿市场的波动,而另一些股票表现出微弱的、错误的或不相关的价格波动。一些投资者使用贝塔系数作为衡量某只股票受市场风险(波动性)影响程度的指标。虽然我们应该记住,沃伦·巴菲特曾警告说,波动性远不是风险的同义词,但贝塔系数仍是一个值得考虑的有用因素。要很好地利用它,你必须首先知道整个市场的贝塔系数是1。贝塔系数大于1的股票比贝塔系数小于1的股票对更广泛的市场波动更敏感。

See our latest analysis for John Wiley & Sons What JW.A’s beta value tells investors

查看我们对John Wiley&Sons的最新分析JW.A的贝塔值告诉投资者什么

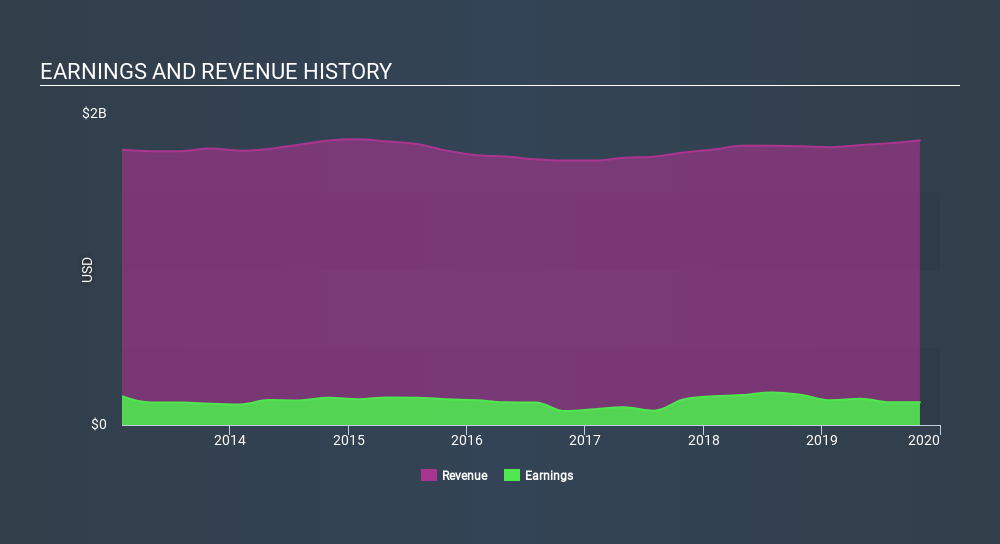

With a beta of 1.08, (which is quite close to 1) the share price of John Wiley & Sons has historically been about as voltile as the broader market. While history does not always repeat, this may indicate that the stock price will continue to be exposed to market risk, albeit not overly so. Beta is worth considering, but it’s also important to consider whether John Wiley & Sons is growing earnings and revenue. You can take a look for yourself, below.

John Wiley&Sons的贝塔系数为1.08(相当接近1),从历史上看,它的股价与大盘一样起伏不定。虽然历史并不总是重演,但这可能表明,股价将继续受到市场风险的影响,尽管不会过度。贝塔值得考虑,但同样重要的是要考虑John Wiley&Sons的收益和收入是否在增长。你可以在下面自己看一看。

How does JW.A’s size impact its beta?

JW.A的规模对其Beta版有何影响?

John Wiley & Sons is a reasonably big company, with a market capitalisation of US$2.7b. Most companies this size are actively traded with decent volumes of shares changing hands each day. We shouldn’t be surprised to see a large company like this with a beta value quite close to the market average. Large companies often move roughly in line with the market. In part, that’s because there are fewer individual events that are signficant enough to markedly change the value of the stock (compared to small companies, at least). What this means for you:

John Wiley&Sons是一家相当大的公司,市值为27亿美元。大多数这种规模的公司交易活跃,每天都有相当数量的股票换手。看到这样一家大公司的贝塔值非常接近市场平均水平,我们不应该感到惊讶。大公司的走势往往与市场大体一致。在一定程度上,这是因为重大到足以显著改变股票价值的个别事件较少(至少与小公司相比)。这对你意味着什么:

It is probable that there is a link between the share price of John Wiley & Sons and the broader market, since it has a beta value quite close to one. However, long term investors are generally well served by looking past market volatility and focussing on the underlying development of the business. If that’s your game, metrics such as revenue, earnings and cash flow will be more useful. In order to fully understand whether JW.A is a good investment for you, we also need to consider important company-specific fundamentals such as John Wiley & Sons’s financial health and performance track record. I highly recommend you dive deeper by considering the following: Future Outlook : What are well-informed industry analysts predicting for JW.A’s future growth? Take a look at ourfree research report of analyst consensusfor JW.A’s outlook. Past Track Record : Has JW.A been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look atthe free visual representations of JW.A’s historicalsfor more clarity. Other Interesting Stocks : It’s worth checking to see how JW.A measures up against other companies on valuation. You could start with thisfree list of prospective options.

John Wiley&Sons的股价很可能与大盘之间存在联系,因为它的贝塔值非常接近1。然而,通过回顾市场波动并专注于业务的潜在发展,长期投资者通常会得到很好的服务。如果这是你的游戏,收入、收益和现金流等指标将更有用。为了充分了解JW.A对你是否是一项好的投资,我们还需要考虑特定于公司的重要基本面,如John Wiley&Sons的财务健康和业绩记录。I强烈建议你更深入地潜水,考虑以下几点:未来展望:消息灵通的行业分析师对JW.A未来的增长有什么预测?看看我们对JW.A前景的分析师一致意见的免费研究报告。过去的记录:JW.A是否一直表现良好,无论UPS以及市场的低迷?在过去的性能分析中进行更详细的分析,并查看JW.A历史的免费视觉表示,以获得更清晰的信息。其他有趣的股票:值得一查,看看JW.A在估值方面与其他公司相比如何。你可以从这个免费的未来选择列表开始。

If you spot an error that warrants correction, please contact the editor ateditorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

如果您发现了需要更正的错误,请发送电子邮件至EDITICATION-Team@implywallst.com联系编辑。本文由Simply Wall St.撰写,具有概括性。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。Simply Wall St.对上述股票没有持仓。

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

我们的目标是为您带来由基础数据驱动的长期重点研究分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。感谢您的阅读。

These great dividend stocks are beating your savings account

这些股息丰厚的股票正在击败你的储蓄账户

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains).Click here to see them for FREE on Simply Wall St. Want early acess? We're giving a select group of investors early access to an entirely new way of valuing stocks

这些股票不仅在过去10年里是可靠的股息支付者,而且在收益率超过3%的情况下,它们也很容易超过你的储蓄账户(更不用说可能的资本利得了)。单击此处在Simply Wall St.上免费观看它们想要提早访问吗?我们让一批精挑细选的投资者提前进入股票估值的新方法

译文内容由第三方软件翻译。