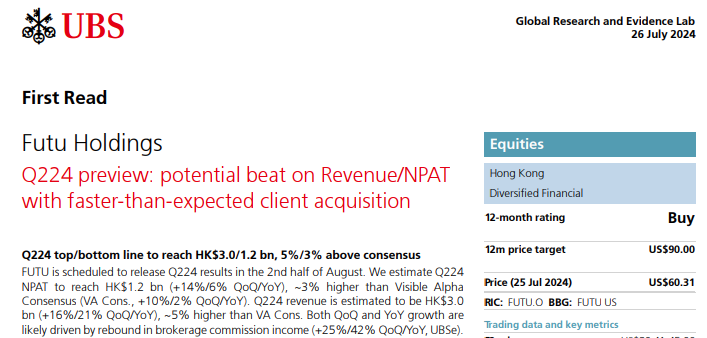

On July 26, UBS released a research report, maintaining a BUY rating on FUTU with a target price of US$90.00

UBS pointed out the following highlights on FUTU:

Client acquisition faster-than-expected; strong rebound in trading commission: 1) client acquisition in HK, SG (and likely JP) accelerated QoQ on improved equity markets sentiment, despite moderation in Malaysia.2) High-single-digit QoQ growth in client AUM is expected, supported by both a strong net inflow of client assets and a slight MTM gain. 3) Rebound in trading commission, as trading volume increases driven by higher velocity. 4) Gross margin of interest income stabilized QoQ. A mid-teens QoQ growth in MFSL balance is expected amid improved market sentiment in Q2.

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.

Valuation: UBS maintains FY25/26 EPS largely unchanged at US$5.8/6.7. UBS maintains the price target at US $90.00 with a Buy rating. FUTU is trading at 11-12x 12-month forward P/E

Key risks to FUTU include:

(1) lower-than-expected international expansion (especially in Japan and Malaysia market)

(2) worse-than-expected market conditions

7月26日,瑞銀發布研究報告,維持對富途的 “買入”評級,目標價爲90.00美元。

瑞銀指出,富途有以下亮點:

客戶拓展速度超預期,交易佣金強勁反彈:1) 儘管馬來西亞市場有所放緩,但香港、新加坡(可能還有日本)的拓客速度因股市情緒改善而按季加快。2) 在客戶資產淨流入強勁和持倉市值略有增長的支持下,預計客戶資產管理規模季度增速將達到高個位數。3) 交易熱度提升有望帶動交易佣金反彈。4) 利息收入毛利率保持穩定。隨着Q2市場情緒的改善,預計獲取利息收入的融資和融券業務餘額將按季增長。

即將發布的業績中需要關注的主要項目:1) 24年第三季度至今各市場的付費客戶獲取量和客戶資產淨流入量,對2024年全年獲客指引的任何潛在修正;2)日本和馬來西亞市場的發展路線圖和最新情況,特別是用戶/客戶增長和潛在產品。

即將發布的業績中需要關注的主要項目:1) 24年第三季度至今各市場的付費客戶獲取量和客戶資產淨流入量,對2024年全年獲客指引的任何潛在修正;2)日本和馬來西亞市場的發展路線圖和最新情況,特別是用戶/客戶增長和潛在產品。

估值:瑞銀維持25/26財年EPS在5.8/6.7美元的水平不變並維持買入評級,目標價90美元。富途的12個月遠期市盈率爲11-12倍。

主要風險包括

(1) 國際擴張低於預期(尤其是日本和馬來西亞市場)

(2) 市場環境不如預期

即將發布的業績中需要關注的主要項目:1) 24年第三季度至今各市場的付費客戶獲取量和客戶資產淨流入量,對2024年全年獲客指引的任何潛在修正;2)日本和馬來西亞市場的發展路線圖和最新情況,特別是用戶/客戶增長和潛在產品。

即將發布的業績中需要關注的主要項目:1) 24年第三季度至今各市場的付費客戶獲取量和客戶資產淨流入量,對2024年全年獲客指引的任何潛在修正;2)日本和馬來西亞市場的發展路線圖和最新情況,特別是用戶/客戶增長和潛在產品。

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.