Adobe (NASDAQ:ADBE) Jumps 7.8% This Week, Though Earnings Growth Is Still Tracking Behind Five-year Shareholder Returns

Adobe (NASDAQ:ADBE) Jumps 7.8% This Week, Though Earnings Growth Is Still Tracking Behind Five-year Shareholder Returns

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the Adobe Inc. (NASDAQ:ADBE) share price is up 86% in the last five years, slightly above the market return. Also positive is the 17% share price rise over the last year.

如果想在股票市場上累積財富,可以通過購買指數基金來實現,但是通過購買價格合理的優質業務可以做得更好。例如,adobe(納斯達克:adbe)的股價在過去五年中上漲了86%,略高於市場回報。過去一年中,股價上漲了17%。

The past week has proven to be lucrative for Adobe investors, so let's see if fundamentals drove the company's five-year performance.

過去一週對於adobe的投資者來說證明很有價值,因此讓我們看看基本面是否推動了公司的五年表現。

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

引用本傑明·格雷厄姆的話:短期內市場是個投票機,在長期中是個稱重機。考慮一家公司的市場感知如何變化的一個不完美但簡單的方法是將每股收益(EPS)的變化與股價的變動進行比較。

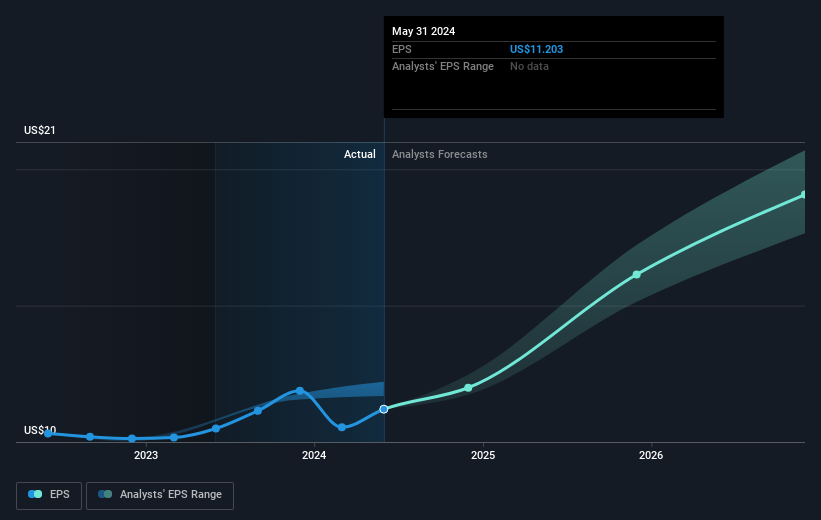

Over half a decade, Adobe managed to grow its earnings per share at 16% a year. The EPS growth is more impressive than the yearly share price gain of 13% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

在過去的五年中,adobe成功地將每股收益增長了16%。 EPS的增長比同期的每年股價漲幅13%更令人印象深刻。因此,市場對該股票的熱情似乎不如以前。

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

該公司的每股收益(隨時間的推移)如下圖所示(單擊可查看確切數字)。

NasdaqGS:ADBE Earnings Per Share Growth July 4th 2024

納斯達克:ADBE每股收益增長2024年7月4日

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

在購買或出售股票之前,我們始終建議仔細研究歷史增長趨勢,此處提供。

A Different Perspective

不同的觀點

Adobe provided a TSR of 17% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 13% per year over five year. It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Adobe that you should be aware of before investing here.

過去十二個月,adobe的總股票回報率爲17%,但低於市場平均水平。好消息是,這一收益實際上比過去五年平均每年13%的回報率更好。隨着業務基本面的改善,收益可能會提高。儘管考慮市場條件對股價的影響很值得,但有其他更重要的因素。例如,在投資之前,我們發現了一個adobe的風險警示。

But note: Adobe may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

但是請注意:Adobe可能不是最佳的買入股票。因此,請查看具有過去盈利增長(以及進一步增長預測)的有趣公司的免費清單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文所引述的市場回報反映了目前在美國交易所上市的股票的市場加權平均回報。

譯文內容由第三人軟體翻譯。