Lincoln National (LNC) Unveils Lincoln Level Advantage 2SM

Lincoln National Corporation LNC recently introduced Lincoln Level Advantage 2SM index-linked annuity, which is an upgraded version of its Lincoln Level Advantage product. This new product is the first in the industry to track Capital Group’s active ETF performance. This move bodes well for the company, as enhancement in its offerings is expected to help it retain and grow its customer base.

This move highlights LNC’s efforts to stay up-to-date and meet investors’ needs with innovative features. LNC is enhancing its product suite by catering to the growing needs of customers wanting to invest in Capital Group active ETFs and providing more control and protection with the Secure Lock+ feature. Investors will be able to track the Capital Group Growth ETF and Capital Group Global Growth Equity ETF, thus giving them growth and expansion opportunities.

Lincoln National’s partnership with Capital Group is a time opportune move as Registered Index Linked Annuity’s (RILA) sales are reaching record highs. Per a recent study by LNC, investors are concerned about rising inflation and not having enough money for retirement, highlighting the need for such annuity products. The study highlighted that 50% of customers seek investment products that secure their initial investment, 44% of customers look for cash flows, and 44% of customers look for protection against market volatility.

With the new product, investors can capture gains in their accounts and make adjustments in their strategy in the short term without changing their long-term view. Investors will also be given the option to reset their growth potential and hold and reallocate indexed account value. This move is expected to drive RILA sales in the future, as in the first quarter of 2024, it experienced a decline due to high competition in this space.

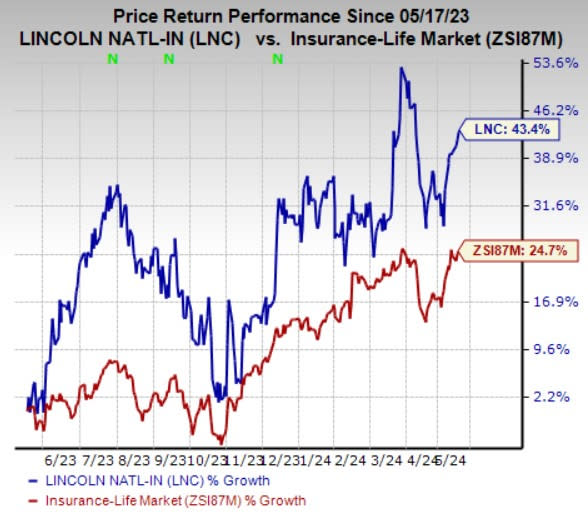

Shares of Lincoln National have gained 43.4% in the past year compared with the industry’s 24.7% growth. LNC currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the insurance space are Skyward Specialty Insurance Group, Inc. SKWD, RLI Corp. RLI and Reinsurance Group of America, Inc. RGA. Each of these companies presently sports a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Skyward Specialty outpaced estimates in each of the last four quarters, the average surprise being 30.5%. The Zacks Consensus Estimate for SKWD’s 2024 earnings suggests an improvement of 31.8%, while the consensus mark for revenues indicates growth of 25.8% from the corresponding year-ago reported figures.

RLI’s bottom line outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 132.4%. The Zacks Consensus Estimate for RLI’s 2024 earnings indicates an 18.2% rise, while the consensus mark for revenues suggests 15.3% growth from the respective prior-year reported figures.

The bottom line of Reinsurance Group of America outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.5%. The Zacks Consensus Estimate for RGA’s 2024 earnings suggests a 3% improvement, while the consensus mark for revenues indicates 6.1% growth from the respective prior-year reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Skyward Specialty Insurance Group, Inc. (SKWD) : Free Stock Analysis Report