Exploring Dividend Stocks On Euronext Amsterdam In May 2024

As of May 2024, the Euronext Amsterdam is witnessing a keen interest in dividend stocks amid fluctuating global economic conditions. This focus comes at a time when investors are increasingly seeking stable returns in a landscape marked by varying central bank policies and economic uncertainties across Europe. In this context, understanding what constitutes a good dividend stock involves looking for companies with consistent payout histories, robust financial health, and the potential to sustain or grow dividends even during economic downturns. These qualities become particularly appealing as they can offer investors a degree of predictability and security amidst broader market volatility.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.52% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.60% | ★★★★☆☆ |

Van Lanschot Kempen (ENXTAM:VLK) | 9.99% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.51% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.33% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

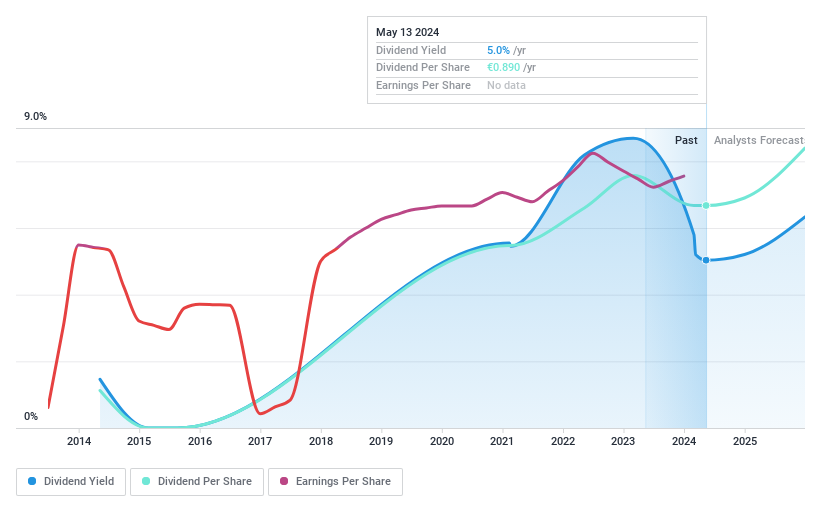

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and abroad, with a market capitalization of approximately €487.16 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate segment (€411.79 million), Van Wanrooij division (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology sector (€1.08 billion).

Dividend Yield: 4.9%

Koninklijke Heijmans exhibits a mixed performance as a dividend stock. While the company maintains a low payout ratio of 37.1%, ensuring earnings sufficiently cover dividend payments, its dividend history shows volatility over the past decade, indicating some level of unpredictability in returns to shareholders. Furthermore, despite a reasonable cash payout ratio of 59%, the annual growth in earnings (19.4% over five years) and an upcoming stock split suggest potential for future stability and growth in shareholder value. However, its current dividend yield at 4.9% remains below the top quartile of Dutch dividend payers.

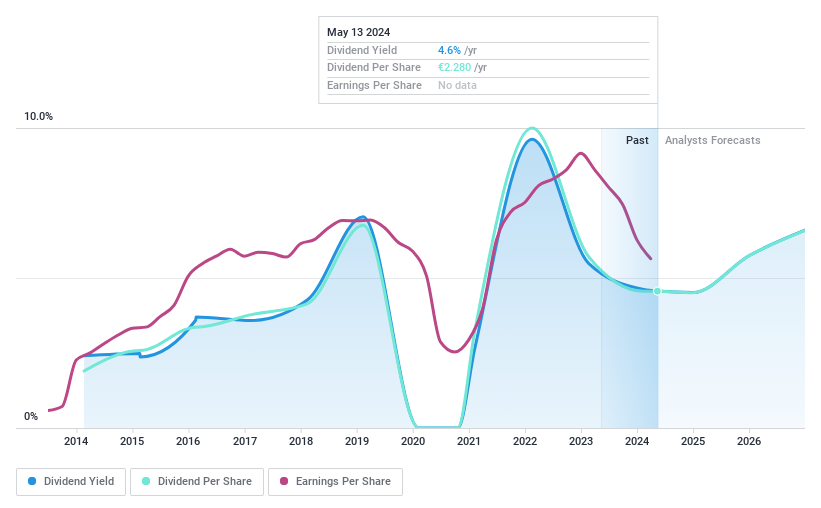

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a range of work and human resources services, with a market capitalization of approximately €8.96 billion.

Operations: Unfortunately, the provided text does not include specific details on Randstad N.V.'s revenue segments in terms of numerical values or descriptions, so I'm unable to summarize this information into a sentence.

Dividend Yield: 4.5%

Randstad N.V. faces challenges as a dividend stock with its 4.51% yield trailing the top Dutch payers and a history of unstable dividends over the past decade. Despite this, dividends are sustainable with a payout ratio of 73.4% and cash payout ratio at 45.9%, indicating coverage by both earnings and cash flows. Recent financials show a dip in Q1 sales to €5.94 billion from €6.52 billion year-over-year, with net income also down to €88 million from €154 million, reflecting potential pressures on future dividend reliability.

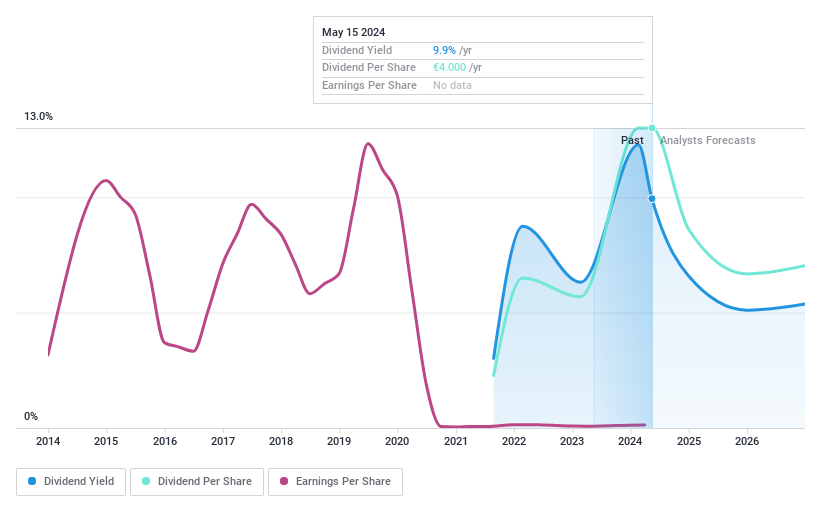

Van Lanschot Kempen

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV, operating both in the Netherlands and internationally, offers a range of financial services with a market capitalization of approximately €1.69 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through two segments: €41 million from Investment Banking Clients and €83.10 million from Wholesale & Institutional Clients.

Dividend Yield: 10%

Van Lanschot Kempen, trading at a reasonable price-to-earnings ratio of 12.9x, below the Dutch market average of 18.8x, has shown significant profit growth with a net income increase to €125.2 million from €84.16 million year-over-year. Despite only initiating dividends three years ago, the company has consistently raised its dividend payout, proposing an increase to €2.00 per share for 2023 from €1.75 previously. However, its dividend history remains relatively short and unstable over this period; yet with a current payout ratio of 70.9%, dividends are well-covered by earnings which are forecasted to grow by 4.22% annually.

Take a closer look at Van Lanschot Kempen's potential here in our dividend report.

Our valuation report here indicates Van Lanschot Kempen may be undervalued.

Seize The Opportunity

Access the full spectrum of 6 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:HEIJM ENXTAM:RAND and ENXTAM:VLK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance