Earlier in the year, investors reacted negatively to Phase III clinical trials of a prospective treatment, and shares of Ironwood Pharmaceuticals (NASDAQ:IRWD) dropped over 55% in the past 90 days. In addition, the company recently missed revenue and earnings estimates for Q1, and management reduced its 2024 guidance. However, positive results from ongoing clinical trials and a successful acquisition point to potential growth in the future. Yet, investors may want to hold off until further signs of recovery and positive momentum in the stock are observable.

Ironwood Pharma’s LINZESS Is the Top IBS Treatment

Ironwood Pharmaceuticals, a biotech corporation specializing in developing solutions for gastrointestinal (GI) diseases, continues to lead in its field with its flagship product, LINZESS. This FDA-approved drug, which has been on the market for 11 years, is the top prescribed treatment for adults with irritable bowel syndrome (IBS) or chronic idiopathic constipation. It’s also received approval for use in pediatric patients aged between 6 and 17. LINZESS has reached approximately five million unique patients and has seen a 10% year-on-year increase in prescription volume.

The company has also reported positive results from the Phase III STARS and Phase II STARGAZE trials for its new drug apraglutide. Used in the treatment of adults with short bowel syndrome with intestinal failure and gastrointestinal acute Graft-versus-Host Disease, apraglutide has shown promising results in efficacy and tolerability, leading to the company’s confidence about its potential approval and projected $1 billion in peak net sales.

Furthermore, Ironwood has completed a tender offer to purchase shares of VectivBio, a clinical-stage biopharmaceutical company leveraging its CoMET platform, based on proprietary stabilized pantetheine backbone chemistry, to create treatments for Inherited Metabolic Diseases (IMDs) previously considered undruggable. The platform is currently being tested on diseases like methylmalonic acidemia (MMA) and propionic acidemia (PA).

Analysis of Ironwood’s Recent Results & Outlook

Ironwood Pharmaceuticals recently reported Q1 financial results. Total revenue for Q1 2024 was recorded at $74.9 million, marking a 28% year-over-year decrease and missing expectations by $30.82 million. Furthermore, the GAAP net loss for Q1 2024 was -$4.2 million, starkly contrasting the GAAP net income of $45.7 million in Q1 2023. This is mainly due to a $30.0 million reduction in collaborative arrangements revenue due to a gross-to-net change in estimate for LINZESS. GAAP EPS of -$0.03 significantly missed consensus estimates by $0.17.

Ironwood Pharmaceuticals ended Q1 2024 with $121.5 million in cash and cash equivalents. During the quarter, the company repaid $25.0 million of the outstanding principal on its revolving credit facility, leaving an outstanding principal balance of $275.0 million as of March 31, 2024.

Management has revised its 2024 guidance, projecting total revenue to range from $405 to $425 million, down from original projections of $435 to $455 million.

Is IRWD Stock a Buy?

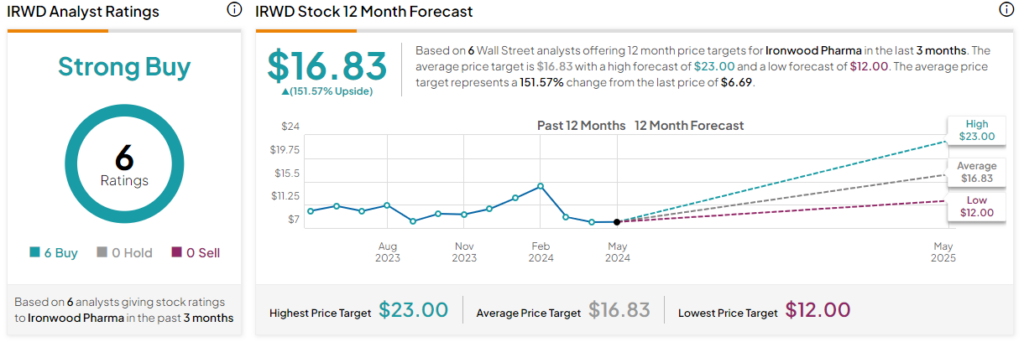

Analysts following the company have remained constructive on IRWD stock, though many have lowered their near-term price targets. For example, Capital One Financial analyst Tim Chiang recently dropped the price target on the shares to $12 while maintaining a Buy rating, citing the upside potential of treatment candidates in the pipeline.

Overall, Ironwood Pharmaceuticals is rated a Strong Buy based on the recommendations and 12-month price targets six Wall Street analysts issued over the past three months. The average price target is $16.83, which represents a 151.57% upside from current levels.

The stock has been volatile, though lately, it’s been trending in one direction – down, losing -15.10% over the past month. It trades at the low end of its 52-week price range of $6.21-$15.70 and continues to demonstrate negative price momentum, trading below the 20-day (7.79) and 50-day (8.71) moving averages.

Investors Could Wait for a Change in Sentiment

Ironwood has enjoyed the benefits of its blockbuster drug LINZESS. However, it’s now been a decade, and the focus has shifted to what’s next in the pipeline. Clinical trial results have been mixed, though there have been positive results to warrant enthusiasm for bringing apraglutide to market. Further, the company has acquired other potential promising candidates. Still, it may take some time for those treatments to drive growth, and the stock continues to show negative momentum, suggesting investors wait until there’s a change in investor sentiment or if the firm nears bringing new treatments to market.