Unveiling 3 Premier Dividend Stocks Yielding Up To 7.5%

As global markets show signs of resilience, with key indices like the S&P 500 approaching record highs amid fluctuating economic indicators, investors are increasingly scrutinizing opportunities for steady returns. In this context, dividend stocks emerge as appealing options due to their potential to provide investors with a consistent income stream in a landscape marked by both optimism and uncertainty.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.48% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.58% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.38% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.44% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.95% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.61% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.34% | ★★★★★★ |

Innotech (TSE:9880) | 4.04% | ★★★★★★ |

Click here to see the full list of 1792 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

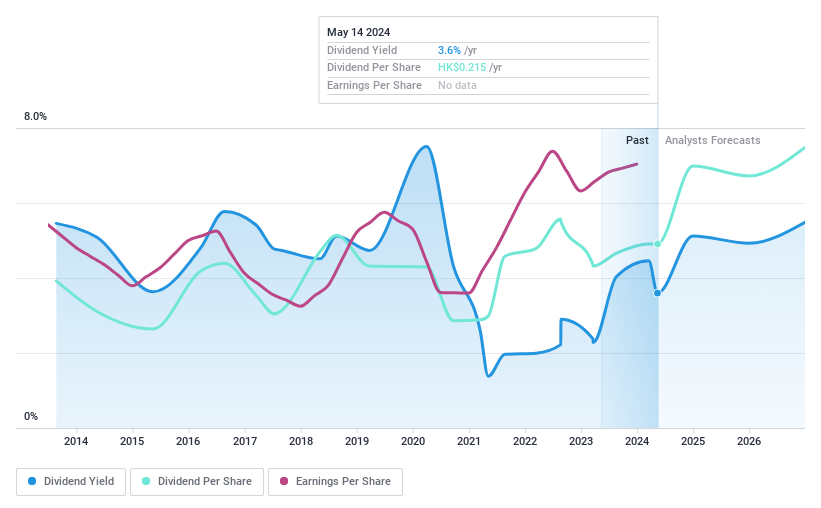

Xtep International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xtep International Holdings Limited is a company based in China that specializes in designing, developing, manufacturing, and marketing sports footwear, apparel, and accessories for adults and children with a market capitalization of approximately HK$14.17 billion.

Operations: Xtep International Holdings generates revenue through three primary segments: Mass Market (CN¥11.95 billion), Fashion Sports (CN¥1.60 billion), and Professional Sports (CN¥0.80 billion).

Dividend Yield: 3.6%

Xtep International Holdings has demonstrated a mixed performance in terms of dividend reliability and growth. While the company's dividend yield stands at 3.6%, which is lower than the top quartile of Hong Kong market payers, its dividends are well-covered by both earnings, with a payout ratio of 48.8%, and cash flows, with a cash payout ratio of 58.5%. However, Xtep's history shows volatility in dividend payments over the past decade despite recent approvals for an increase to HKD 0.08 per share at its latest annual general meeting on May 3, 2024. This instability may concern long-term focused dividend investors looking for consistency.

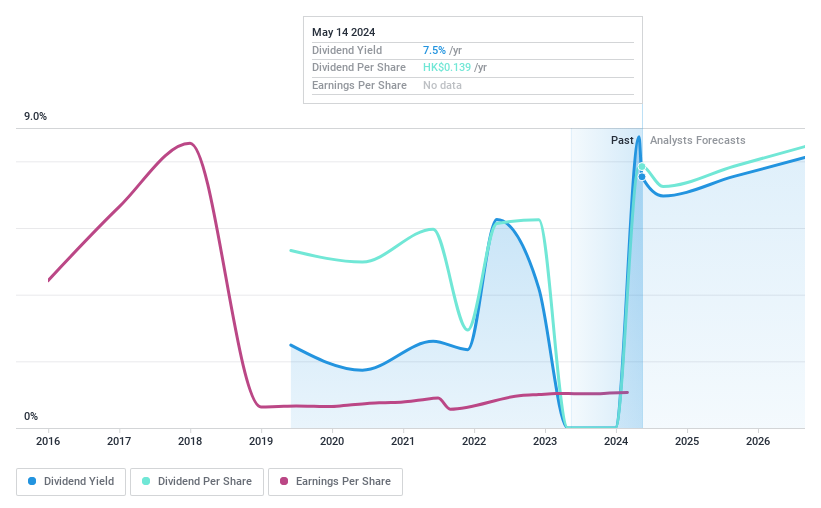

China Kepei Education Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited operates as an investment holding company that offers private vocational education services primarily in China, with a market capitalization of approximately HK$3.46 billion.

Operations: China Kepei Education Group Limited generates revenue primarily through the provision of education services, totaling CN¥1.60 billion.

Dividend Yield: 7.5%

China Kepei Education Group has shown a positive trend in its financial performance with recent half-year sales and net income increases to CNY 871.97 million and CNY 452.49 million respectively. Despite this, the company's dividend history is marked by instability, having paid dividends for only five years with fluctuations in payments. Currently, it offers a dividend yield of 7.54%, placing it among the top payers in Hong Kong, yet concerns about its inconsistent dividend track record may deter investors seeking reliable income streams. The recent interim dividend was declared at HKD 0.07 per share.

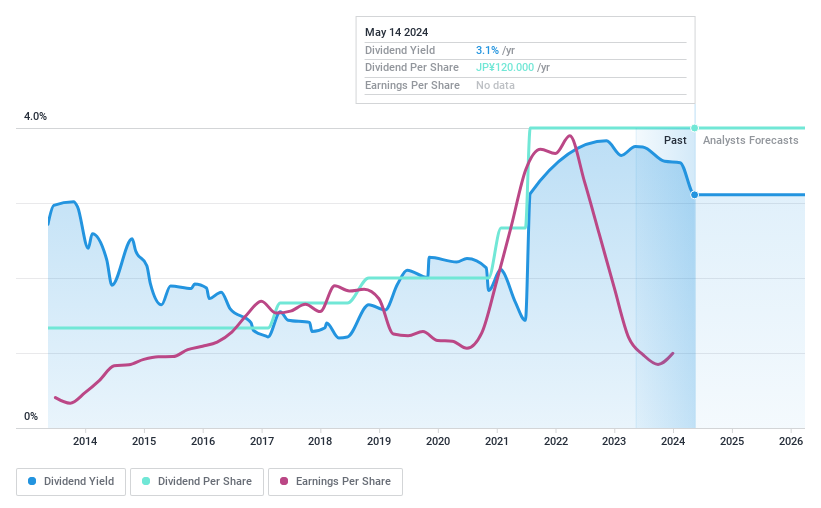

Melco Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Melco Holdings Inc. operates in the development, manufacturing, and sale of digital home appliances and PC peripherals, serving both domestic (Japan) and international markets, with a market capitalization of approximately ¥59.30 billion.

Operations: Melco Holdings Inc. generates revenue primarily from two segments: food (¥38.12 billion) and IT-related products (¥106.08 billion).

Dividend Yield: 3.1%

Melco Holdings has initiated a substantial share repurchase program, buying back up to 11.97% of its shares for ¥8 billion, signaling a commitment to enhancing shareholder value through May 2025. Concurrently, the company has raised its earnings guidance significantly with expected net sales of ¥145 billion and operating profit of ¥1.9 billion. Despite this positive outlook, Melco's dividend yield stands at 3.11%, slightly below the top quartile in Japan’s market, and concerns linger about the sustainability of dividends as they are not well covered by cash flows or earnings with a payout ratio at 80.4%.

Get an in-depth perspective on Melco Holdings' performance by reading our dividend report here.

Our valuation report unveils the possibility Melco Holdings' shares may be trading at a premium.

Where To Now?

Unlock more gems! Our Top Dividend Stocks screener has unearthed 1789 more companies for you to explore.Click here to unveil our expertly curated list of 1792 Top Dividend Stocks.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1368 SEHK:1890 and TSE:6676.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance