Chris Davis Amplifies Stake in Humana Inc, Marking a Strategic Portfolio Shift

Insight into the First Quarter Moves of a Prominent Value Investor

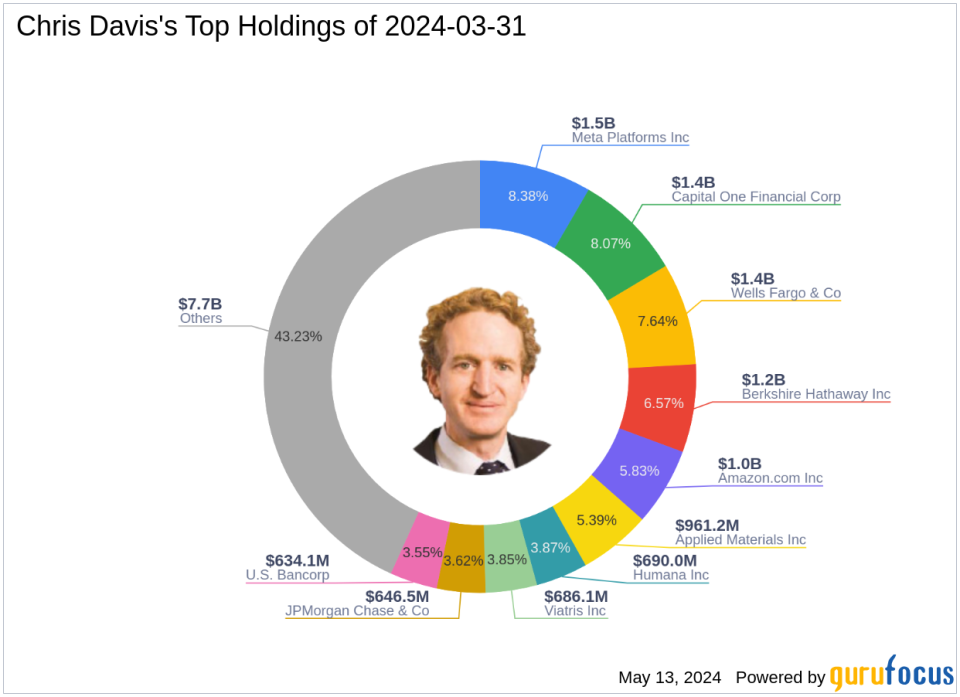

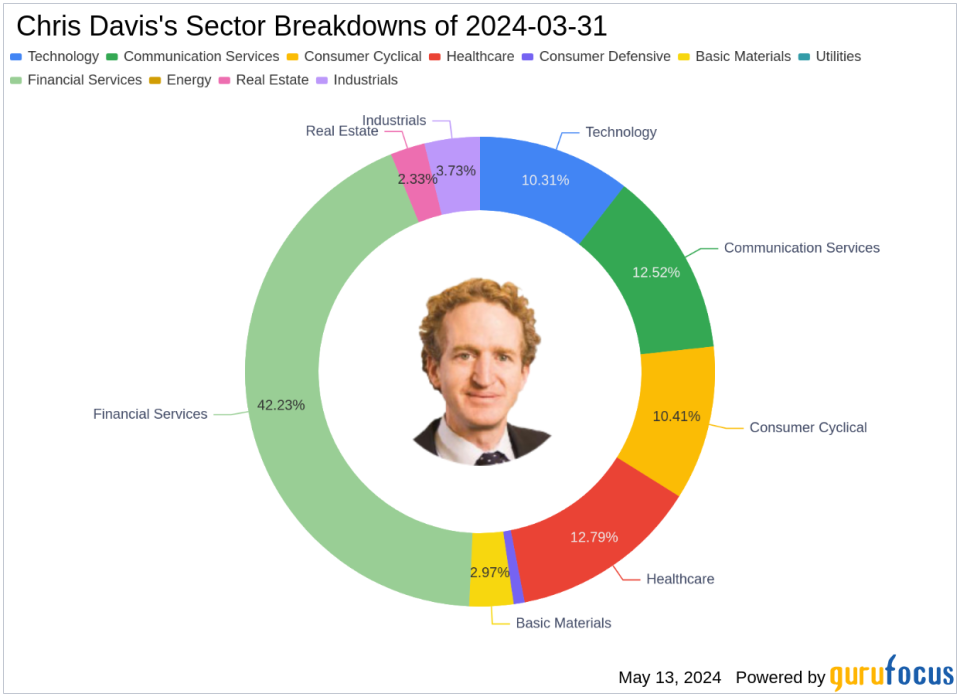

Chris Davis (Trades, Portfolio), the seasoned portfolio manager at Davis Financial Fund, recently disclosed his investment activities for the first quarter of 2024 through the latest 13F filing. Managing over $60 billion, Davis is known for his long-term investment strategy, focusing on undervalued, robust businesses, particularly in the financial services sector. His investment philosophy emphasizes purchasing out-of-favor companies with the potential for substantial long-term returns.

Significant Increases in Portfolio Positions

During the first quarter, Chris Davis (Trades, Portfolio) adjusted his holdings in several key stocks, notably increasing his investment in the following companies:

Humana Inc (NYSE:HUM) saw a dramatic increase of 1,946,566 shares, bringing the total to 1,990,129 shares. This adjustment, a 4,468.39% increase in share count, now constitutes 3.79% of Davis's portfolio, with a total value of approximately $690,017,530.

MGM Resorts International (NYSE:MGM) also experienced a significant boost with an additional 1,563,170 shares, making up a total of 11,895,279 shares. This change represents a 15.13% increase in share count, valued at around $561,576,120.

Strategic Exits from Previous Investments

Chris Davis (Trades, Portfolio) also made decisive moves to exit positions in several companies, effectively reallocating resources within his portfolio:

Eaton Corp PLC (NYSE:ETN) was completely sold off with all 145,440 shares liquidated, impacting the portfolio by -0.2%.

The iShares S&P 500 Value ETF (IVE) was another divestiture, with all 139,545 shares sold, leading to a -0.14% portfolio impact.

Reductions in Key Holdings

The first quarter also saw significant reductions in several of Davis's holdings:

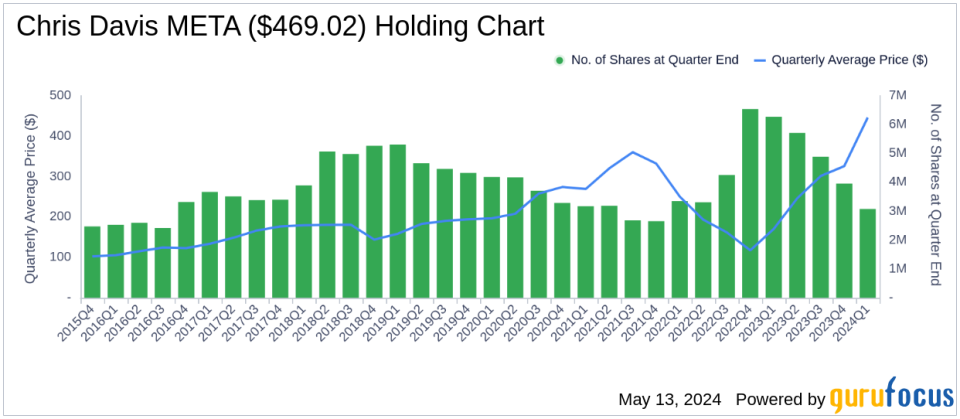

Meta Platforms Inc (NASDAQ:META) was reduced by 878,788 shares, a -22.2% decrease, impacting the portfolio by -1.76%. The stock traded at an average price of $446.07 during the quarter.

Wells Fargo & Co (NYSE:WFC) shares were reduced by 5,851,480, marking a -19.93% decrease and a -1.63% impact on the portfolio. The average trading price was $52.32 during the quarter.

Overview of Chris Davis (Trades, Portfolio)'s Current Portfolio

As of the first quarter of 2024, Chris Davis (Trades, Portfolio)'s investment portfolio comprises 98 stocks. The top holdings include significant positions in Meta Platforms Inc (NASDAQ:META), Capital One Financial Corp (NYSE:COF), Wells Fargo & Co (NYSE:WFC), Berkshire Hathaway Inc (NYSE:BRK.A), and Amazon.com Inc (NASDAQ:AMZN). These investments are predominantly spread across nine industries, with a heavy concentration in Financial Services and Healthcare.

This strategic realignment in Chris Davis (Trades, Portfolio)'s portfolio highlights his adaptive investment approach, responding to market dynamics while staying true to his value-based investment philosophy. The significant increase in Humana Inc, alongside other key adjustments, reflects a calculated move to capitalize on potential market opportunities ahead.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance