Edgewell Personal Care Company Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

It's been a good week for Edgewell Personal Care Company (NYSE:EPC) shareholders, because the company has just released its latest quarterly results, and the shares gained 5.7% to US$39.97. Edgewell Personal Care reported US$599m in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of US$0.72 beat expectations, being 5.4% higher than what the analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Edgewell Personal Care

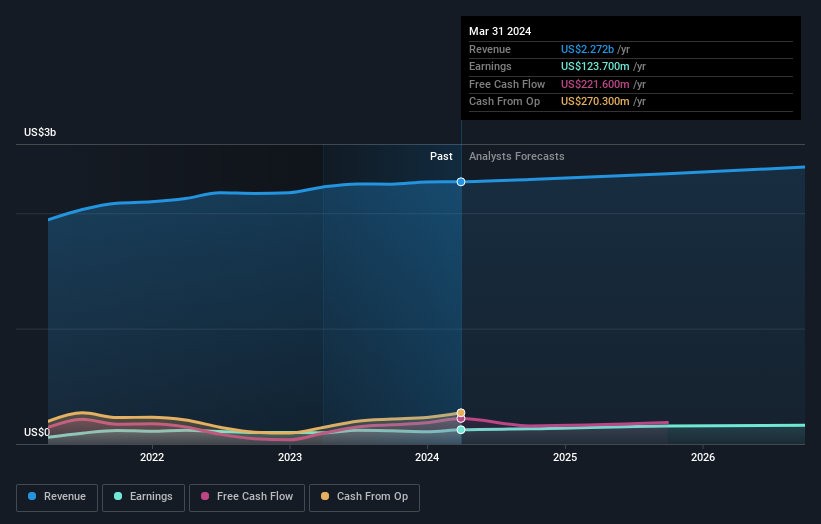

Taking into account the latest results, Edgewell Personal Care's six analysts currently expect revenues in 2024 to be US$2.29b, approximately in line with the last 12 months. Statutory per-share earnings are expected to be US$2.51, roughly flat on the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of US$2.31b and earnings per share (EPS) of US$2.58 in 2024. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

It might be a surprise to learn that the consensus price target was broadly unchanged at US$43.43, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Edgewell Personal Care, with the most bullish analyst valuing it at US$53.00 and the most bearish at US$35.00 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Edgewell Personal Care shareholders.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 1.8% growth on an annualised basis. That is in line with its 1.8% annual growth over the past five years. Compare this with the broader industry (in aggregate), which analyst estimates suggest will see revenues grow 6.9% annually. So it's pretty clear that Edgewell Personal Care is expected to grow slower than similar companies in the same industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Edgewell Personal Care. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Edgewell Personal Care's revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Edgewell Personal Care going out to 2026, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Edgewell Personal Care , and understanding this should be part of your investment process.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.