Quantum-Si Inc (QSI) Q1 2024 Earnings: Narrowing Losses and Revenue Growth

Revenue: Reported $457,000 for Q1 2024, surpassing the estimate of $430,000.

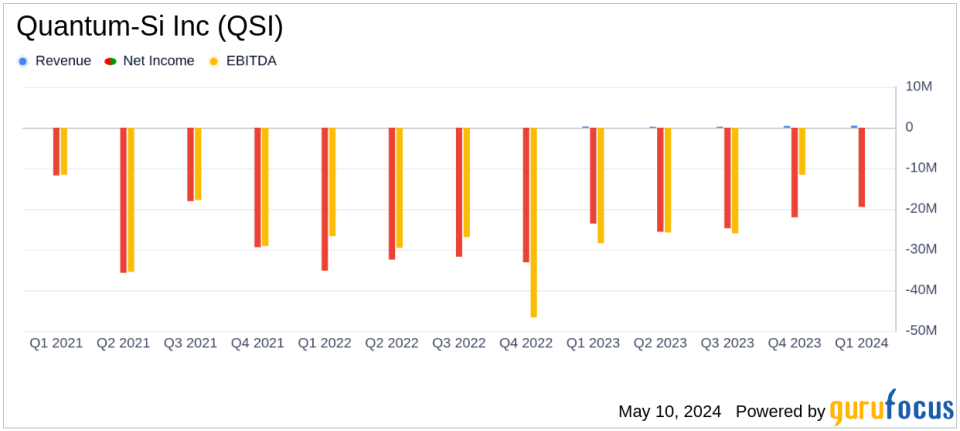

Net Loss: Recorded at $19.5 million, below the estimated loss of $26.12 million.

Gross Margin: Achieved a gross margin of 59% during the quarter.

Operating Expenses: Total operating expenses were $23.6 million, reduced from $29.3 million in the same period last year.

EBITDA: Adjusted EBITDA was negative $20.5 million, an improvement from negative $23.7 million year-over-year.

Cash Position: Ended the quarter with $235.4 million in cash and marketable securities, affirming a financial runway into 2026.

2024 Financial Guidance: Reaffirms revenue guidance of $3.7 to $4.2 million and total cash usage of less than $100 million for the full year.

Quantum-Si Inc (NASDAQ:QSI), a leader in the field of proteomics, released its 8-K filing on May 9, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company reported a net loss of $19.5 million, a notable improvement from the $23.6 million loss in the same period last year. This performance reflects a strategic reduction in operating expenses and a successful transition to the full commercial launch of its Platinum instrument.

About Quantum-Si Incorporated

Quantum-Si, The Protein Sequencing Company, is at the forefront of revolutionizing proteomics with its semiconductor chip technology, which enables next-generation single-molecule protein sequencing. This technology aims to transform drug discovery and diagnostics, pushing the boundaries of what has been achievable with DNA sequencing.

Financial Highlights and Strategic Achievements

For Q1 2024, Quantum-Si reported revenues of $457,000, surpassing the previous year's Q1 revenue of $254,000. This increase is primarily attributed to the full commercial launch of the Platinum instrument, which also led to the acquisition of the company's first government and pharmaceutical customers. The gross margin stood strong at 59%, although it is expected to fluctuate as the company scales its commercial operations.

Total operating expenses were significantly reduced to $23.6 million from $29.3 million year-over-year, reflecting efficient capital utilization and a focused reduction in research and development (R&D) and general and administrative (G&A) expenses. This strategic realignment is part of Quantum-Si's broader initiative to enhance R&D efficiency and product delivery.

Financial Stability and Future Outlook

As of March 31, 2024, Quantum-Si maintained a robust financial position with $235.4 million in cash, cash equivalents, and marketable securities, expected to fund operations into 2026. The company has reaffirmed its full-year 2024 revenue guidance in the range of $3.7 million to $4.2 million and anticipates total cash usage to remain below $100 million.

Operational and Market Expansion

Quantum-Si's transition from a controlled launch to a full commercial phase has not only expanded its market presence but also diversified its customer base into significant sectors such as government and pharmaceuticals. The ongoing development of new kits and software tools is set to further enhance the company's product offerings, potentially increasing market penetration and customer retention.

Investor and Analyst Perspectives

The narrowing of Quantum-Si's net loss and the proactive management of operating expenses have been positively viewed by market analysts, suggesting a steady path to reduced losses and potential profitability. The company's strategic focus on expanding its technological offerings and market segments is anticipated to play a crucial role in its growth trajectory and investor confidence.

Conclusion

Quantum-Si's first quarter of 2024 reflects a pivotal period of financial and operational adjustments that have begun to yield tangible benefits. With its innovative approach to protein sequencing and a clear strategic direction, Quantum-Si is well-positioned to advance in the biotechnology industry, promising exciting developments for investors and stakeholders.

Explore the complete 8-K earnings release (here) from Quantum-Si Inc for further details.

This article first appeared on GuruFocus.