BigCommerce Holdings Inc (BIGC) Q1 2024 Earnings: Aligns with EPS Projections and Surpasses ...

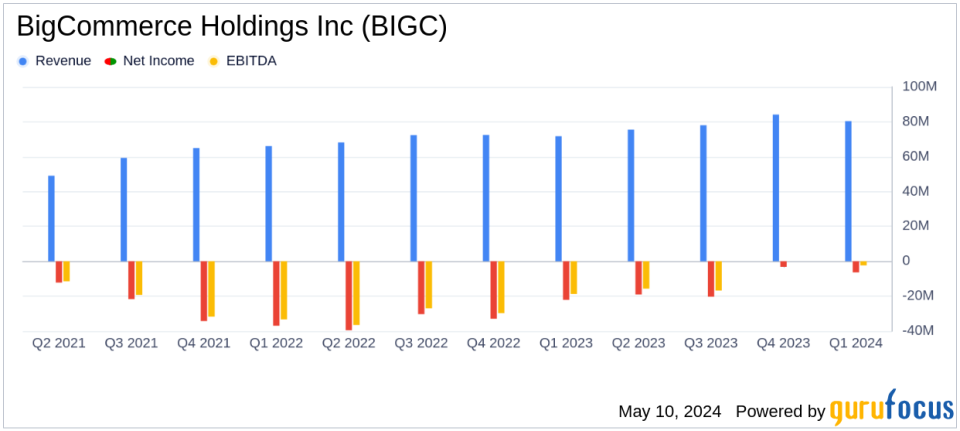

Revenue: Reported at $80.4 million, up 12% year-over-year, slightly below the estimate of $80.48 million.

Net Income: Non-GAAP net income reached $5.0 million, significantly surpassing the estimated $3.08 million.

Earnings Per Share: Non-GAAP EPS was $0.07, exceeding the estimated EPS of $0.04.

Gross Margin: GAAP gross margin improved to 77% from 76% in the previous year; Non-GAAP gross margin was 78%, up from 77%.

Free Cash Flow: Reported negative free cash flow of $4.2 million, compared to negative $20.8 million in the prior year.

Annual Revenue Run-Rate (ARR): Increased by 7% to $340.1 million as of March 31, 2024.

Subscription Revenue: Grew by 13% to $61.0 million compared to the first quarter of 2023.

On May 9, 2024, BigCommerce Holdings Inc (NASDAQ:BIGC) unveiled its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a robust start to the year with total revenue reaching $80.4 million, marking a 12% increase year-over-year and slightly surpassing analyst estimates of $80.48 million. This growth was propelled by significant enhancements in their SaaS e-commerce platform, catering to both B2C and B2B sectors.

Company Overview

BigCommerce, a leading SaaS provider, specializes in e-commerce solutions that streamline the creation and management of online stores and multi-channel commerce. Operating primarily in the Americas, the company has also expanded its reach in EMEA and APAC regions, contributing to its diversified revenue streams.

Financial and Operational Highlights

The first quarter saw BigCommerce achieve a non-GAAP net income of $5.0 million, a significant improvement from a net loss of $4.9 million in the same quarter the previous year. This turnaround reflects a strategic emphasis on operational efficiency and product innovation. Notably, the company's GAAP net loss narrowed to $6.4 million from $22.1 million year-over-year, with a non-GAAP net income per share at $0.07, aligning with analyst EPS estimates of $0.04.

Subscription revenue climbed to $61.0 million, up by 13% from the prior year, driven by an increase in enterprise accounts which now represent 73% of the total Annual Revenue Run-rate (ARR) standing at $340.1 million. The company's focus on enterprise solutions is evident from the growth in Enterprise ARR, which saw an 8% increase to $248.2 million.

Geographical and Segment Performance

Revenue growth was recorded across all geographical segments with the Americas leading at 12%, followed by EMEA at 15%, and APAC at 11%. This geographical diversification underscores BigCommerce's expanding global footprint and its ability to cater to varied market dynamics.

Strategic Initiatives and Product Enhancements

During the quarter, BigCommerce launched over 100 new product enhancements and features, including the Catalyst storefront technology and the Open Source B2B Buyer Portal. These innovations are designed to lower barriers to entry for composable commerce projects and enhance the customer experience across enterprise applications.

Financial Health and Future Outlook

BigCommerce's balance sheet remains solid with $266.3 million in cash and marketable securities. Looking ahead to Q2 2024, the company expects total revenue to be between $79.8 million and $81.8 million, projecting a growth rate of 6% to 8%. For the full year, revenue is anticipated to be between $329.7 million and $335.7 million, with non-GAAP operating income projected between $10.2 million and $14.2 million.

Investor and Analyst Perspectives

The company's ability to exceed revenue forecasts while aligning with EPS projections provides a positive signal to investors about its growth trajectory and operational improvements. The strategic leadership additions and continuous product innovations are set to further solidify BigCommerce's position in the competitive e-commerce platform market.

For detailed financial figures and future projections, stakeholders and potential investors are encouraged to view the full earnings report and join the upcoming webcast on BigCommerces investor relations website.

This comprehensive analysis of BigCommerces Q1 earnings illustrates a promising start to 2024, marked by strategic expansions and robust financial performance, positioning the company for sustained growth in the evolving e-commerce industry.

Explore the complete 8-K earnings release (here) from BigCommerce Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance