Leslie's Inc. (LESL) Q2 Fiscal 2024 Earnings: Misses Analyst Forecasts Amid Seasonal Challenges

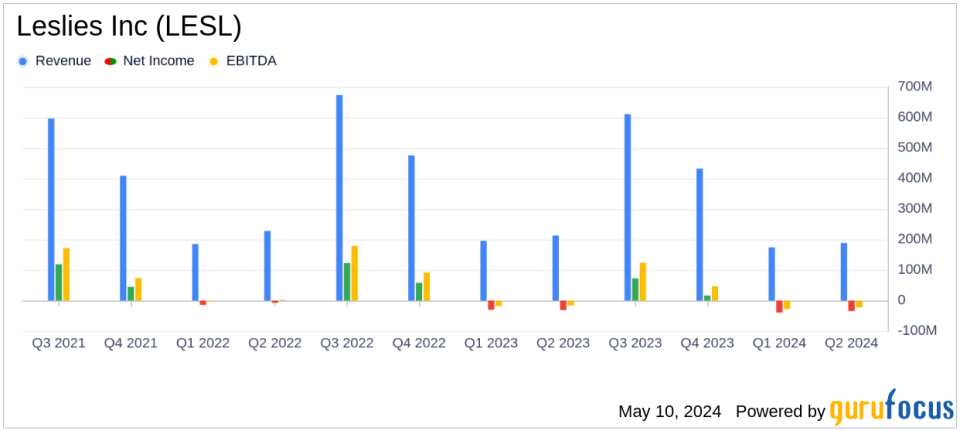

Revenue: $188.7 million, down 11.4% year-over-year, falling short of estimates of $619.57 million.

Net Loss: $34.6 million, widened from a net loss of $31.5 million in the prior year period, and below the estimated net loss of $78.23 million.

Diluted EPS: $(0.19), compared to $(0.17) year-over-year, falling short of the estimated EPS of $0.42.

Gross Margin: 28.8%, a decrease from 33.4% in the prior year period, indicating reduced profitability.

Adjusted EBITDA: $(19.3) million, a significant decline from $(8.4) million in the prior year period.

Inventory Levels: Decreased by 23% to $379.1 million, reflecting effective inventory management.

Outlook: Fiscal 2024 guidance reaffirmed, projecting sales between $1.41 billion and $1.47 billion, and adjusted EPS of $0.25 to $0.33.

On May 8, 2024, Leslie's Inc. (NASDAQ:LESL) disclosed its financial results for the second quarter of fiscal year 2024 through its 8-K filing. The company, a leading direct-to-consumer pool and spa care brand in the U.S., reported a challenging quarter with significant declines in sales and profitability.

Company Overview

Leslie's Inc. operates exclusively in the United States, providing a wide range of products for residential and commercial pools and spas. The company's offerings include chemicals, equipment, parts, and accessories necessary for the maintenance and enjoyment of pools and spas.

Financial Performance Highlights

For Q2 2024, Leslie's reported sales of $188.7 million, a decrease of 11.4% from $212.8 million in the same period last year. This decline was primarily attributed to adverse weather conditions and a normalization in consumer spending post-pandemic. The net loss widened to $34.6 million from $31.5 million year-over-year, and diluted earnings per share fell to $(0.19) from $(0.17). Adjusted EBITDA also saw a significant downturn, coming in at $(19.3) million compared to $(8.4) million in the prior year.

Operational and Market Challenges

CEO Mike Egeck highlighted the impact of cool, wet weather and shifting consumer behaviors on the company's performance. Despite these challenges, he noted improvements in inventory management and competitive pricing strategies. Egeck remains optimistic about the second half of the fiscal year, historically a more profitable period for Leslie's, emphasizing the company's readiness and strategic positioning for the peak pool season.

Financial Position and Cash Flow

The balance sheet reflects a decrease in cash and cash equivalents to $8.4 million from $8.7 million year-over-year. Total debt was reduced to $882.7 million from $965.8 million, showing effective debt management. However, net cash used in operating activities was substantial at $115.1 million for the quarter.

Outlook and Strategic Focus

Leslie's reaffirmed its fiscal 2024 outlook, projecting sales between $1,410 million and $1,470 million and net income ranging from $32 million to $46 million. The adjusted EBITDA forecast is set between $170 million and $190 million, with adjusted diluted earnings per share expected to be between $0.25 and $0.33.

Investor and Analyst Perspectives

The company's performance this quarter significantly missed analyst expectations, particularly concerning net income and revenue projections. Analysts had estimated earnings of $0.42 per share with a net income of $78.23 million for the quarter, underscoring the extent of the financial shortfall.

Conclusion

Leslie's Inc. faces ongoing challenges as it navigates a complex market environment characterized by changing consumer spending habits and external economic pressures. While management remains confident in a stronger performance in the latter half of the year, the company will need to continue optimizing its operations and strategic initiatives to meet its annual financial targets and improve shareholder value.

For detailed insights and further information, refer to the full earnings presentation and the upcoming conference call, details of which can be found on Leslies investor relations website.

Explore the complete 8-K earnings release (here) from Leslies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance