Viridian Therapeutics Inc (VRDN) Q1 2024 Earnings: Narrowing Losses Amidst Clinical Advancements

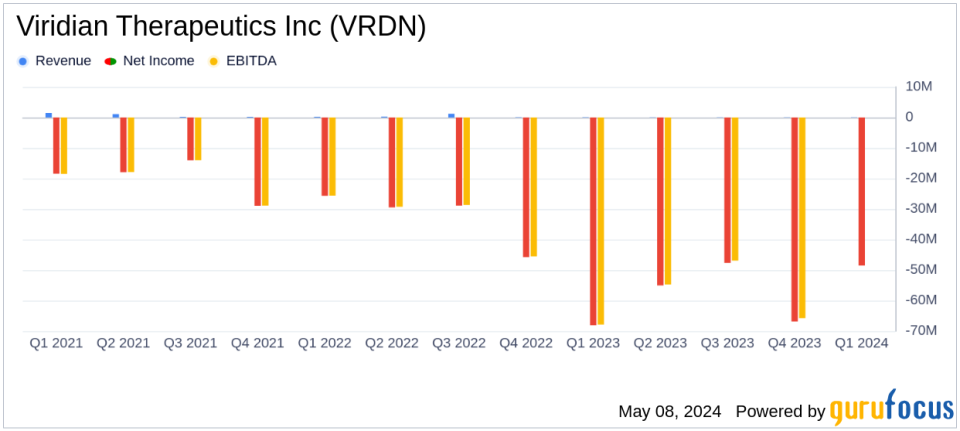

Revenue: Reported at $72,000 for Q1 2024, surpassing the estimated $70,000.

Net Loss: Recorded at $48.54 million for Q1 2024, below the estimated loss of $62.60 million.

Earnings Per Share: Reported a loss of $0.79 per share, surpassing the estimated loss of $1.10 per share.

Research and Development Expenses: Totaled $40.94 million, down from $50.74 million in the previous year.

General and Administrative Expenses: Decreased to $15.03 million from $21.83 million year-over-year.

Total Assets: Increased to $630.38 million as of March 31, 2024, up from $490.42 million at the end of 2023.

Cash Position: Cash, cash equivalents, and short-term investments stood at $613.19 million, significantly higher than the $477.37 million at the end of the previous year.

On May 8, 2024, Viridian Therapeutics Inc (NASDAQ:VRDN) disclosed its first-quarter financial results through an 8-K filing. The biopharmaceutical company, known for its focus on developing treatments for serious and rare diseases, particularly thyroid eye disease (TED), reported a net loss of $48.54 million for the quarter, which marks an improvement from the $68.15 million loss recorded in the same period last year. This performance notably beats the analysts' expectation of a $62.60 million net loss.

Viridian Therapeutics Inc is advancing its portfolio with significant clinical trials and regulatory milestones. The company's lead product candidate, VRDN-001, has completed enrollment for its THRIVE phase 3 trial in active TED, with results anticipated by September 2024. Additionally, the THRIVE-2 trial for chronic TED is progressing as planned, with outcomes expected by the end of 2024.

Financial Highlights and Strategic Progress

The company's financial health showed marked improvement with a reduced quarterly net loss compared to the previous year. Total revenue for the quarter stood at $72,000, derived from collaboration revenue, which is a slight decrease from $98,000 in Q1 2023. Despite this, the reduction in total operating expenses from $72.57 million to $55.97 million significantly contributed to narrowing the net loss.

Research and development expenses were reported at $40.94 million, down from $50.74 million year-over-year, reflecting efficient management of resources as the company advances its clinical programs. General and administrative expenses also saw a reduction, amounting to $15.03 million compared to $21.83 million in the previous year.

Viridian's balance sheet remains robust with $613.19 million in cash, cash equivalents, and short-term investments as of March 31, 2024, an increase from $477.37 million at the end of 2023. This financial positioning supports the company's strategic initiatives and operational activities well into the second half of 2026.

Operational and Clinical Developments

President and CEO Steve Mahoney highlighted the company's operational excellence and the rapid progress in clinical programs. The successful enrollment in the THRIVE trial not only underscores the demand for new therapies in TED but also demonstrates Viridian's capability to meet significant clinical milestones.

Aside from VRDN-001, Viridian is also progressing with its FcRn inhibitor portfolio. The IND submission for VRDN-006 is anticipated by the end of 2024, and VRDN-008 is expected to provide non-human primate data in the latter half of the year. These developments are crucial as they expand the company's therapeutic reach beyond TED.

Investor and Analyst Perspectives

During the earnings call, management expressed confidence in the ongoing clinical trials and the strategic direction of the company. The financial results and operational achievements indicate a solid trajectory towards achieving regulatory milestones and commercial readiness, particularly for their lead candidates in the TED treatment pipeline.

For investors and stakeholders, Viridian Therapeutics Inc's Q1 2024 performance reflects a company effectively managing its clinical developments and financial operations, poised for potential growth and market impact upon successful trial outcomes and product approvals.

For further details, please refer to the official earnings call transcript and additional financial documentation available on the Viridian Therapeutics website under the Investors section.

Explore the complete 8-K earnings release (here) from Viridian Therapeutics Inc for further details.

This article first appeared on GuruFocus.