Immunocore Holdings PLC Reports Q1 2024 Earnings: Misses EPS Estimates, Surpasses Revenue Forecasts

Revenue: Reported $70.3 million in Q1 2024, up 36% from $51.6 million in Q1 2023, falling short of the estimated $71.3 million.

Net Loss: Increased to $24.4 million in Q1 2024 from $19.4 million in Q1 2023, exceeding the estimated net loss of $18.39 million.

Earnings Per Share (EPS): Recorded a loss of $0.49 per share, below the estimated loss of $0.37 per share.

Research & Development Expenses: Rose significantly to $57.5 million in Q1 2024 from $36.6 million in Q1 2023, reflecting ongoing investment in clinical programs.

Selling, General and Administrative Expenses: Increased to $39.3 million in Q1 2024 from $32.6 million in Q1 2023, supporting expanded commercial activities.

Cash Position: Strong liquidity with $832.8 million in cash and cash equivalents as of March 31, 2024, bolstered by recent financing activities.

Global Expansion: Continued growth with KIMMTRAK, now launched in 17 countries for metastatic uveal melanoma treatment.

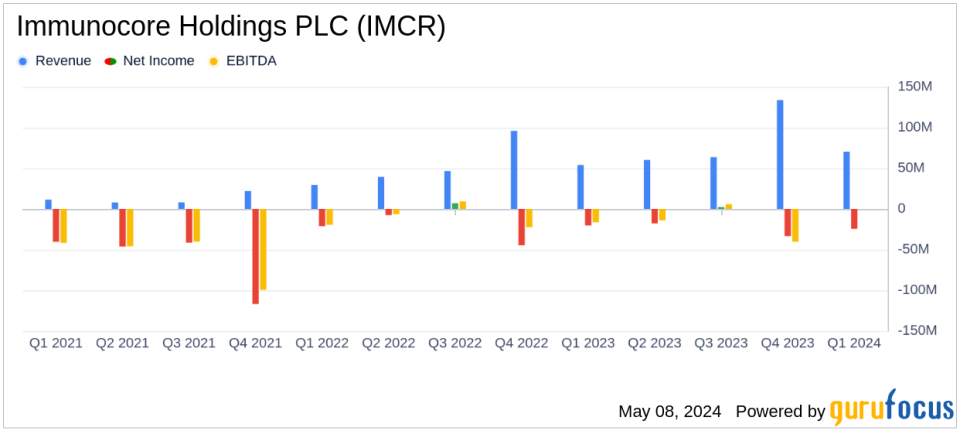

On May 8, 2024, Immunocore Holdings PLC (NASDAQ:IMCR) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, a trailblazer in TCR bispecific immunotherapies for cancer, infectious, and autoimmune diseases, reported significant developments and financial details that underline both progress and challenges in its operations.

Company Overview

Immunocore Holdings PLC operates primarily in the United States and the United Kingdom, focusing on novel therapies for severe diseases, including metastatic uveal melanoma through its flagship product, KIMMTRAK. The company's innovative approach includes expanding treatment indications and advancing a pipeline of promising therapeutic candidates.

Financial Performance

Immunocore's revenue for Q1 2024 reached $70.3 million, a notable increase from $51.6 million in the same period last year, primarily driven by robust sales of KIMMTRAK in the United States and ongoing global expansion. This figure surpasses the analyst revenue estimate of $71.3 million for the quarter. However, the company reported a net loss of $24.4 million, or $0.49 per share, which did not meet the anticipated $-0.37 EPS, reflecting increased operational costs and investment in research and development (R&D).

Operational Highlights and R&D Progress

R&D expenses saw a significant rise to $57.5 million from $36.6 million year-over-year, attributed to the advancement of the PRAME and other oncology programs. SG&A expenses also increased to $39.3 million due to scaling operations to support the expanded product pipeline and commercial activities. Despite these increases, Immunocore's strategic investments signify a strong commitment to broadening its therapeutic impact, particularly highlighted by the progression of its PRAME ImmTAC therapy and other clinical trials.

Strategic Developments and Future Outlook

Immunocore's CEO, Bahija Jallal, emphasized the company's urgency in advancing its clinical programs and expanding access to KIMMTRAK. The ongoing Phase 3 trials and additional launches in new markets underscore the company's strategic direction towards solidifying its presence in oncology while exploring potential in infectious and autoimmune diseases.

Liquidity and Financial Health

The company ended the quarter with a strong cash position of $832.8 million, bolstered by $390.2 million net proceeds from a convertible notes offering. Plans are underway to utilize part of these funds to repay existing loans, ensuring a robust balance sheet that supports extensive R&D activities and potential commercial expansions.

Market and Analyst Perspectives

While the earnings per share fell short of market expectations, the increase in revenue and the strategic advancements in clinical programs provide a mixed yet optimistic outlook for Immunocore. The company's focus on expanding indications for KIMMTRAK and progressing its pipeline projects could play crucial roles in its growth trajectory and market valuation.

Conclusion

Immunocore Holdings PLC's Q1 2024 results reflect a transformative phase with increased investment in innovation and market expansion strategies. Although facing challenges in net losses and operational costs, the company's robust revenue growth and strategic R&D investments are pivotal in its long-term success in the biotechnology industry.

For detailed financial tables and further information, refer to the original 8-K filing by Immunocore Holdings PLC.

Explore the complete 8-K earnings release (here) from Immunocore Holdings PLC for further details.

This article first appeared on GuruFocus.