Janux Therapeutics Reports Narrower Q1 Loss, Misses Revenue Estimates

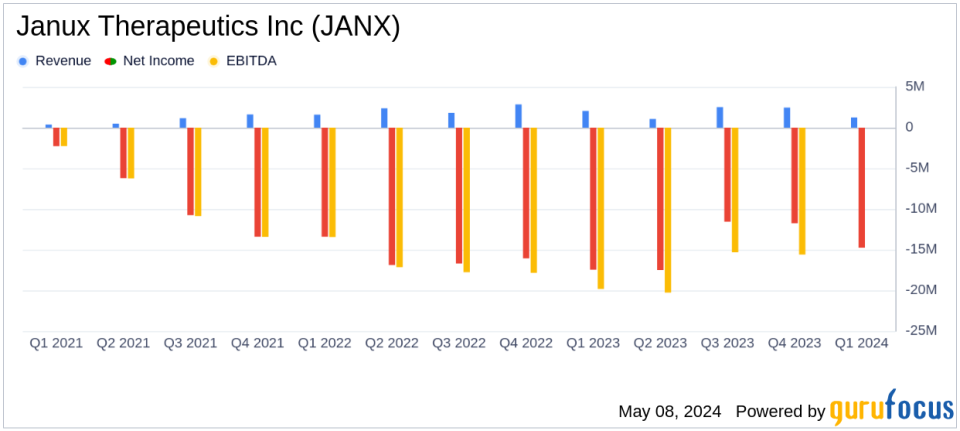

Net Loss: Reported a net loss of $14.76 million for Q1 2024, an improvement from a net loss of $17.46 million in Q1 2023, beating the estimated net loss of $18.10 million.

Revenue: Generated $1.25 million in collaboration revenue, exceeding the estimated revenue of $0.76 million.

Earnings Per Share (EPS): Recorded an EPS of -$0.30, better than the estimated EPS of -$0.33.

Research and Development Expenses: R&D expenses amounted to $14.07 million, down from $15.87 million in the same quarter the previous year.

General and Administrative Expenses: G&A expenses rose to $7.34 million, up from $6.46 million in Q1 2023.

Cash Reserves: Cash and cash equivalents, along with short-term investments, significantly increased to $651.8 million from $344.0 million at the end of the previous quarter.

On May 7, 2024, Janux Therapeutics Inc (NASDAQ:JANX) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The clinical-stage biopharmaceutical company, known for its innovative approach in developing tumor-activated immunotherapies for cancer, reported a net loss of $14.8 million, which shows an improvement from a net loss of $17.5 million in the same quarter the previous year.

Company Overview

Janux Therapeutics Inc is at the forefront of developing next-generation therapeutics for cancer treatment. By leveraging its proprietary Tumor Activated T Cell Engager (TRACTr) and Tumor Activated Immunomodulator (TRACIr) platforms, Janux aims to deliver safer and more effective solutions to combat various solid tumors.

Financial Performance

The company's financial health has shown significant improvement with a substantial increase in its cash reserves. As of March 31, 2024, Janux reported having $651.8 million in cash and cash equivalents and short-term investments, a considerable rise from $344.0 million at the end of 2023. This financial strengthening provides Janux with a robust foundation to continue its research and development efforts.

Research and development expenses for the quarter were $14.1 million, slightly down from $15.9 million in the prior year's quarter, reflecting a more focused allocation of resources towards key clinical trials. General and administrative expenses saw a rise to $7.3 million from $6.5 million, indicating increased operational activities.

Strategic Business Highlights and Clinical Progress

Janux is actively enrolling participants for its two major clinical studies: PSMA-TRACTr (JANX007) targeting prostate cancer, and EGFR-TRACTr (JANX008) aimed at treating solid tumors. "We continue to focus on enrollment in the two clinical studies... and we are pleased with the progress," stated David Campbell, Ph.D., President and CEO of Janux. The company expects to provide an update on JANX007 in the second half of 2024 and on JANX008 in 2025.

Analysis of Revenue and Earnings

Despite the reduced net loss, Janux's revenue for the quarter stood at $1.25 million, down from $2.05 million in the same period last year, missing analyst expectations of $0.76 million for the quarter. The net loss per share improved to $0.30 from $0.42 year-over-year, aligning closely with analyst estimates of a $0.33 loss per share.

Investor and Market Implications

The financial results and ongoing clinical developments of Janux Therapeutics suggest a strategic positioning to advance its pipeline effectively. However, the revenue shortfall highlights the challenges in monetizing its innovative platforms during the early stages of clinical trials. Investors might view the substantial cash reserves as a buffer that enables sustained R&D, potentially leading to long-term gains.

For more detailed information and continuous updates on Janux Therapeutics Inc (NASDAQ:JANX), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Janux Therapeutics Inc for further details.

This article first appeared on GuruFocus.