Rush Street Interactive (NYSE:RSI) is one of the more prominent players in the world of online gaming. After a recent Bloomberg article suggesting it may be an acquisition target for potential competitors such as DraftKings (NASDAQ:DKNG), investors have driven the stock up over 50% in a classic “buy on the rumor, sell on the news” fashion.

The company is well placed to continue increasing its revenue in an expanding market that’s growing worldwide and reaching new heights with mobile phones and eased regulations, making it far more convenient and secure to place a bet.

While the long-term growth potential is attractive, it is currently a speculative play based on the animal spirits a potential sale of the company has unleashed. A buyer may be willing to pay a premium over the currently rich valuation, but if the rumors prove unfounded, the stock could see a pullback. So, potential investors may want to leave this one to the gamblers for now.

RSI’s Innovative Approach to a Growing Global Market

Rush Street Interactive operates globally in the online casino and sports betting industry. RSI has a track record of being the first to launch regulated online gaming sites in several U.S. states, such as New Jersey, Pennsylvania, Indiana, Colorado, and Illinois. It has also made great strides in entering the Latin America market, such as being the first U.S.-based operator to introduce a legal and regulated online casino and sportsbook in Colombia.

The online gambling market’s revenue is predicted to hit US$100.90 billion in 2024 and grow annually thereafter at a CAGR of 6.20%, with a projected market volume of $136.30 billion driven by 281.3 million users by 2029.

Rush Street’s Recent Financial Results & Outlook

The company recently reported financial results for Q1 2024, surpassing estimates across critical metrics. Revenue increased 34% year over year to $217.4 million, exceeding expectations by $19.44 million. This represents a robust uptick from the first quarter of 2023 to $162.4 million. Reported Non-GAAP EPS of $0.03 beat the forecast by $0.05.

Additional highlights from the quarterly report include growth in the Monthly Active Users (MAU) figures. In the United States and Canada, MAUs were approximately 176,000, marking a 20% increase year over year. In Latin America, the number expanded by 72% year over year, reaching around 224,000. Average Revenue per Monthly Active User (ARPMAU) also saw a rise in both regions. In the United States and Canada, it increased 9% year over year to $355, while in Latin America, it raised 4% year over year to $43.

After a strong first-quarter performance, management’s guidance for 2024 has been upgraded. The projected full-year revenue is now anticipated to fall between $810 million and $860 million, increasing the midpoint estimate to $835 million, a $35 million raise from the initial guidance. Likewise, the full-year EBITDA prediction has also increased between $50 million and $60 million, raising the midpoint to $55 million, a $15 million and 38% increase compared to the initial guidance.

What is the Price Target for RSI Stock?

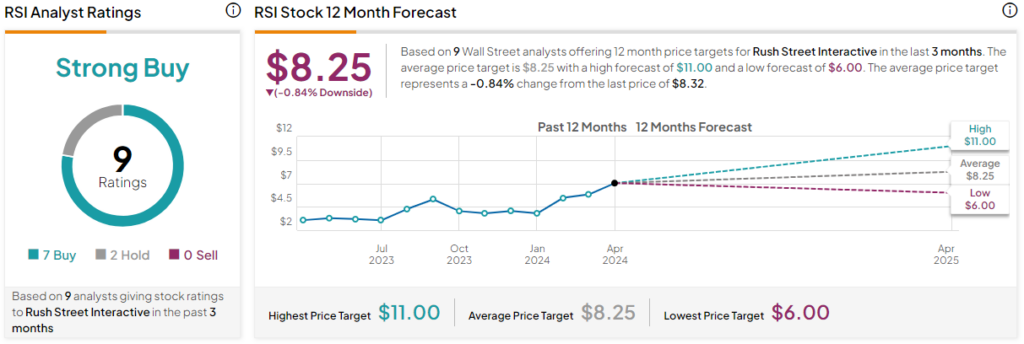

Rush Street Interactive is rated a Strong Buy based on nine Wall Street analysts’ recommendations and price targets over the past three months. The average price target for RSI stock is $8.25, which represents a -0.84% change from the current levels.

Analysts following the company have been mostly bullish on the stock. Craig-Hallum analyst Ryan Sigdahl recently raised the price target on the stock to $10 from $8 while keeping a Buy rating on the shares. He notes Rush Street is executing well, showing growth, cost discipline, and meaningful profitability improvements.

Meanwhile, the stock has been trending up, climbing by over 158% in the past year. It trades at the high end of its 52-week price range of $2.85-$8.38 and continues to show upward price momentum, trading above the 20-day (6.51) and 50-day (6.10) moving averages.

Final Thoughts on RSI Stock

In closing, Rush Street Interactive is well-positioned to capture market share in an expanding market and continue to enhance its revenue growth. The shares have been bought on rumors of a potential acquisition, driving the stock to a rich valuation. Long-term investors may want to let the dust settle and revisit this growth opportunity after gaining clarity on the rumors of the company’s sale.