At first glance, discount retailer Ross Stores (NASDAQ:ROST) – which specializes in off-price brand goods and has a Strong Buy consensus rating on TipRanks – seems like a risky investment. With consumer sentiment down in the dumps, people aren’t willing to open their wallets for discretionary goods, even if they’re on discount. However, a twist in the narrative could support the optimistic case for the department store chain. As a result, I am bullish on ROST stock.

Critics of ROST Stock Have a Point

Before diving into the optimistic argument, it must be pointed out that critics of ROST stock have a point. Specifically, credit card balances have hit a record high of over $1 trillion. One could frame this statistic as confidence in the system. However, the reality is that people are having severe problems making ends meet. What’s worse, credit card delinquencies are also on the rise.

Further, the company itself sounded the alarm. Back in March, when Ross released its results for the fourth quarter of 2023, it posted revenue of about $6 billion. This tally represented an increase of 15.5% on a year-over-year basis. More importantly, it exceeded analysts’ consensus view of $5.81 billion.

On the bottom line, the discount retailer delivered earnings per share of $1.82. This figure, too, beat the consensus estimate, which was pegged at $1.66. Also, the print represented a robust rise of 39% year-over-year. To emphasize everything, Ross raised its quarterly dividend by 10% to 36.75 cents per share. It also hiked its stock repurchase plan by 11%.

Nevertheless, ROST stock tumbled on the disclosure. Contributing to the red ink was management expressing uncertainty regarding the macroeconomic and geopolitical landscapes. As well, higher costs tied to housing, food and energy applied pressure on discretionary spending habits of low-to-moderate-income customers.

To accommodate the new realities, Ross maintained a conservative outlook for Fiscal 2024. That’s not what the market wanted to hear, sending ROST stock southbound.

Loosening Labor Market a Possible Tailwind for Ross Stores

One of the perplexing challenges for Ross Stores in prior months was the booming labor market. With monthly jobs reports consistently coming in above forecasts, it effectively meant that reasonably qualified individuals could find employment opportunities. However, the latest April print presented a plot twist.

Last month, the economy added 175,000 jobs. This figure conspicuously fell below economists’ expectation of 240,000 jobs. Also, it was significantly below March’s gain of over 300,000. With the unemployment rate rising to 3.9% from 3.8% in March, the data implied the rise of worker desperation. Unlike other economic cycles, the elevated inflation rate today means that few people can afford to go for long without a paycheck.

In addition, major enterprises – including well-known technology firms offering high-paying positions – continue to lay off their workers. Essentially, the pool of job applicants is rising while the number of available jobs is decreasing. It’s a viable framework for ROST stock.

How so? People will need to upgrade their wardrobes for job interviews. Whether it’s in person or remote, you don’t have a second chance to make a first impression. And with limited opportunities available, that first impression is all the more critical.

Let’s also not forget that a great many people during the worst of the COVID-19 pandemic gained weight. In fact, some sources state that the average weight gain was 29 pounds or over 13 kilograms for the international audience. Such gains will almost surely necessitate a wardrobe upgrade, which bolsters ROST stock.

ROST Stock May Need an Upward Valuation Adjustment

Despite the recent pullback, ROST stock trades hands at 2.1x trailing-year revenue. In contrast, the average sales multiple for the apparel retail industry sits at 0.74x. Shares would have to fall considerably more to be considered objectively undervalued.

However, one could make the case that Ross Stores offers a relatively good deal when looking at its historical valuation. For the current fiscal year, analysts believe revenue could reach $21.26 billion on average. Further, the high-side target lands at $21.54 billion. In the following year, the consensus revenue target is $22.49 billion and the most optimistic forecast calls for $22.84 billion.

Given the labor market dynamics, it’s possible that Ross Stores could see revenue hit $22 billion this year. If so, the revenue multiple would fade to 2x. That would be a multiple that hasn’t been seen since the quarter ended April 30, 2023.

Granted, it’s not the most enticing discount in the world. However, analysts believe strongly in ROST stock, and it may be for the reason that the underlying retailer enjoys strong fundamentals. Yes, it’s true that consumers are struggling. However, a business wardrobe upgrade is super critical now in an increasingly competitive labor market.

Ross provides a solution to the problem at a relatively low cost. Therefore, it’s a surprising bargain for both the customer and the investor.

Is ROST Stock a Buy, According to Analysts?

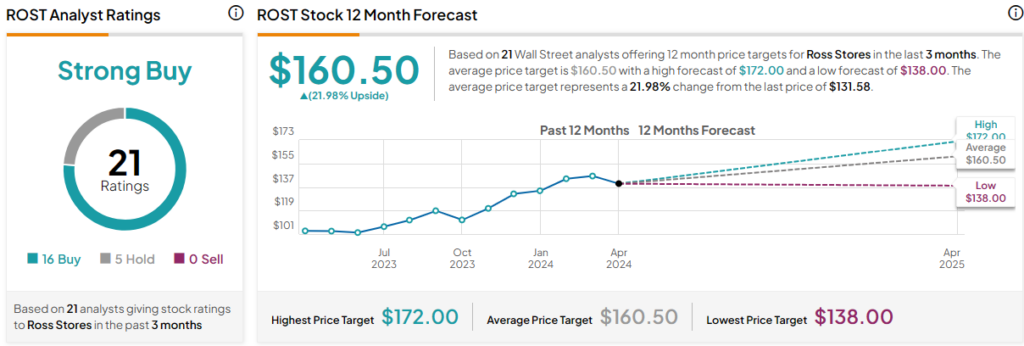

Turning to Wall Street, ROST stock has a Strong Buy consensus rating based on 16 Buys, five Holds, and zero Sell ratings. The average ROST stock price target is $160.50, implying 22% upside potential.

The Takeaway: Harsh Realities May Cynically Lift ROST Stock

Previously, Ross Stores struggled amid a challenging consumer economic environment. However, the narrative has shifted in the labor market, with the supply of available opportunities declining while the number of job applicants rises. Given the necessity of making a good first impression, Ross is actually an incredibly relevant retailer. That’s what makes ROST stock a good idea to consider while its stock is deflated.