VAALCO Energy Inc (EGY) Q1 2024 Earnings: Consistent With Analyst Projections

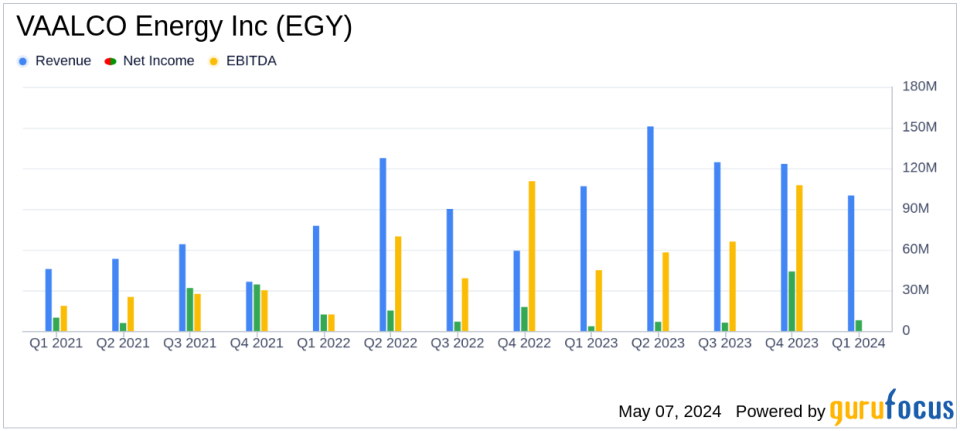

Net Income: Reported $7.7 million for Q1 2024, a decrease from Q4 2023's $44.0 million but an increase from Q1 2023's $3.4 million.

Earnings Per Share (EPS): Achieved $0.07 per diluted share in Q1 2024, falling short of the estimated $0.25.

Revenue: Generated $100.2 million in total commodity sales, falling short of the estimated $404.7 million annual target.

Adjusted EBITDAX: Reached $61.7 million in Q1 2024, showing robust operational cash flow despite a decrease from $95.9 million in Q4 2023.

Production Levels: Reported production of 16,848 net revenue interest barrels of oil equivalent per day (BOEPD), maintaining strong output levels.

Capital Expenditure: Invested $16.6 million in net capital expenditures on a cash basis, focused on development drilling programs in Egypt and Canada.

Dividends and Share Buybacks: Paid a quarterly dividend of $0.0625 per share and completed $30 million in share buybacks, enhancing shareholder value.

On May 7, 2024, VAALCO Energy Inc (NYSE:EGY) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company, an independent energy entity with operations across Gabon, Egypt, Canada, Equatorial Guinea, and now Cote d'Ivoire, reported a net income of $7.7 million, or $0.07 per diluted share, aligning with analyst expectations for earnings per share.

Company Overview

Founded in 1985 and based in Houston, Texas, VAALCO Energy Inc focuses on the acquisition, exploration, development, and production of crude oil and natural gas. The company has recently expanded its operations through strategic acquisitions, including the purchase of Svenska Petroleum Exploration AB, enhancing its footprint in West Africa, particularly in Cote d'Ivoire.

Operational and Financial Highlights

The first quarter saw VAALCO successfully close the acquisition of Svenska for $40.2 million, adding significant assets in Cote d'Ivoire. The company reported strong production numbers with 16,848 net revenue interest barrels of oil equivalent per day (BOEPD) and total sales of 1,490,000 barrels of oil equivalent (BOE). Additionally, VAALCO maintained robust liquidity with $113.3 million in unrestricted cash.

Financial Performance Analysis

VAALCO's net income for Q1 2024 was $7.7 million, consistent with analyst EPS estimates of $0.07 and significantly up from $3.4 million in Q1 2023. This performance was supported by high production and sales volumes, although it marked a decrease from $44.0 million in Q4 2023 due to lower sales revenue and increased expenses. Adjusted EBITDAX was reported at $61.7 million, a decrease from the previous quarter but an increase from the same period last year, reflecting the fluctuating nature of commodity prices and operational costs.

Strategic Developments and Future Outlook

CEO George Maxwell highlighted the strategic expansion in West Africa and the integration of new assets which are expected to enhance future production and financial metrics. The company anticipates continued growth in production and has provided guidance reflecting this positive outlook for Q2 2024.

Shareholder Returns and Capital Management

VAALCO remains committed to returning value to its shareholders, evidenced by the payment of dividends and the completion of a $30 million share buyback program. The ongoing dividend program and strategic capital deployment underscore VAALCO's robust financial management and shareholder-friendly policies.

Conclusion

VAALCO Energy Inc's first quarter of 2024 demonstrated a solid operational performance and strategic expansions that align with its long-term goals. With consistent financial results and a strong focus on value creation through strategic acquisitions and efficient operations, VAALCO is well-positioned to maintain its growth trajectory and enhance shareholder value.

For further details on VAALCO's financial performance and strategic initiatives, interested parties are encouraged to join the upcoming conference call or visit the company's website.

Explore the complete 8-K earnings release (here) from VAALCO Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance