AbCellera Biologics Inc (ABCL) Q1 2024 Earnings: Misses Revenue and Net Loss Estimates

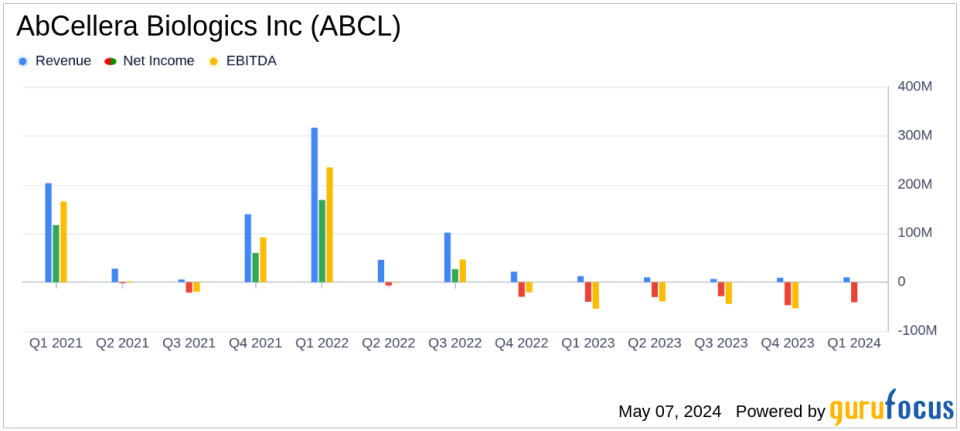

Revenue: Reported at $10.0 million, down from $12.2 million in Q1 2023, falling short of the estimated $10.84 million.

Net Loss: Recorded a net loss of $40.6 million, slightly below above the estimated net loss of $48.13 million.

Earnings Per Share (EPS): Reported at -$0.14, exceeding the estimated EPS of -$0.17.

Research & Development (R&D) Expenses: Decreased to $39.3 million from $52.6 million in the previous year, reflecting efficiency in spending.

Liquidity: Ended the quarter with $725.3 million in cash, cash equivalents, and marketable securities, showcasing a strong financial position.

Partner-initiated Programs: Increased to 90 starts, up from 75 last year, indicating a 20% growth and potential for future revenue through partnerships.

Molecules in the Clinic: Grew from 9 to 13, a 44% increase, demonstrating progress in clinical developments.

On May 7, 2024, AbCellera Biologics Inc (NASDAQ:ABCL) released its financial results for the first quarter of 2024 through an 8-K filing. The company, known for its advanced antibody discovery and development platform, reported a challenging quarter with revenues and net loss figures that did not meet analyst expectations.

Company Overview

AbCellera Biologics Inc operates an integrated platform aimed at transforming the speed and quality of antibody discovery. This technology-driven approach is designed to enhance the development of antibody-based therapies across various diseases, including cancer and autoimmune disorders. The company's robust partnerships and strategic collaborations are central to its operational model.

Q1 2024 Financial Performance

The reported revenue for Q1 2024 was $10.0 million, a decrease from $12.2 million in the same quarter the previous year, and below the estimated $10.84 million. This decline was primarily due to decreased research fees and the absence of milestone payments which were present in Q1 2023. The net loss for the quarter was $40.6 million, or $(0.14) per share, consistent year-over-year but worse than the anticipated net loss of $48.13 million.

Operational Highlights and Strategic Developments

Despite the financial downturn, AbCellera highlighted several strategic achievements during the quarter. These include initiating new collaborations aimed at discovering antibodies for neurological conditions and launching biotech companies with prominent investors. Furthermore, the company presented promising data on its T-cell engager (TCE) programs, showcasing their potential in delivering effective treatments with lower toxicity.

Key Financial Metrics

AbCellera's R&D expenses saw a significant reduction to $39.3 million from $52.6 million in Q1 2023, reflecting a strategic scaling of operations and absence of one-time investments. S&M expenses slightly decreased, while G&A expenses increased to $17.4 million due to expanded administrative functions to support growth. Importantly, the company maintains a strong liquidity position with nearly $1 billion in available resources, including cash and marketable securities, and non-dilutive government funding.

Analysis of Performance

The decrease in revenue and the steady net loss highlight ongoing challenges in scaling operations amidst high R&D costs. However, the strategic investments in TCE programs and new collaborations could pave the way for future revenue streams through milestone payments and royalties. The financial discipline in managing operating expenses and the strong liquidity position provide AbCellera with a solid foundation to navigate the competitive landscape of biotech innovation.

Forward Outlook

Looking ahead, AbCellera is poised to continue leveraging its technological platform to expand its pipeline and enhance its collaborative engagements. The focus will likely remain on advancing clinical programs and optimizing operational efficiencies to improve financial performance in upcoming quarters.

For more detailed information, investors and stakeholders are encouraged to review the full earnings report and stay tuned for updates on AbCelleras strategic initiatives and financial progress.

Explore the complete 8-K earnings release (here) from AbCellera Biologics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance