Otter Tail Corp (OTTR) Surpasses Q1 Earnings Estimates with Strong Performance in Plastics Segment

Earnings Per Share: Reported at $1.77, up 19% year-over-year, surpassing estimates of $1.45.

Annual Earnings Guidance: Increased midpoint for 2024 to $6.38 per share, indicating a 21% rise from prior guidance.

Return on Equity: Achieved a robust 22% over the trailing twelve months.

Operating Cash Flow: Grew to $71.9 million for the quarter, up from $55.6 million in the same period last year, driven by stronger Plastics segment performance.

Dividend: Declared a quarterly dividend of $0.4675 per share, payable on June 10, 2024.

Plastics Segment Performance: Revenue increased by $25.8 million, with net income up $13.1 million, fueled by a 56% rise in sales volumes and lower material costs.

Electric Segment Challenges: Faced a revenue decline of $10.4 million and a slight net income decrease due to warmer weather and increased operating costs.

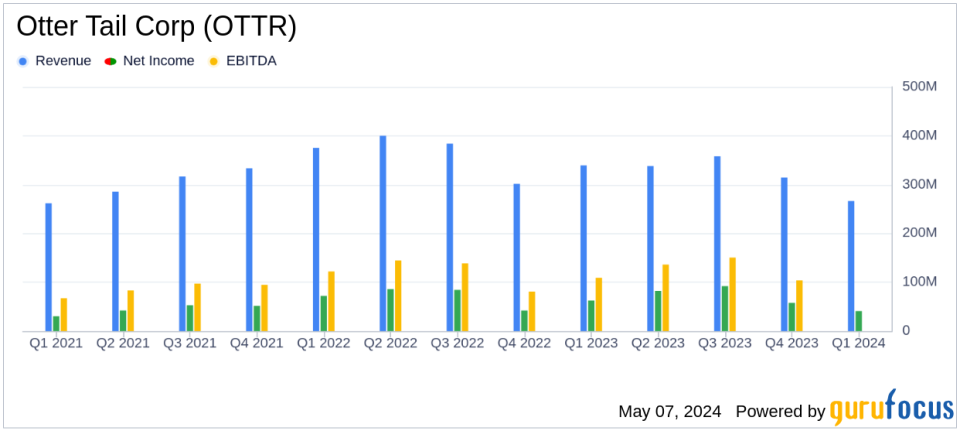

On May 6, 2024, Otter Tail Corp (NASDAQ:OTTR) released its quarterly earnings, showcasing a robust performance that exceeded analyst expectations. The company announced a significant 19% increase in diluted earnings per share, reaching $1.77, surpassing the estimated $1.45. This financial achievement was highlighted in their recent 8-K filing. Otter Tail Corp, a diversified U.S. energy company primarily operating in electric, manufacturing, and plastics segments, has its operations concentrated in Minnesota, South Dakota, and North Dakota, with the majority of its revenue stemming from the Electric segment.

Financial Performance and Challenges

The company's financial results reflect a strong quarter, particularly in the Plastics segment, which saw a remarkable 39% increase in earnings due to higher sales volumes and strong market demand. However, the Electric and Manufacturing segments faced challenges. The Electric segment experienced a modest decline in earnings due to warmer-than-normal weather affecting energy usage, while the Manufacturing segment saw a 23% decrease in earnings due to lower sales volumes and changing market conditions.

This mixed performance underscores the importance of Otter Tail Corp's diversified business model, which allows it to leverage strengths in one area to offset challenges in another, a strategy that continues to benefit the company amidst varying market conditions.

Segment Analysis and Financial Metrics

The Electric segment reported a decrease in operating revenues by 6.9% and a net income reduction of 3.2%, primarily due to decreased fuel recovery revenues and retail revenue impacted by unfavorable weather. Conversely, the Plastics segment enjoyed a significant revenue increase of $25.8 million, driven by a 56% increase in sales volumes, though tempered by a 15% decrease in sales prices from the previous year.

The company's overall liquidity remains strong, with significant increases in cash provided by operating activities, which rose to $71.9 million from $55.6 million in the previous year. This financial health is crucial for sustaining operations and funding future expansion projects, particularly in the Electric segment which continues to invest heavily in capital projects like wind repowering.

Outlook and Strategic Moves

Otter Tail Corp has raised its 2024 earnings guidance to $6.23-$6.53 per share, up from the initial range of $5.13-$5.43, reflecting confidence in its operational strategies and market position. This adjustment is primarily attributed to the stronger-than-expected performance of the Plastics segment.

The company remains committed to its key regulatory priorities and strategic initiatives, including the ongoing general rate case in North Dakota and the execution of its Integrated Resource Plan, which aims to enhance sustainability and operational efficiency.

In conclusion, Otter Tail Corp's first-quarter performance paints a picture of a company adept at navigating market fluctuations and capitalizing on its diversified operational strengths. Despite some segment-specific challenges, the overall financial health and strategic direction suggest a positive outlook for 2024.

Investor and Analyst Information

Otter Tail Corp will host a live webcast on May 7, 2024, to discuss detailed financial and operational performance. Interested parties can access the webcast via the company's website at www.ottertail.com/presentations.

For further details, investors and stakeholders are encouraged to consult the full earnings release and financial statements available on the SEC's website and Otter Tail Corp's investor relations page.

Explore the complete 8-K earnings release (here) from Otter Tail Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance